wow, if you work in semicon, you should be super-rich by know since you can grasp the following relationships between the companies that enjoyed massive bull runs several times:Dell, HPe, AVGO, APPL all of them are our customers.

Dell will stonk.

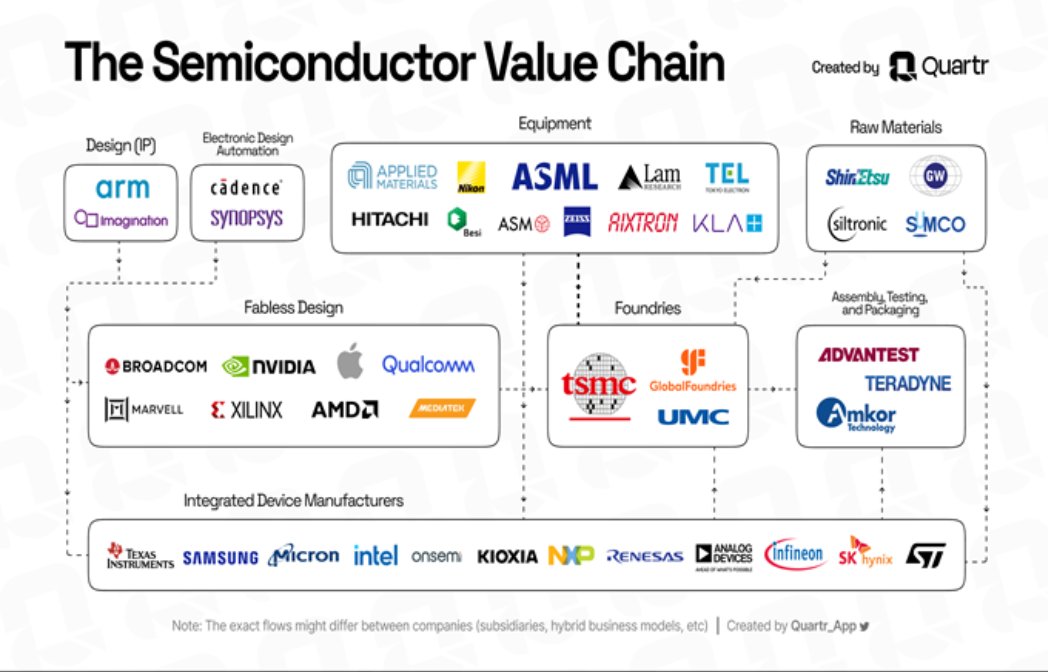

I seriously got confused by all the semicon names until I learnt about this chart.

Just set up a watchlist with all these companies, and then buy when stock price goes into bull trend.