You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BOC Visa Infinite

- Thread starter phayze

- Start date

More options

Who Replied?gravityz3r0

Senior Member

- Joined

- Aug 6, 2008

- Messages

- 1,491

- Reaction score

- 8

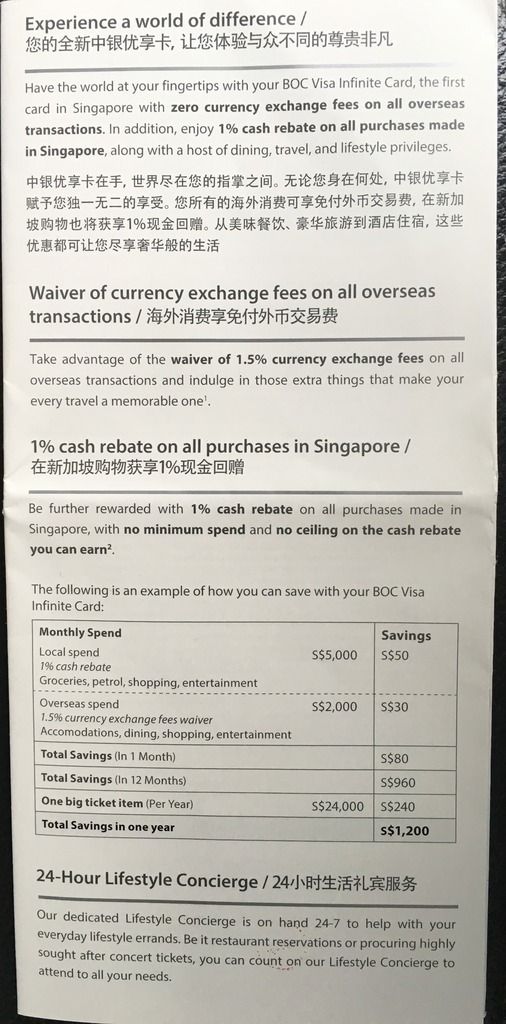

Saw this new card brochure.

• 1st year fee waiver

• 6% cashback for 1st 3 month upto $5000 spend.

any more details? min annual income, and what after 3 months? Seems very similar to TCB card offer.

sgdividends

Senior Member

- Joined

- Oct 11, 2008

- Messages

- 2,428

- Reaction score

- 25

cannnot find on BOC singapore website....

cannnot find on BOC singapore website....

their website is always laggy...

Saw this new card brochure.

• 1st year fee waiver

• 6% cashback for 1st 3 month upto $5000 spend.

Sui! Hopefully more details will follow...

Have to go branch pick up brochure?

Min $120k pa income. After 3 mth, 1% cash back, no capped.

any more details? min annual income, and what after 3 months? Seems very similar to TCB card offer.

SCG8866T

Senior Member

- Joined

- Mar 14, 2013

- Messages

- 998

- Reaction score

- 1

Min $120k pa income. After 3 mth, 1% cash back, no capped.

Sianz, same as CIMB infinite, except for the first 3 months 6%.

Min $120k pa income. After 3 mth, 1% cash back, no capped.

does it come with free unlimited Priority Pass?

Thai_Rak_Thai

Master Member

- Joined

- Mar 18, 2006

- Messages

- 4,790

- Reaction score

- 557

Thanks for taking trouble to get nice photos

derrickgoh

High Supremacy Member

- Joined

- Jan 1, 2000

- Messages

- 39,095

- Reaction score

- 12

1st 3 month 6% good lah. After that might as well go CIMB. Free for life & also 1%.Saw this new card brochure.

• 1st year fee waiver

• 6% cashback for 1st 3 month upto $5000 spend.

sandwicher

Senior Member

- Joined

- Nov 27, 2007

- Messages

- 1,421

- Reaction score

- 4

Wow, and the dining benefits is mirroring Amex's platinum card. Pity I don't meet the annual income.

Unless they're quite slack in that regards like ANZ?

Is CIMB strict on the annual income portion as well?

Unless they're quite slack in that regards like ANZ?

Is CIMB strict on the annual income portion as well?

htngwilliam

Supremacy Member

- Joined

- Dec 31, 2004

- Messages

- 8,703

- Reaction score

- 4

Is there annual fee levied on this card?

CIMB service sucks! Really pissed off with them

Wow, and the dining benefits is mirroring Amex's platinum card.

Not Amex, but CIMB Infinite. Same list of restaurants.

derrickgoh

High Supremacy Member

- Joined

- Jan 1, 2000

- Messages

- 39,095

- Reaction score

- 12

ANZ is slack meh? CIMB is the easiest. Just deposit $50K with them can liao. Other banks also offer secured VI card but ask for much larger amounts.Wow, and the dining benefits is mirroring Amex's platinum card. Pity I don't meet the annual income.

Unless they're quite slack in that regards like ANZ?

Is CIMB strict on the annual income portion as well?

derrickgoh

High Supremacy Member

- Joined

- Jan 1, 2000

- Messages

- 39,095

- Reaction score

- 12

Why would you need to engage them in the first place? To be honest I have been using credit cards for so many years and never even had to engage their customer service people except to request fee waiver.CIMB service sucks! Really pissed off with them

Thai_Rak_Thai

Master Member

- Joined

- Mar 18, 2006

- Messages

- 4,790

- Reaction score

- 557

Is there annual fee levied on this card?

$350 per year for principal. First year waived

Important Forum Advisory Note

This forum is moderated by volunteer moderators who will react only to members' feedback on posts. Moderators are not employees or representatives of HWZ. Forum members and moderators are responsible for their own posts.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.