MAS do something for Hyflux retailer.

How can PUB remove tuasspring worth billions and now become zero overnight.

the contract between PUB and hyflux, how on earth are we to know of such lousy contract ? All of us are are tricked right from the beginning.

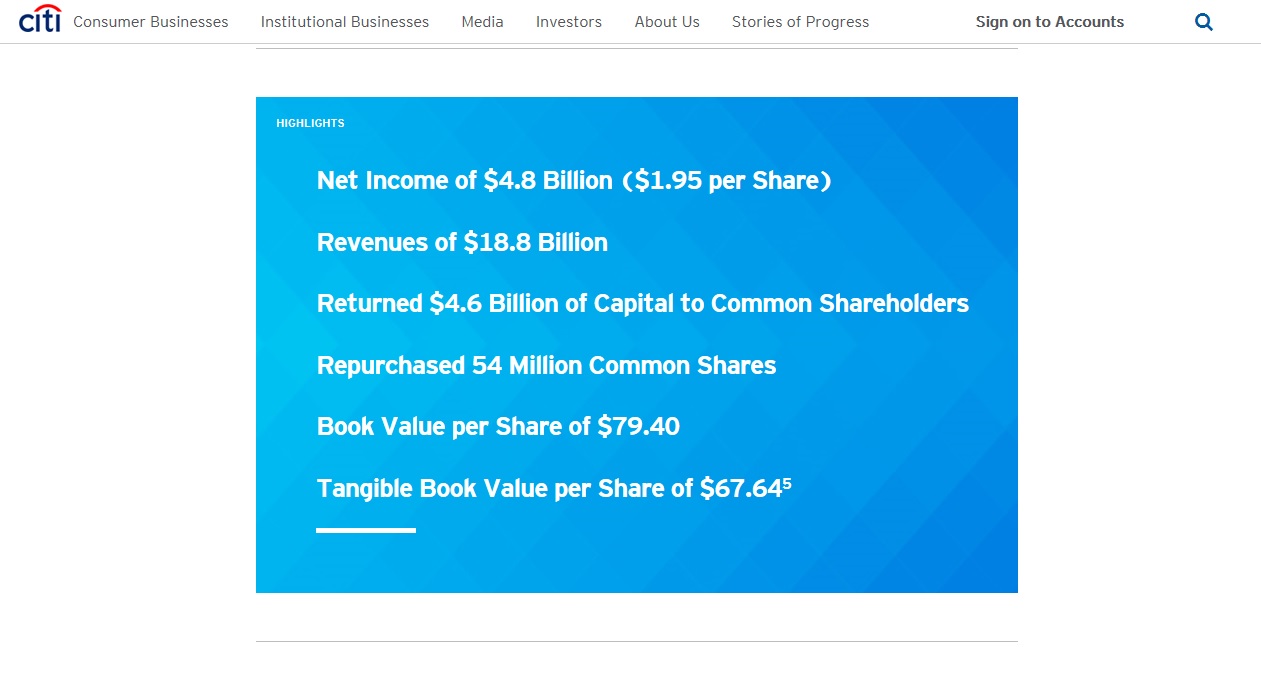

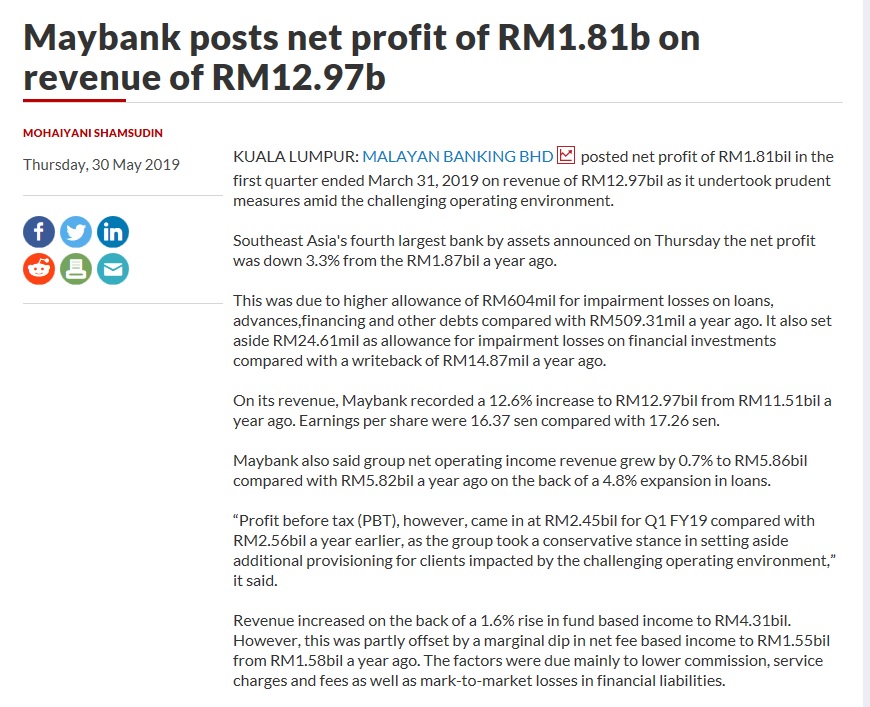

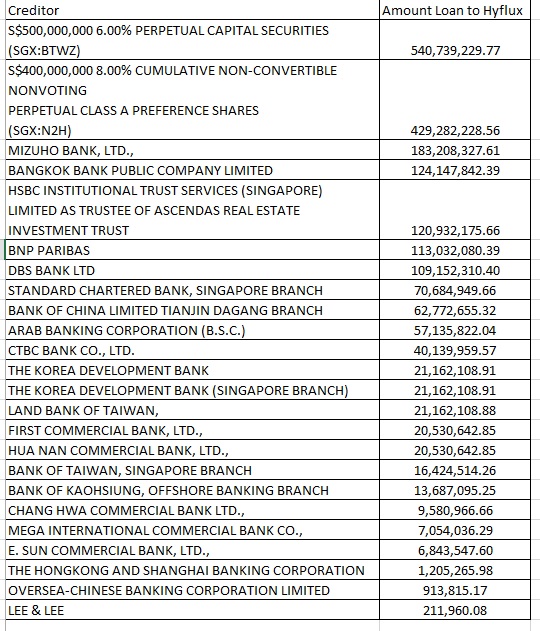

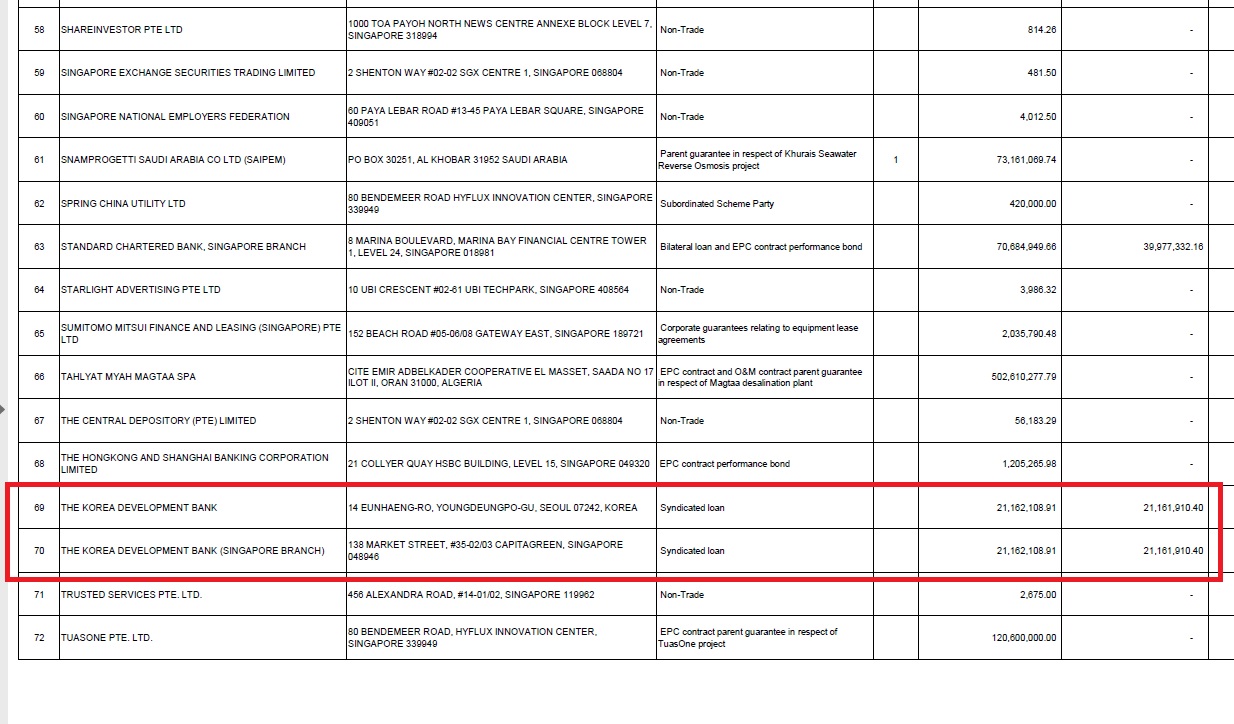

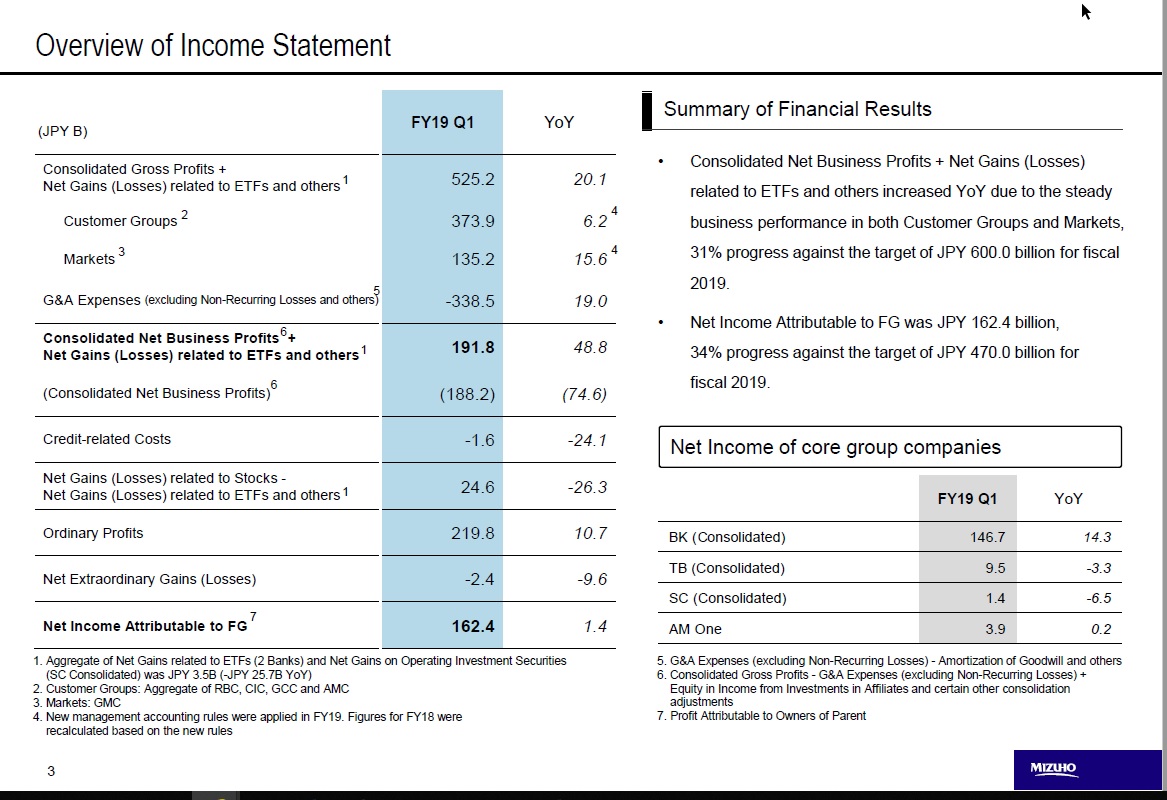

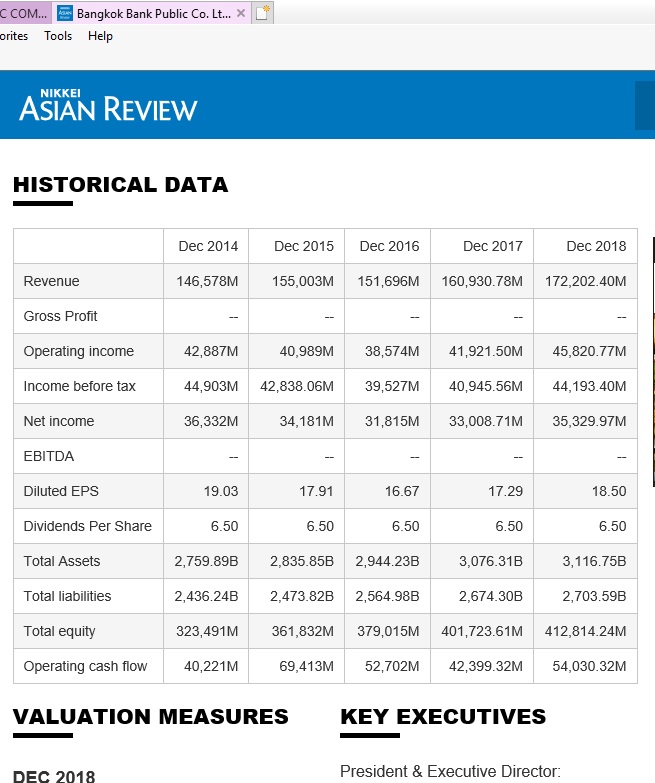

And look at these bank profits. They can survive with write off.

But retailer are getting bullied by the legal clauses.

This is unfair

SINGAPORE - The regulatory arm of the Singapore Exchange (SGX RegCo) has devised a roadmap to tighten its oversight over the market here, which includes setting up a whistle-blowing office and increasing the accountability of auditors, sponsors and issue managers.

SGX RegCo chief executive Tan Boon Gin announced the initiatives during an update on the organisation's measures for the first half of the 2020 financial year.

They will help to increase the trust and accountability of all participants in the marketcommunity, he said, adding: "We are looking to increase our regulatory presence in order to strengthen investor confidence and deter wrongdoing."

SGX RegCo's listings disciplinary committee has started hearings against three companies. This internal process ensures that penalties will be served if there has been wrongdoing.

It will also establish a whistle-blowing office to channel all regulation-related feedback to staff who can process these concerns.

"We want to assure the market that we take whistle-blowing seriously and that we are committed to following up on any information that we received in accordance with a public policy that we are going to publish on our website, that deals with, among other things how we maintain the confidentiality of the information," Mr Tan said.

Sponsors for Catalist companies will also be held more accountable. SGX RegCo will go to them for immediate answers when companies have problems.

Sponsors are professionals who vet offer documents and can come from banks, law or corporate finance firms.

Mr Tan noted: "Currently, we already perform regular and thematic inspections of our sponsors. However, if the answers that we receive are not satisfactory, you can expect us to go in to inspect them immediately, off-cycle, to check if there are gaps in their processes that need to be rectified."

It will also enhance the regulation of issue managers, who conduct due diligence on companies that are brought to list on the exchange. This will include how they can be taken to task if they fall short of standards.

Auditors will be held more accountable as well, with SGX RegCo holding public consultations over the next few months on requiring a second auditor in certain cases, and appointing a Singapore-based auditor for listed companies.

SGX RegCo will also work with independent financial advisers on standardising best practices, such as how they determine whether an exit offer is fair and reasonable.

The body will explore more robust regulations for property valuations, including proposals to ensure valuers are professionally qualified and their reports meet standards equivalent to the Singapore Institute of Surveyors and Valuers.

It is also reviewing its policies to ensure they stay effective, said Mr Tan, such as the need for quarterly reporting and the policy of having a minimum trading price (MTP).

He said: "We have actually developed other tools that are more direct, more effective and more surgical than MTP in addressing the risk of manipulation.

"At the same time, we have observed certain unintended consequences from MTP. For example, when a company consolidates its shares, in theory its market capitalisation should remain the same.

"But in practice, once companies have actually done the consolidation, we have observed that their share price has fallen post-consolidation and their market value has further declined."

Lastly, SGX RegCo will form a working group to review the retail bonds framework to better support retail investors when an issuer defaults.

Mr Tan said: "The default by issuers of retail bonds has been an issue of public concern. We will put together in the next few months a working group comprising industry professionals, investors and SGX RegCo, to review and see what is needed to improve disclosures and make clearer what happens in a default."

SGX RegCo will look at how investors can better organise themselves, provide more clarity on the role of the trustee which is required for retail bonds, and in the context of defaults, see how investors can better exercise their rights.

SINGAPORE (Aug 7): Singapore is examining ways to tighten regulation of retail bond issues and the real estate investment trust sector as it steps up investor protection in the city-state.

The Singapore Exchange’s regulatory arm, SGX RegCo, will create a working group to review and improve disclosures relating to retail bonds, SGX RegCo’s Chief Executive Officer Tan Boon Gin said in a statement setting out his organization’s goals for the remainder of the year.

The initiative follows a slew of bond defaults in Singapore, including by Swiber Holdings Ltd, Noble Group Ltd and Hyflux Ltd, which have left retail investors nursing losses in recent years.

The working group will look into ways to provide clarity on the role of trustees and how investors can better exercise their rights in the event of a default, according to the statement. A public consultation will follow the review.

Tan said SGX RegCo will also be consulting on a more robust regime for property valuations, as it looks to turn Singapore into an international center for REITs. These will include proposals to ensure property valuers have qualifications from professional bodies, and for valuation reports to meet standards equivalent to those set by the Singapore Institute of Surveyors and Valuers.

Among the other SGX RegCo initiatives announced Wednesday were:

•A review of the minimum trading price policy for listed companies

•A new framework for companies’ quarterly reporting, pending regulatory approval

•A review of the listings due-diligence guidelines issued by the Association of Banks in Singapore, with a view to improving internal controls and financial forecasts