wahkao3

High Supremacy Member

- Joined

- Mar 6, 2005

- Messages

- 26,805

- Reaction score

- 24

good lesson.the final lesson is like many had said, dont invest money you cant lose. Leverage will kill/propel you instantly.

but there's much more to learn

good lesson.the final lesson is like many had said, dont invest money you cant lose. Leverage will kill/propel you instantly.

I think FFO and AFFO are also important, more important than PEs!Ultimately reits rely heavily on borrowings to finance their properties. Things to check:

1) debt levels

2) cash levels

3) what kind of debt and at what rates (floating or fix)

4) major tenants occupancy expiry

Not just see Yield %, NAV , Gearing.. if yield so good but price dont move..means.... what? You may be attracted to yield.. give you 1 or 2 times div then company start to chu pattern liao.. then you spit saliva

You see maple logistics, so over valued over NAV but still can move up.

for those of you who think dividend will save you during recession, remember :

total return = dividend gain - capital loss

if the capital loss is -100 and the dividend gain is 80, you make a net loss of -20. Its still wiser to sell off and buy at cheaper price. dont be fooled by the dividend. dont be hard up over dividend!

ya good point there on capital loss

that's why also good to diversify, have some gold and bonds

for garmen bonds, harder for capital loss especially if u have no problems holding to maturity

if young, 100% stocks is fine too, since u still got income and can take capital loss

if old man liao want to retire then should stick more to bonds and defensive stocks for passive income and prevention of capital loss

100% stocks over the advantage of having some bond and gold allocation to do rebalancing? I think not. Too dangerous also...

I was in my final year when the 08-09 crisis strike, lost around 30 k in a week. Hand shake when I was washing test tube. And due to some emotional problem, I din dare to look at the stock screen for almost a year. Still remember that time vested in spc and some commodities counter. The next year, I was quite lucky because the oil price rebound strongly and spc get some privatization offer, eventually sold almost all my holdings with slight profit of few k.

Feel lucky coz I experience all this in my earlier year. I dunno what will be the situation like when the loss is 6 digits.

it's all relative.. to your networth..

i lose high six digits on portfolio.. but i slept well.. lol

coz my daily portfolio movement is five digits..

that's 1 big ass portfolio!!it's all relative.. to your networth..

i lose high six digits on portfolio.. but i slept well.. lol

coz my daily portfolio movement is five digits..

dont be fooled by the dividend. dont be hard up over dividend!

it's all relative.. to your networth..

i lose high six digits on portfolio.. but i slept well.. lol

coz my daily portfolio movement is five digits..

it's all relative.. to your networth..

i lose high six digits on portfolio.. but i slept well.. lol

coz my daily portfolio movement is five digits..

Thats right bro - no exit, no money. Got exit, got money.So its like a all or nothing? Either u get back everything + returns or nothing at all, no in between

Thats right bro - no exit, no money. Got exit, got money.

u say walton right?u cant say like u tired of waiting after 7 years, want to exit when still nobody buy over that land yet? just that maybe u get back only 50-70% of your initial investment (the others already eaten up due to commissions n other stuff)

Never asked before - if I remember correctly can transfer to another guy who want to take over. Partial exit on any some at certain cut must ask again if possible.u cant say like u tired of waiting after 7 years, want to exit when still nobody buy over that land yet? just that maybe u get back only 50-70% of your initial investment (the others already eaten up due to commissions n other stuff)

DBS $6.90! Buy buy buy!!!

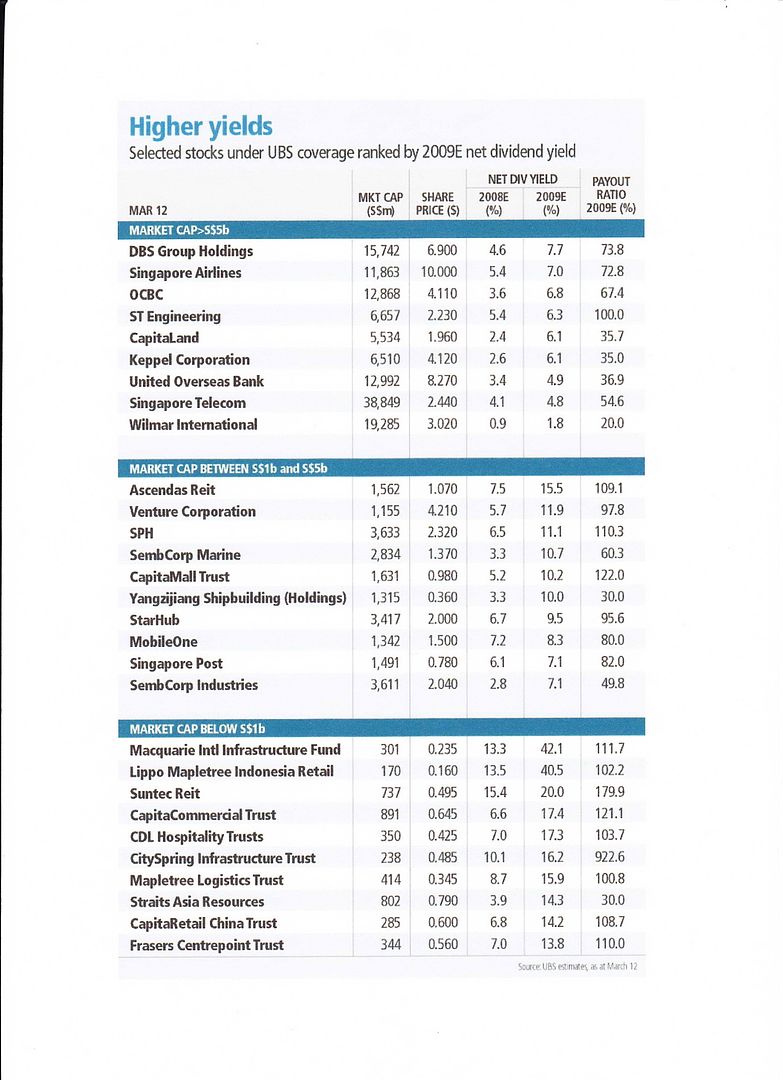

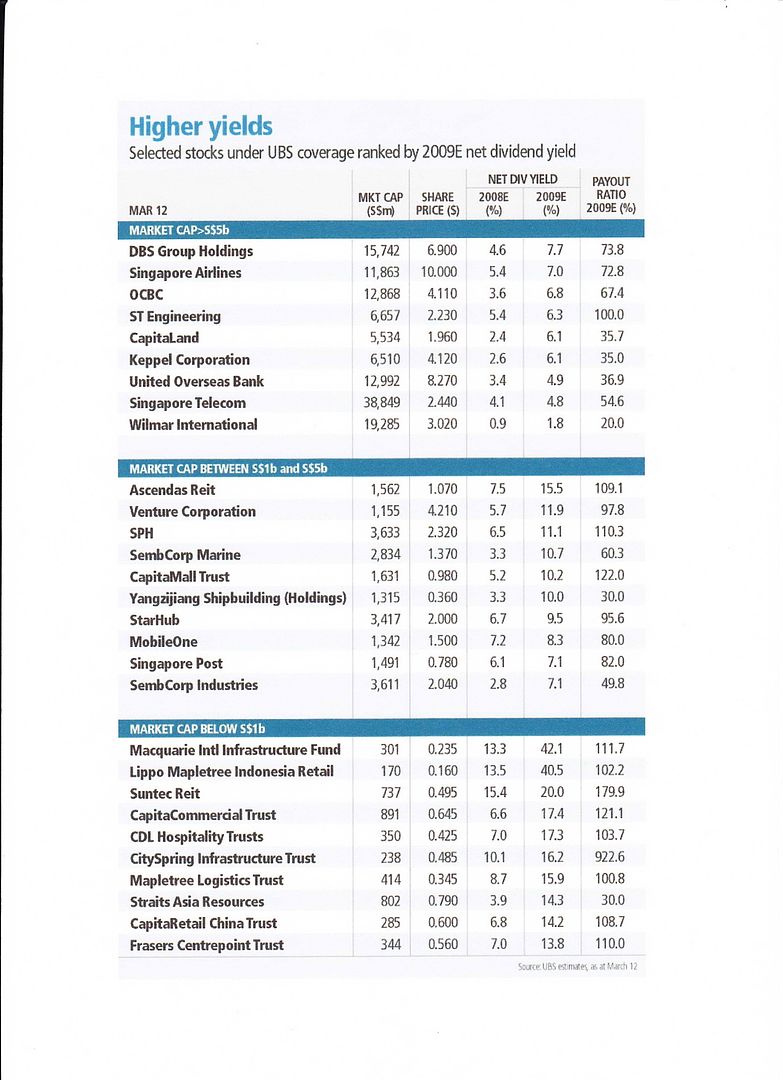

During the financial crisis, dividend yield was a major consideration (but not the only one) in deciding which stocks to pick.

Most of my buys were from this list were coincidentally from this list (i.e. I already bought into these counters earlier on before I saw this and had started averaging down), spread between all 3 categories. One of those not in the list was my portfolio's worst performer, ComfortDelgro, think average price was 1.45, which failed to move in price until recently...

You see this kind of yields, screaming buy buy buy, yet a lot of internet forummers paralyzed by fear...

It was so important that I even kept this printout. Can't remember whether it was businesstimes or an analyst report.