This is the same concept apply to online and physical casino table gaming. But too often ppl cannot control.Cashing out early, means that you'll give up some future upside in exchange for protecting existing profits.

IMO, the peace of mind and ability to enjoy spending profits is more important than trying to milk the max out of every rally.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2024 Market Sentiment & Positioning

- Thread starter Hello_Kitty

- Start date

More options

Who Replied?Assuming we have a pre GFC 1,0 normal yield curve, there is a 100 to 200 bps gap btw the short end and the long end of the curve. This translates to 450 - 575. The 30 year yield is already at 450 with no price action to indicate that a top has been found.

The current supply of new treasuries differs greatly from the pre-GFC era. Can the normal yield curve from before the GFC still apply today?

https://en.macromicro.me/collections/51/us-treasury-bond/4458/us-treasury-issuance-gross

Trump intends to continue what he started in his 1st presidency (which was interrupted by Covid pandemic):

1. Set up import tariffs to punish US companies outsourcing production overseas for strategic high-value goods

2. Cut corporate income taxes down to 15% to promote US-based production

3. Cut regulations (esp. environmental) strangling new businesses in US

4. Reduce US Federal deficits (i.e. pay off more debt)

#1,2,3 are designed to boost US-based production/businesses and thus increase Federal tax receipts to pursue #4.

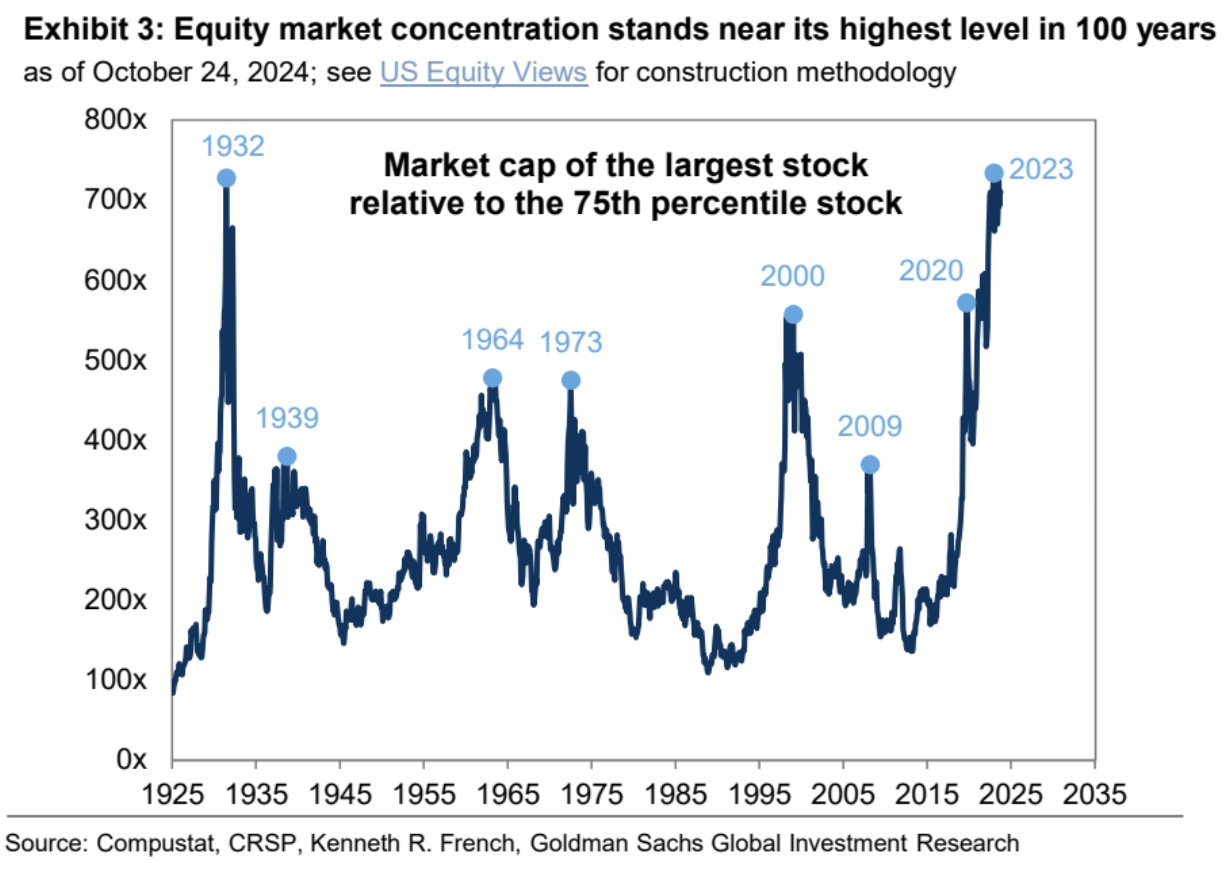

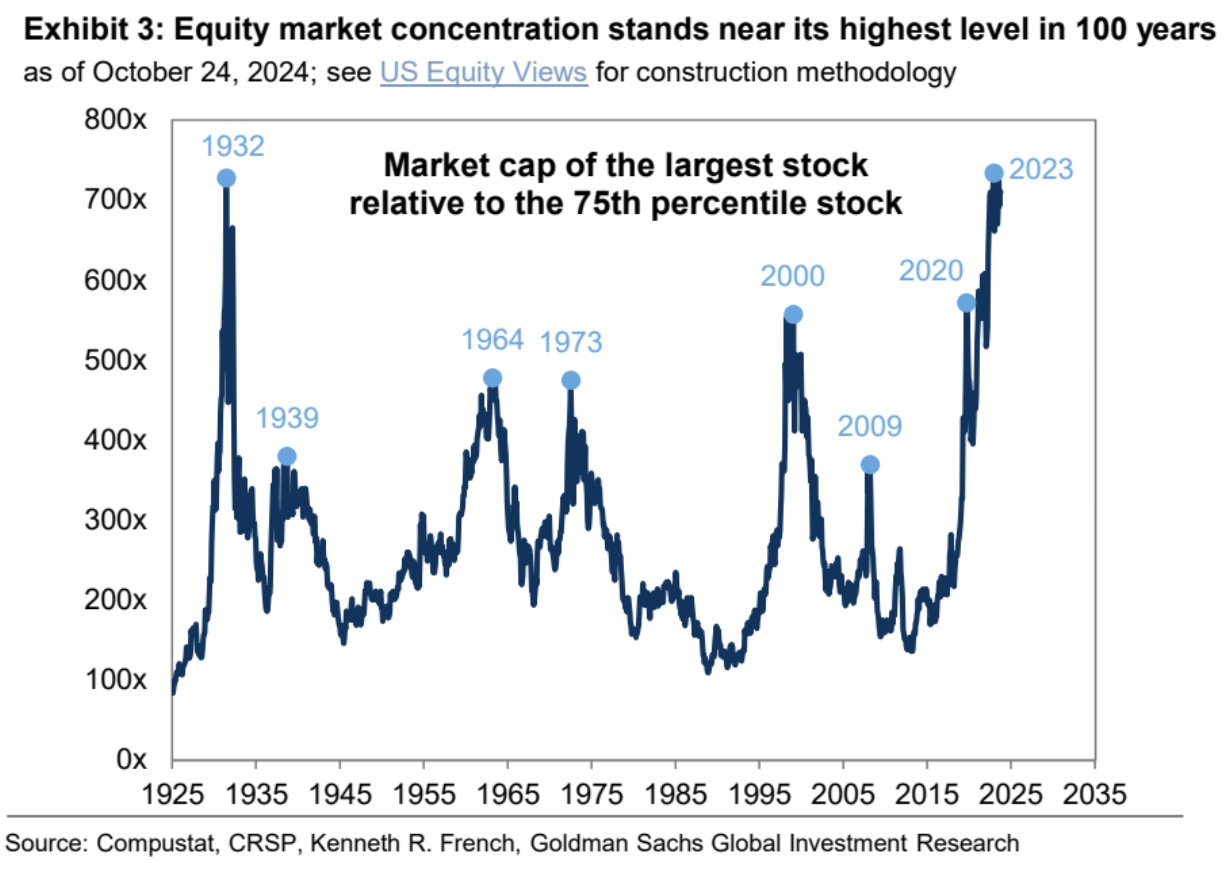

Watch out for your Mag7-heavy portfolio. #1 and #4 will temporarily cripple companies (or their clients) that are currently profiting heavily from foreign goods and wasteful govt contracts.

Mean-reversion from Mag7 concentration can be very nasty.

1. Set up import tariffs to punish US companies outsourcing production overseas for strategic high-value goods

2. Cut corporate income taxes down to 15% to promote US-based production

3. Cut regulations (esp. environmental) strangling new businesses in US

4. Reduce US Federal deficits (i.e. pay off more debt)

#1,2,3 are designed to boost US-based production/businesses and thus increase Federal tax receipts to pursue #4.

Watch out for your Mag7-heavy portfolio. #1 and #4 will temporarily cripple companies (or their clients) that are currently profiting heavily from foreign goods and wasteful govt contracts.

Mean-reversion from Mag7 concentration can be very nasty.

Last edited:

Tiny Shrimp

Master Member

- Joined

- Sep 18, 2024

- Messages

- 3,452

- Reaction score

- 2,497

Trump intends to continue what he started in his 1st presidency (which was interrupted by Covid pandemic):

1. Set up import tariffs to punish US companies outsourcing production overseas for strategic high-value goods

2. Cut corporate income taxes down to 15% to promote US-based production

3. Cut regulations (esp. environmental) strangling new businesses in US

4. Reduce US Federal deficits (i.e. pay off more debt)

#1,2,3 are designed to boost US-based production/businesses and thus increase Federal tax receipts to pursue #4.

Watch out for your Mag7-heavy portfolio. #1 and #4 will temporarily cripple companies (or their clients) that are currently profiting heavily from foreign goods and wasteful govt contracts.

thanks for this

have to say, you always post very informative things

Beware of liquidity crisis. The last two years (2023-2024) of higher corp earnings and stock bubble was funded by huge increases in federal deficit spending by Biden-Harris administration.

Adam Khoo just released a video about the US debt time bomb, and he acknowledges the effects of austerity measures will hit his stocks:

What he missed out is the domino effect. He only thinks the effects are limited to those that are directly paid by govt contracts. The suppliers will also get cut. And the supplier of the suppliers too.

In addition, Biden-Harris admin gave out a lot of money to bring in the illegal migrants, Covid-related tax credits for small business owners, canceled student loans, etc. which are not limited to any sector. Removal of these money flow is bound to reduce purchases that these ppl have been making.

Mag7 stocks are quite dependent on ad spending and consumer shopping. There is no way they can avoid the effects of federal govt austerity rippling through the economy.

For those who doubt Trump's ability to cut Federal spending: here's his story about getting massive discounts for Air Force One.

Adam Khoo just released a video about the US debt time bomb, and he acknowledges the effects of austerity measures will hit his stocks:

What he missed out is the domino effect. He only thinks the effects are limited to those that are directly paid by govt contracts. The suppliers will also get cut. And the supplier of the suppliers too.

In addition, Biden-Harris admin gave out a lot of money to bring in the illegal migrants, Covid-related tax credits for small business owners, canceled student loans, etc. which are not limited to any sector. Removal of these money flow is bound to reduce purchases that these ppl have been making.

Mag7 stocks are quite dependent on ad spending and consumer shopping. There is no way they can avoid the effects of federal govt austerity rippling through the economy.

For those who doubt Trump's ability to cut Federal spending: here's his story about getting massive discounts for Air Force One.

Last edited:

This man is even more savage at cutting costs.

https://www.breitbart.com/politics/...iden-harris-3-billion-healthcare-bureaucracy/

Among the more damaging provisions the Biden-Harris regime snuck into the IRA were measures to expand the federal healthcare bureaucracy by $3 billion. Every clear-thinking person on the planet knows that healthcare dollars should be spent on healing patients rather than hiring bureaucrats or on enriching middlemen, like massively wealthy pharmacy benefit managers (PBMs).

Putting special interests above the people would have been a more accurate name for the IRA. Unfortunately, stealing money from seniors has been all too commonplace in the Biden-Harris White House. Their regime raided almost $300 billion from Medicare and reallocated those funds to bogus pro-China “green” projects. And then to cover up the resulting Medicare Part D premium increases that resulted, they raided billions more from the Medicare Trust Fund to bail out big insurance companies right before the election.

To fix this, Donald Trump recently called for the creation of an efficiency commission to perform “a complete financial and performance audit of the entire federal government.” This visionary idea was pitched to him by none other than Elon Musk, who has also volunteered to lead it.

Instead of more word salads, America needs real solutions. The Trump-Musk efficiency commission will claw back the $3 billion that Biden and Harris are spending on a new federal healthcare bureaucracy and instead put the focus back on stabilizing Medicare where it belongs.

XLV ETF (Healthcare) has entered short-term downtrend.

https://www.breitbart.com/politics/...iden-harris-3-billion-healthcare-bureaucracy/

Trump-Musk Efficiency Commission Would ‘Unburden’ Us from a Federal Healthcare Nightmare and the Biden-Harris $3 Billion Healthcare Bureaucracy

Among the more damaging provisions the Biden-Harris regime snuck into the IRA were measures to expand the federal healthcare bureaucracy by $3 billion. Every clear-thinking person on the planet knows that healthcare dollars should be spent on healing patients rather than hiring bureaucrats or on enriching middlemen, like massively wealthy pharmacy benefit managers (PBMs).

Putting special interests above the people would have been a more accurate name for the IRA. Unfortunately, stealing money from seniors has been all too commonplace in the Biden-Harris White House. Their regime raided almost $300 billion from Medicare and reallocated those funds to bogus pro-China “green” projects. And then to cover up the resulting Medicare Part D premium increases that resulted, they raided billions more from the Medicare Trust Fund to bail out big insurance companies right before the election.

To fix this, Donald Trump recently called for the creation of an efficiency commission to perform “a complete financial and performance audit of the entire federal government.” This visionary idea was pitched to him by none other than Elon Musk, who has also volunteered to lead it.

Instead of more word salads, America needs real solutions. The Trump-Musk efficiency commission will claw back the $3 billion that Biden and Harris are spending on a new federal healthcare bureaucracy and instead put the focus back on stabilizing Medicare where it belongs.

XLV ETF (Healthcare) has entered short-term downtrend.

Last edited:

For the following statistics, "adult" is defined as age 20 and over. The overweight + obese percentages for the overall US population are higher reaching 39.4% in 1997, 44.5% in 2004,[13] 56.6% in 2007,[14] 63.8% (adults) and 17% (children) in 2008,[15][16] in 2010 65.7% of American adults and 17% of American children are overweight or obese, and 63% of teenage girls become overweight by age 11.[17] In 2013 the Organization for Economic Co-operation and Development (OECD) found that 57.6% of all American citizens were overweight or obese. The organization estimated that 3/4 of the American population would likely be overweight or obese by 2020.[18] According to research done by the Harvard T.H. Chan School of Public Health, it is estimated that around 40% of Americans are considered obese, and 18% are considered severely obese as of 2019. Severe obesity is defined as a BMI over 35 in the study. Their projections say that about half of the US population (48.9%) will be considered obese and nearly 1 in 4 (24.2%) will be considered severely obese by 2030

https://en.wikipedia.org/wiki/Obesity_in_the_United_StatesCompared to non-obese Americans, between 2001 and 2016, obese Americans incurred an average of $2,505 more in medical expenses annually, and in 2016, the aggregate medical cost due to obesity in the United States of America was $260.6 billion

USA don't want to face the hard truth that if they cut down obesity, they will save a lot of money. $260bn a year is the medical cost of obesity and doesn't include the economic productivity loss (more MC, work less hours).

I am putting LLY and NVO on my watchlist for good entry price. Better to be long weight loss drug manufacturers as Govt start buying weight loss drugs to give to obese people:

https://www.theguardian.com/society...s-jabs-to-get-back-to-work-says-wes-streeting

LWZ

High Supremacy Member

- Joined

- Jul 9, 2016

- Messages

- 36,049

- Reaction score

- 13,399

american buibui is really in a league of their own.https://en.wikipedia.org/wiki/Obesity_in_the_United_States

USA don't want to face the hard truth that if they cut down obesity, they will save a lot of money. $260bn a year is the medical cost of obesity and doesn't include the economic productivity loss (more MC, work less hours).

I am putting LLY and NVO on my watchlist for good entry price. Better to be long weight loss drug manufacturers as Govt start buying weight loss drugs to give to obese people:

https://www.theguardian.com/society...s-jabs-to-get-back-to-work-says-wes-streeting

even aussie buibui don't come close.

american buibui is really in a league of their own.

even aussie buibui don't come close.

Looks at the amount and kinds of junk food Americans are eating and continue to eat. Aussies are nowhere close.

narutos

Member

- Joined

- Oct 20, 2020

- Messages

- 301

- Reaction score

- 89

My GOOG become green green like an apple.Google earning is very good.

Euqorab

Arch-Supremacy Member

- Joined

- Jul 8, 2001

- Messages

- 24,000

- Reaction score

- 4,196

GreatMy GOOG become green green like an apple.

I buyed AMD at 162.x and it falled

fml

My view still stand just hoot the trillion dollar market cap US listed stocks won't go too wrong. Imagine Warren sold AAPL also not big effect it shows the number of supporters.My GOOG become green green like an apple.

wutawa

Arch-Supremacy Member

- Joined

- Jan 25, 2003

- Messages

- 11,864

- Reaction score

- 3,513

GG msft..Googl, msft and visa. Yeah!

Trillion dollar market cap stock you think will go bankrupt? Just in Spore alone govt stat boards and so many private sector companies using their products both frontend and backend. Price may retreat of cuz but not saying go bankrupt that is what I mean. Long term should still be ok IMHO and I always do fractional so ok still green colour.GG msft..

mooseolly

High Supremacy Member

- Joined

- Mar 21, 2009

- Messages

- 28,818

- Reaction score

- 12,802

Microsoft like seems to be downplaying their guidance so that they can easily exceed expectations in their next earnings. Their financials is still very solid. Slightly over valued. Maybe when openAI goes ipo they could see meaningful gain in their investment.

Meta earning is also very solid, about fairly valued. Don’t see the share price going below $500 in the shorter term but if it does could be a good buying opportunity.

Meta earning is also very solid, about fairly valued. Don’t see the share price going below $500 in the shorter term but if it does could be a good buying opportunity.

Last edited:

For me I just hoot the trillion dollar market cap stocks in US exchanges will do. Same as SGX just hoot the three local banks will do.Microsoft like seems to be downplaying their guidance so that they can easily exceed expectations in their next earnings. Their financials is still very solid. Slightly over valued. Maybe when openAI goes ipo they could see meaningful gain in their investment.

Meta earning is also very solid, about fairly valued. Don’t see the share price going below $500 in the shorter term but if it does could be a good buying opportunity.

For ppl doing pure trading then there is difference becuz the price can fluctuate quite a bit. But if one is going for pure trading can whack other high volume stocks no need to be fixated on these magnificent seven logical?

mooseolly

High Supremacy Member

- Joined

- Mar 21, 2009

- Messages

- 28,818

- Reaction score

- 12,802

Indeed, these companies have much more free cashflow than their debt and they can weathered high interest rate environment anytime. They are also multi national and even if US undergo recession as long as the rest of the world is ok these companies can still bring in tonnes of profits from abroad.For me I just hoot the trillion dollar market cap stocks in US exchanges will do. Same as SGX just hoot the three local banks will do.

For ppl doing pure trading then there is difference becuz the price can fluctuate quite a bit. But if one is going for pure trading can whack other high volume stocks no need to be fixated on these magnificent seven logical?

Important Forum Advisory Note

This forum is moderated by volunteer moderators who will react only to members' feedback on posts. Moderators are not employees or representatives of HWZ. Forum members and moderators are responsible for their own posts.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.