You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

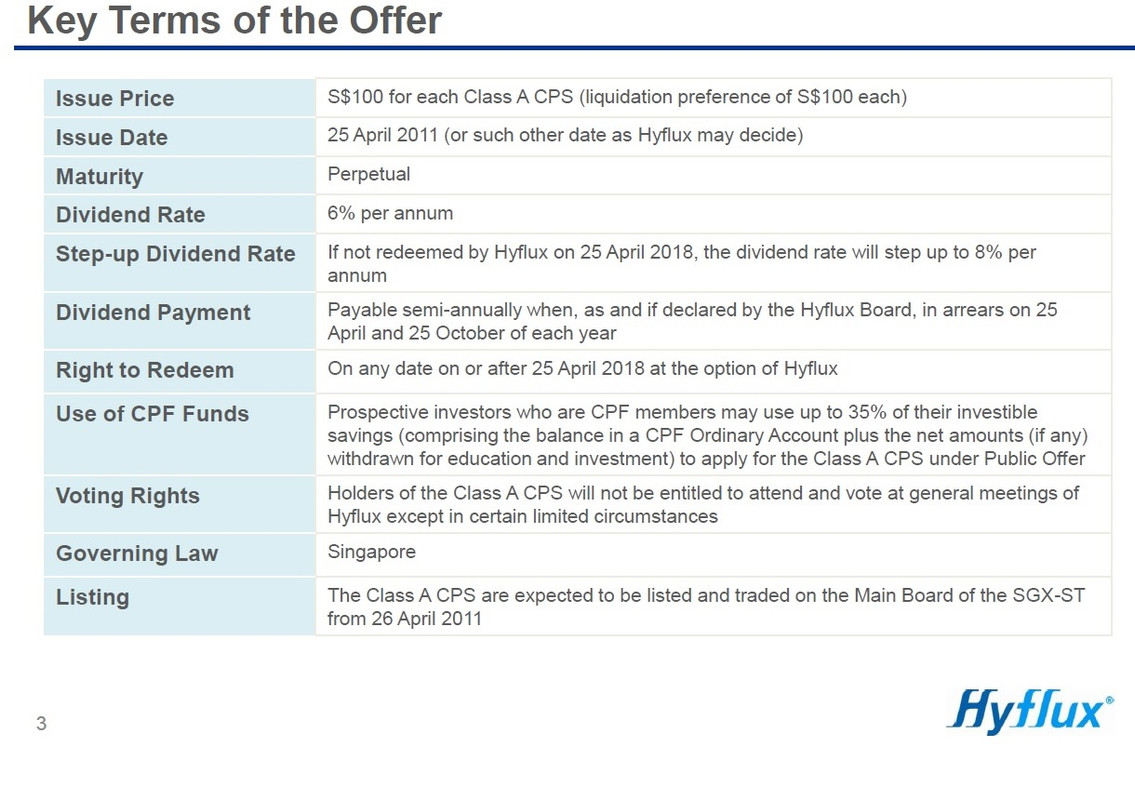

Hyflux 6% Perpetual Securities

- Thread starter SpinFire

- Start date

More options

Who Replied?Dividends Warrior

Arch-Supremacy Member

- Joined

- Nov 7, 2010

- Messages

- 22,945

- Reaction score

- 878

This dreamwork must be lose money in Hyflux until siao Liao....

Maybe he regretted searching for yield in the wrong place. Sometimes, i dun understand these investors. Singapore market got solid reits and dividend bluechips. But they go buy simi junk bonds. Sigh

Maybe he regretted searching for yield in the wrong place. Sometimes, i dun understand these investors. Singapore market got solid reits and dividend bluechips. But they go buy simi junk bonds. Sigh

Because bonds are perceived to be "safer". Guess never read deeper into the risks involved. Sometimes lessons have to be learnt the hard way.

Why did MAS & SGX approve junk bonds to Singapore retail?

And do they still approve such to lay people?

Because there are no regulatory requirements to get the bonds rated in the first place...If it is not a requirement by law, why would any company pay a rating agency money to get the bonds rated in the first place?

sanzhu

Great Supremacy Member

- Joined

- Nov 24, 2005

- Messages

- 52,344

- Reaction score

- 2,431

Perpetual bonds should not be even called bonds, very misleading if it is marketed to retailers that way. When claiming on company assets, perpetual bond has the least priority.

U know 70% are illetrate right

Because bonds are perceived to be "safer". Guess never read deeper into the risks involved. Sometimes lessons have to be learnt the hard way.

Bonds are just a rank higher than the shareholders but in the grand scheme of things, they are the second last in line...so to say bonds are "safer" is not entirely false...

This dreamwork must be lose money in Hyflux until siao Liao....

Lose money, broke up with girlfriend and call off wedding, can go crazy one as it is from one misfortune to another...When good times, can come here brag about 6% yield from Hyflux...

Easier to blame another entity for all of one's misfortune than blame ownself for any faults...

And the ones who could disapprove it approved it.

LTA has the power to stop the import of those fire-causing PMDs much earlier but didn't and still allows them till 2020.

Those PMD- induced fires in hdb flats are 100% users fault.

LTA has the power to stop the import of those fire-causing PMDs much earlier but didn't and still allows them till 2020.

Those PMD- induced fires in hdb flats are 100% users fault.

Because there are no regulatory requirements to get the bonds rated in the first place...If it is not a requirement by law, why would any company pay a rating agency money to get the bonds rated in the first place?

Last edited:

事后孔明.... hindsight is always 6/6. Lol.

6/6? Yeah.

I stopped my parents from buying this bond when it was offered.

The only 6/6, I will admit is that I didn't expect them to be bankrupt that quickly. I thought they would last another few more years.

They did indeed, but let’s assume a Hyflux investor foolishly didn’t read anything except “6%!!!!” What on earth did they imagine to be a 6% coupon note in a ~1.5% yielding government bond interest environment? Risk free? Low risk? All you had to do was look at the promised yield! There was/is absolutely no special analytical skill required here. That number told you all you needed to know about how extremely risky these notes were. They were offered at about quadruple the yield of government bonds!

Yes, OK, the regulatory environment in Singapore is too lax, and for no good reason. In many jurisdictions DBS and Hyflux would not have been legally permitted to sell these notes to retail investors. Perpetuals are illegal in many jurisdictions, and low minimum unrated bonds/notes (i.e. retail denominations) are also often illegal. The same should be true in Singapore, in my view. If anything this nonsense is holding back the development of reasonable bond funds for retail investors. (MBH is OK, but it could be better.) And Hyflux investors have my sympathies. But, good grief, 6%!

If Perps are only allowed to be sold to AI, the same group of people will blame the government for being bias and should allow small retail investors to take on higher risk or it is a conspiracy by the government to only let the rich get richer...The problem why bonds are not even rated in Singapore is because there is no regulatory requirements for a company to get their bond rated... Whether it is a good thing or a bad thing is another debate altogether...

At the end of the day, people should only invest money that they are willing to lose...If people really want to have a nanny state, maybe the government justification for CPF minimum sum is right after all as Singaporeans cannot be entrusted with money as they will squander it all away...

And the ones who could disapprove it approved it.

So under what pretext are they going to disprove the application in the first place? Hyflux meet all the requirements to be listed...Bonds ratings are not a regulatory requirements in Singapore so how can anyone with half a brain think that the authority can prevent a listing as all the requirements are met?

BBCWatcher

Arch-Supremacy Member

- Joined

- Jun 15, 2010

- Messages

- 20,219

- Reaction score

- 3,058

To repeat (and in fairness), they didn’t approve anything. They simply didn’t disapprove. The absence of disapproval is not approval.And the ones who could disapprove it approved it.

Perhaps, but ministers in Singapore are well compensated to act in the public interest, even in the face of criticism. Besides, retail investors have bond funds (MBH for example), and a junk bond fund is obviously possible.If Perps are only allowed to be sold to AI, the same group of people will blame the government for being bias and should allow small retail investors to take on higher risk or it is a conspiracy by the government to only let the rich get richer...

That didn’t matter in the case of Hyflux. Their bonds were junk, even stinky junk. A competent rating agency would have confirmed that reality, well telegraphed with 6% promised coupons, and in all likelihood the same gamblers who couldn’t afford to lose would have still pressed their luck.The problem why bonds are not even rated in Singapore is because there is no regulatory requirements for a company to get their bond rated... Whether it is a good thing or a bad thing is another debate altogether...

The development and growth of bond funds would encourage more bond issuers to get ratings, at least at the margins. The regulators and ministers could do more to foster the development and growth of bond funds. For example, the government still hasn’t acted on the last CPF review that recommended revamping the CPF Investment Scheme to offer low cost, well diversified, prudently invested stock and bond funds — “target date” funds, I’d suggest.

FrostWurm

Master Member

- Joined

- Feb 14, 2009

- Messages

- 3,212

- Reaction score

- 592

To repeat (and in fairness), they didn’t approve anything. They simply didn’t disapprove. The absence of disapproval is not approval.

Your attempt to use semantics to drive your point is amusing, but it would not stand a day in a court of law.

There is no evidence to suggest that there can a be third state, one in which the subject is neither approved nor disapproved. Indeed, it would be ridiculous to suggest that the bond offerings, as they currently exist, have neither been approved nor disapproved. You may be in line with the literal letter of the law, but certainly not the spirit of the law, which holds just as much, if not more interpretive weight.

This is especially so if a body has been specifically charged with the duty of disapproving matters it finds objectionable. It goes without saying that the lack of disapproval has an implicit meaning of permissibility. I would be most shocked if MAS were to come out and state categorically that they did not approve the bond offerings.

One of the instances where your argument might be plausible, is if the MAS was grossly negligent to the point where they did not even have enough information to decide whether to disapprove. This might well be the case, though I find the odds of that happening to be rather small.

The only other instance, is if there is a different meaning to the word disapprove as interpreted by MAS. Perhaps what MAS looks out for is not the same as us. Maybe they are more procedural, rather than substantial?

Chim wordings of BBCWatcher & no difference from a cunning lawyer.

LTA is not at fault for so many PMD battery fire too.

So many hdb flats destroyed.

Users fault. Lol.

Soon NEA says about imported food.

Died from salmonella food poisoning & your fault.

LTA is not at fault for so many PMD battery fire too.

So many hdb flats destroyed.

Users fault. Lol.

Soon NEA says about imported food.

Died from salmonella food poisoning & your fault.

To repeat (and in fairness), they didn’t approve anything. They simply didn’t disapprove. The absence of disapproval is not approval.

Last edited:

The Monetary Authority of Singapore (MAS) also announced last Thursday the "exempt bond issuer framework", which allows issuers to offer bonds directly to retail investors at the outset without a prospectus if they meet eligibility criteria that are stricter than those used in the seasoning framework.

This was the week Hyflux perp ipo 2016.

https://www.straitstimes.com/busine...n-bigger-buffet-of-retail-bonds-for-investors

This was the week Hyflux perp ipo 2016.

https://www.straitstimes.com/busine...n-bigger-buffet-of-retail-bonds-for-investors

dreamwork7878

Arch-Supremacy Member

- Joined

- Nov 19, 2011

- Messages

- 24,432

- Reaction score

- 161

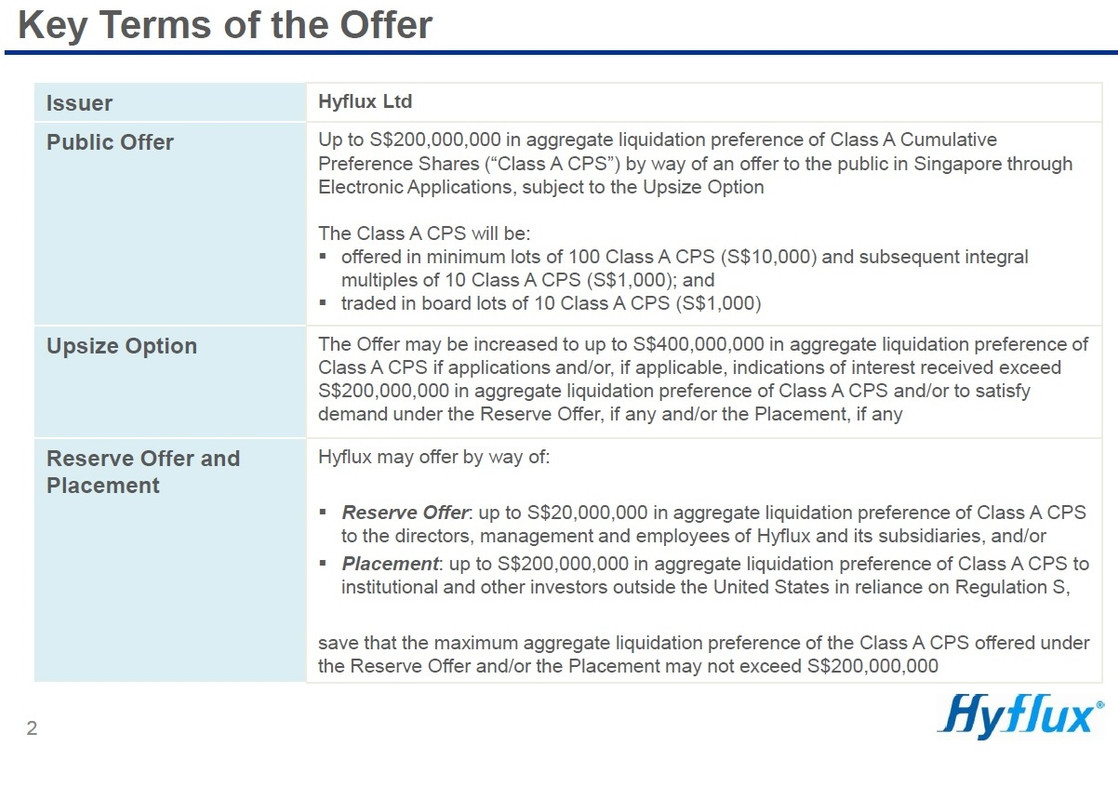

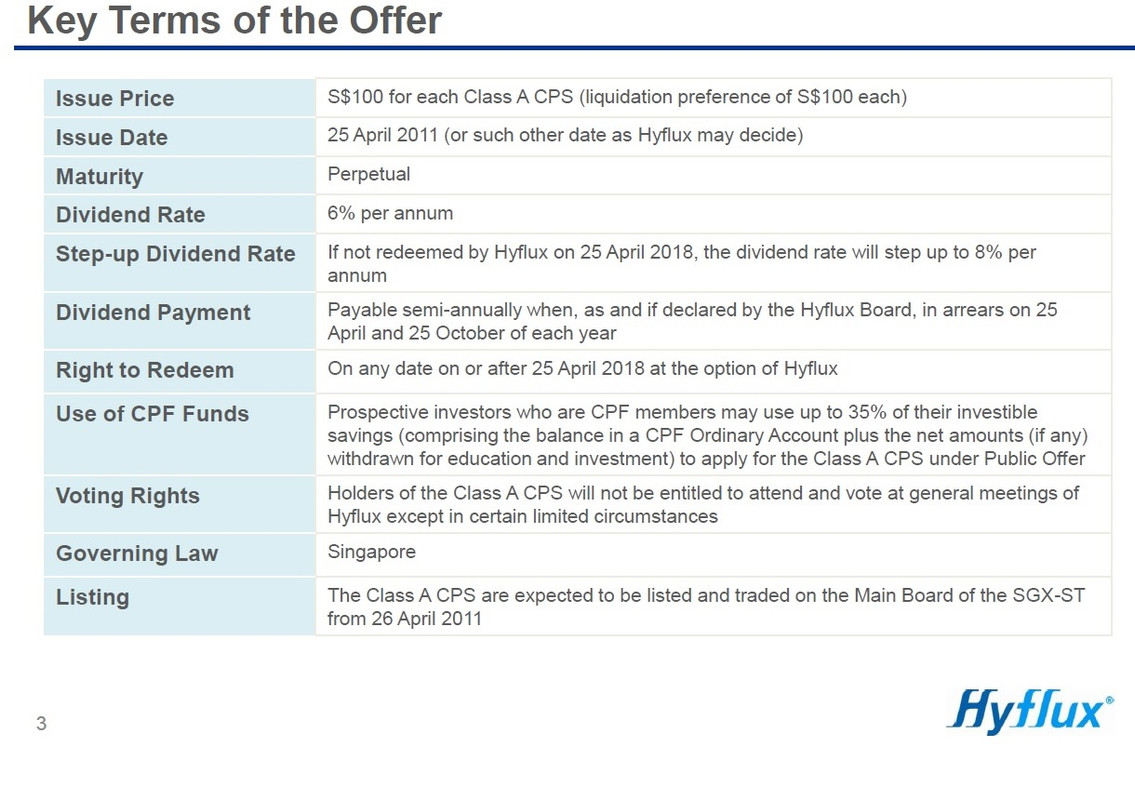

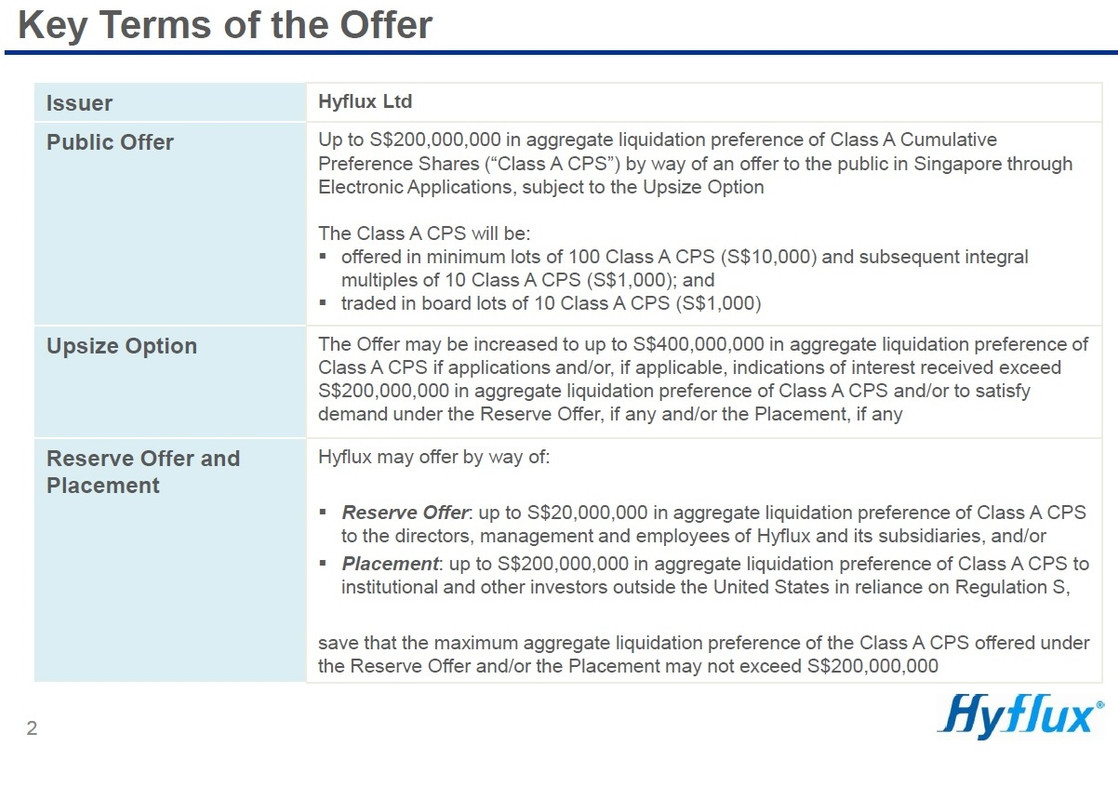

On 13 April 2011.

Hyflux offer 6% Cumulative Preference shares, N2H.

There are Only 3 pages .

https://filebin.net/5iygfz4ptmfw4hkl

Hyflux offer 6% Cumulative Preference shares, N2H.

There are Only 3 pages .

https://filebin.net/5iygfz4ptmfw4hkl

Last edited:

MikeDirnt78

High Supremacy Member

- Joined

- Jun 16, 2002

- Messages

- 47,755

- Reaction score

- 8,250

On 13 April 2011.

Hyflux offer 6% Cumulative Prerernce shares, N2H.

Only 3 pages .

Seriously? You should be getting wiser by now.

http://investors.hyflux.com/newsroom/20110413_112303_600_4A38112CA5F055CD48257871000FD2A5.2.pdf

Important Forum Advisory Note

This forum is moderated by volunteer moderators who will react only to members' feedback on posts. Moderators are not employees or representatives of HWZ. Forum members and moderators are responsible for their own posts.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.