hclee01

Master Member

- Joined

- Nov 5, 2003

- Messages

- 3,952

- Reaction score

- 277

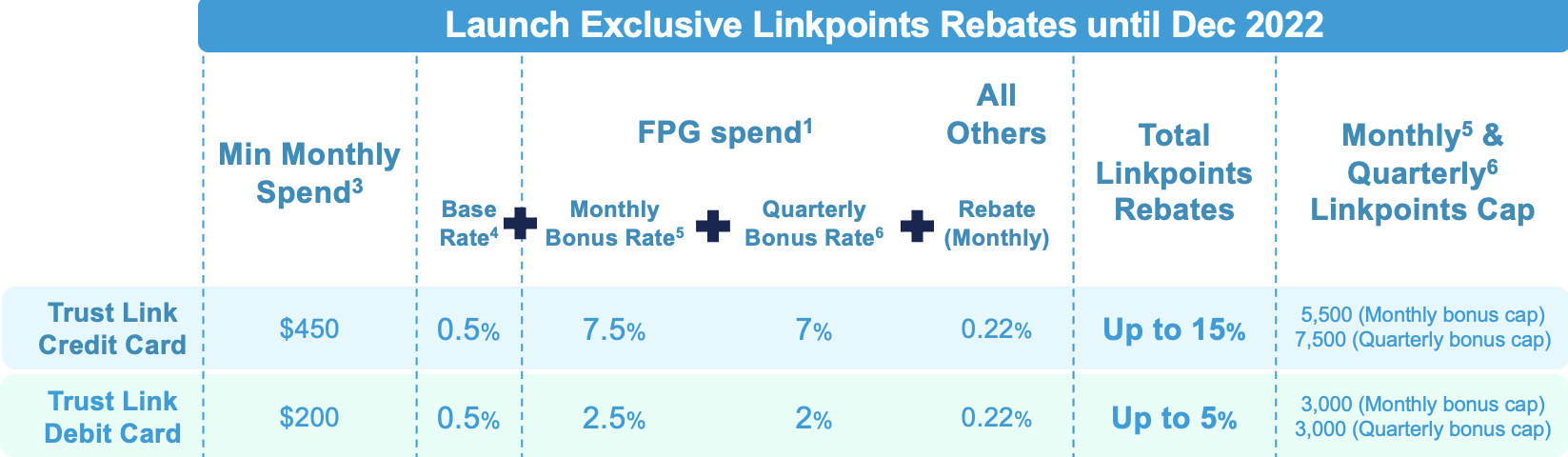

https://trustbank.sg/credit-card/

Receive a S$25 FairPrice E-Voucher on us when you make your first card spend.

Receive a S$25 FairPrice E-Voucher on us when you make your first card spend.

- No annual fee

- No foreign transaction fee (not even 1% Visa charges)

- No cash advance fee

- No card replacement fee