You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Construction Sector

- Thread starter TVaddict

- Start date

More options

Who Replied?- Joined

- Jan 5, 2015

- Messages

- 84,273

- Reaction score

- 10,137

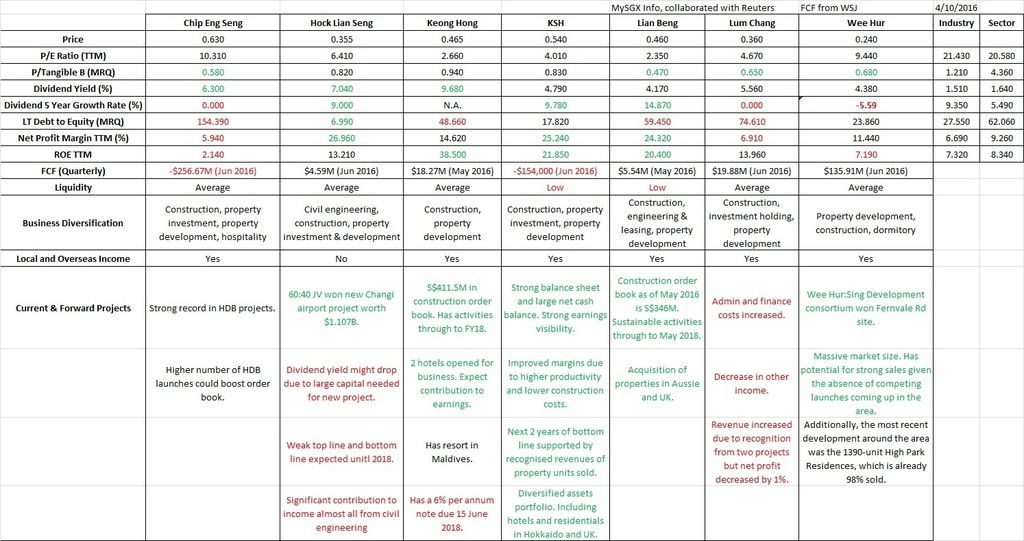

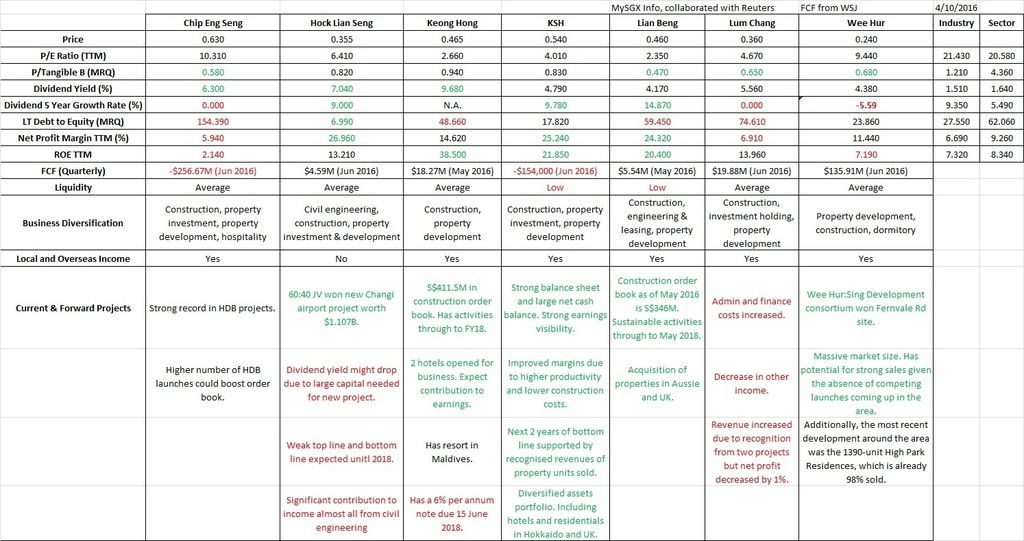

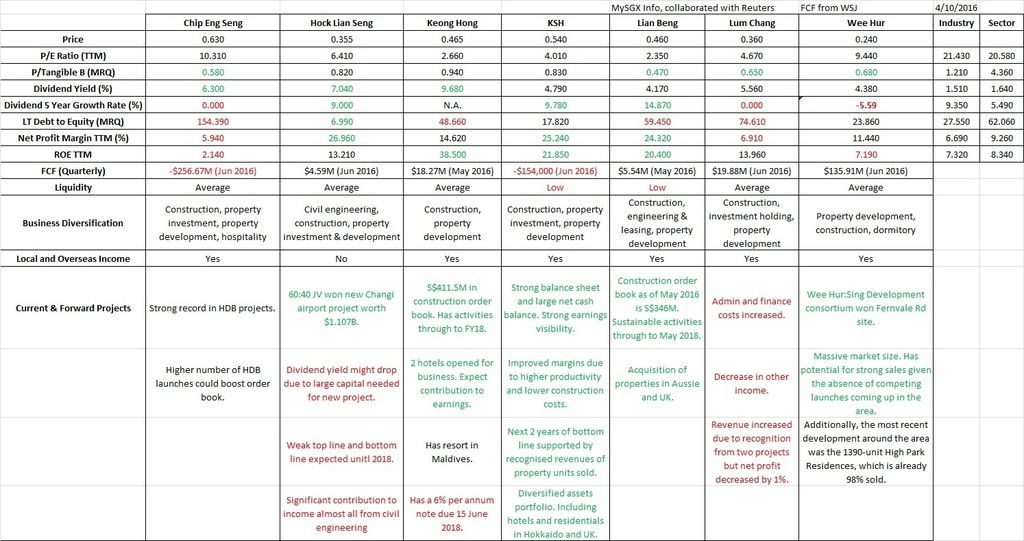

Noticed some interest building up in the construction and related sectors in SSI recently. So thought of tabulating and sharing my studies here for reference.

As usual, for newbies especially, dyodd.

Thank for sharing your work!

Noticed some interest building up in the construction and related sectors in SSI recently. So thought of tabulating and sharing my studies here for reference.

As usual, for newbies especially, dyodd.

buy pan united, they make concrete

TVaddict

Supremacy Member

- Joined

- Dec 25, 2003

- Messages

- 6,322

- Reaction score

- 669

buy pan united, they make concrete

Pan doesn't ticks the boxes for me bro..

Low liquidity, overpriced, high gearing, low margin.

Having said that, the business should be sustainable in the long run from macro environment point of view since Singapore is constructing everywhere

The dividend is more then decent also.

Won't put this in my watch list.

Just my two cents.

strangerjun

Greater Supremacy Member

- Joined

- Mar 25, 2008

- Messages

- 96,258

- Reaction score

- 5

I got ces and hls. Wee Hur in my watchlist for very long time.

xSieghartx

Supremacy Member

- Joined

- Jun 1, 2006

- Messages

- 7,436

- Reaction score

- 0

Bookmarked this thread, thank you TS for the insightful chart.

starfish.starfish

Supremacy Member

- Joined

- Sep 13, 2007

- Messages

- 5,187

- Reaction score

- 1

No problem. As long as it's helpful.

Thanks for sharing ! Used to have lian beng and hock lian Seng.

Maybe time to take anothe roook.

Android user

Senior Member

- Joined

- Nov 22, 2012

- Messages

- 2,428

- Reaction score

- 0

Monitor keong hong before, ty for sharing.No problem. As long as it's helpful.

Sent from Xiaomi REDMI NOTE 3 using GAGT

Mancunian2

Greater Supremacy Member

- Joined

- Jan 7, 2006

- Messages

- 79,186

- Reaction score

- 3,295

is Lum Chang about to be taken private?

or am I mistaken ?

or am I mistaken ?

lbs

Arch-Supremacy Member

- Joined

- Sep 2, 2001

- Messages

- 18,173

- Reaction score

- 8

is Lum Chang about to be taken private?

or am I mistaken ?

What makes you say so?

TheIntelligentInvestor

Senior Member

- Joined

- May 29, 2016

- Messages

- 536

- Reaction score

- 0

Noticed some interest building up in the construction and related sectors in SSI recently. So thought of tabulating and sharing my studies here for reference.

As usual, for newbies especially, dyodd.

Nice chart. I used to hold CES, LB and WH, but since divested. Now focus on only 2, ie HLS and KSH.

- Joined

- Jan 5, 2015

- Messages

- 84,273

- Reaction score

- 10,137

as of today, 5 oct 2016, i would go for KSH due to it low risk and high return

the rest not as good.

Ksh lower Low and lower high recently.

FreedomAngelz

Senior Member

- Joined

- Oct 25, 2007

- Messages

- 1,958

- Reaction score

- 0

Wee Hur caught my attention....thanks TVaddict for sharing!

Android user

Senior Member

- Joined

- Nov 22, 2012

- Messages

- 2,428

- Reaction score

- 0

Pan doesn't ticks the boxes for me bro..

Low liquidity, overpriced, high gearing, low margin.

Having said that, the business should be sustainable in the long run from macro environment point of view since Singapore is constructing everywhere

The dividend is more then decent also.

Won't put this in my watch list.

Just my two cents.

Any thoughts on Yongnam? Not really in construction but will be involve in building of Yangon airport if they get the nod. Recent right issues have lower the share price a lot, but generate liquidity for the company operation.

wahkao3

High Supremacy Member

- Joined

- Mar 6, 2005

- Messages

- 26,835

- Reaction score

- 19

Ksh lower Low and lower high recently.

ok lah, can lah

Important Forum Advisory Note

This forum is moderated by volunteer moderators who will react only to members' feedback on posts. Moderators are not employees or representatives of HWZ. Forum members and moderators are responsible for their own posts.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.