Whenever the topic of CPF comes up, there will always be heated discussions.

I personally think CPF is a useful tool but, not the only tool to rely on for one’s retirement in Singapore. 4%+ p.a. risk free rate compounding. I can’t find a similar bond (AAA rated) that pays that yield. Definitely good to have some of this in my portfolio.

Returning to the topic, I belong to the camp who believes that most can hit their FRS if:

(1) they stay actively employed and strive to build their career;

(2) they don’t over-consume in buying their property;

(3) they actively plan to hit it and YOLO less.

Yes, there will always be exceptions. Some will have to stop working prematurely because of health reasons. And there will always be people who drop out of employment at their own volition like my wife. Uni grad, not interested to work and dropped out of the employment world in her 30s.

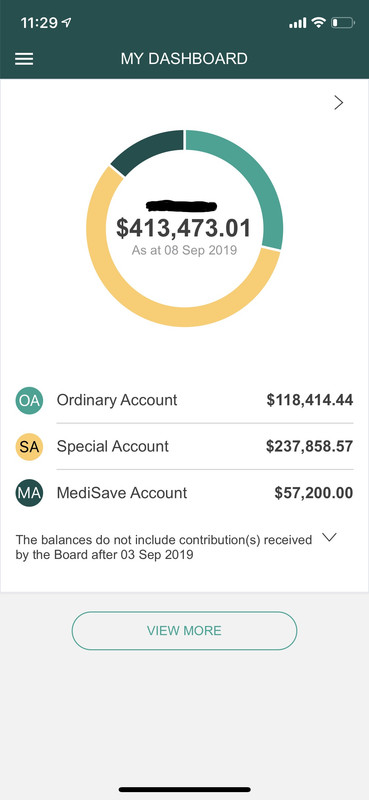

I am just an employee. Have been working more or less consistently since I graduated, focused on progressing as much as I can in my career. I have already exceeded the $181k in my SA for the FRS (I know it is a moving target, depending on one’s age group) but I get 4% compounded annually on my current SA balance. The increase in the last few years for FRS has been ~$5k per annum and if it stays around that level, by the time I hit 55, my FRS will be taken care of solely by the compound interest even if I stop working today, which I don’t intend to. I would like my SA to hit the ERS when I retire.

As for my wife who has stopped working since her 30s, luckily for her she has a husband who plans for her and will ensure that she will at least hit her FRS through regular top-ups when she turns 55. So far, her SA is on track.

That’s 2 persons who will hit their FRS. We are just 2 normal Singaporeans making our way in Singapore. Not looking to the government for any handouts, not intending to game the system for any freebies but merely exercising self responsibility and self reliance.

Well done. Mine is about 50k less than yours.