cherry6

Banned

- Joined

- Jan 16, 2007

- Messages

- 11,993

- Reaction score

- 445

IMF tells Singapore government to steal less money from ordinary citizens.

Basics:

- Every country govt prints money, its just a matter of more or less. All things being equal (productivity and consumption of each country being balanced, exchange rates should be constant if ALL countries print $$$ at the same rate.

- Though not commonly mentioned, such printing of $$$ is actually some form of theft since more circulating dollars means less buying power per dollar- an erosion of the hard earned savings of the average man.

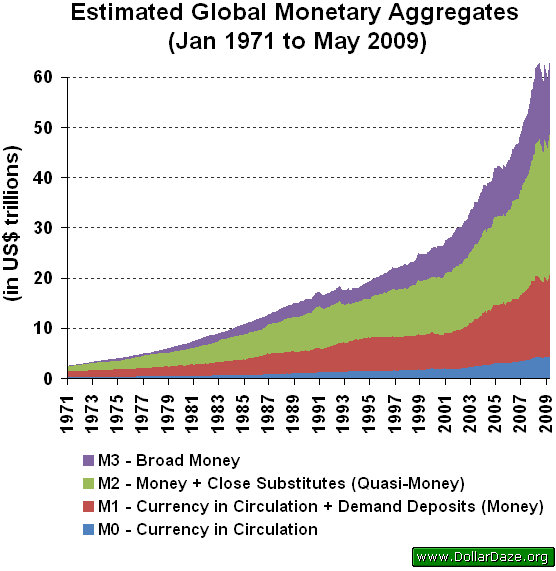

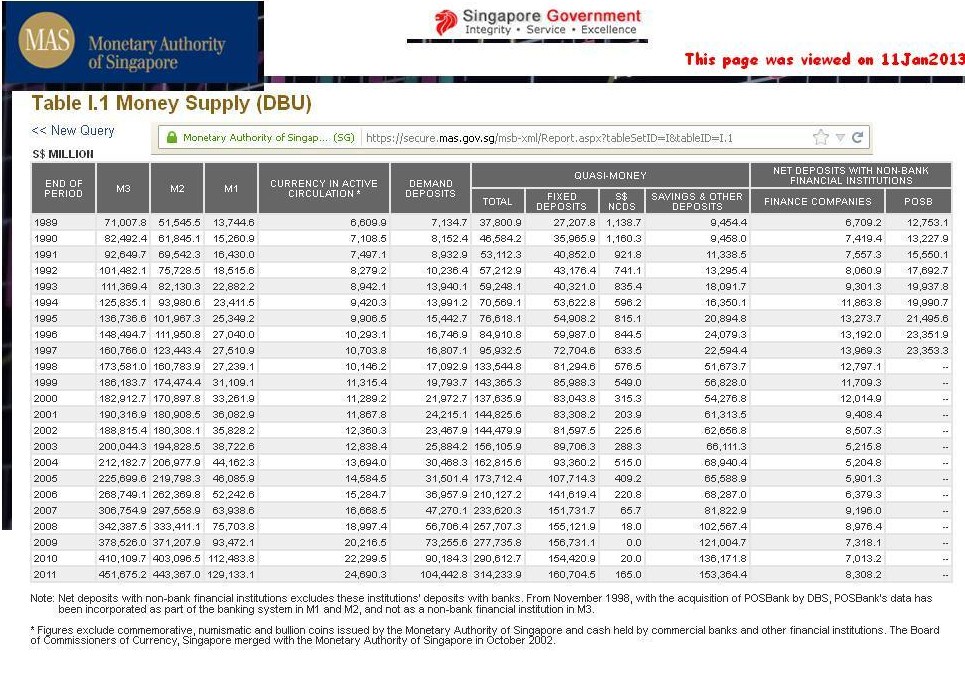

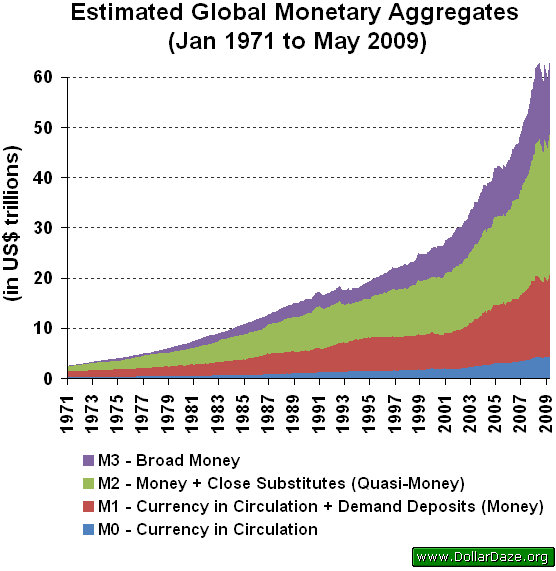

- Chief printers of $$$ in this world are USA, China and Japan, everyone follows, that is why the M1 money supply (and other wider measures of $ (M2, M3 etc) is increasing annually too).

- Devalueing one's currency beyond international average e.g. Japan Yen/ (Abenomics) can make a nation's exports cheaper and its imports more expensive so the citizens have to produce more goods (work harder) for the usual amount of foreign imported goods (consumption).

- Tighten $$$ policy means print relatively less $$$ or lend printed $ at higher interest rates ( so that the value of one's currency increases relative to world currency/ gold prices etc.)

- The IMF finds that Singaporeans are working too hard and consuming too little. ("The island, which has a population of just 5.4 million people, enjoyed a current account surplus of $51.4 billion last year, which was a massive 18.6 percent of gross domestic product (GDP).")- Singapore island overproduced by $51.4b last year. IMF thus feels that Singaporeans need to enjoy themselves more by importing more foreign goods and asks that the Singapore government facilitate this by stealing less money from hardworking Singaporeans- more imports into SG can also help out with European joblessness, some of which exceed 50%(youth unemployment)- so as to assist the IMF with balancing out the world economy I suppose.

IMF "Singapore should consider tightening monetary policy further by letting the local dollar rise at a faster pace to aid external rebalancing"

Reference: 'QE: 'Hidden theft' or 'primary tool' for economy?'

PS: For brevity, this opinion is written based SOLELY on economic logic. Moral considerations/ nationalist fervour however have been scheduled to the later discussion.

(IMG URL)

(IMG URL)

(Hyperinflation in Zimbabwe)

(Hyperinflation in Zimbabwe)

Basics:

- Every country govt prints money, its just a matter of more or less. All things being equal (productivity and consumption of each country being balanced, exchange rates should be constant if ALL countries print $$$ at the same rate.

- Though not commonly mentioned, such printing of $$$ is actually some form of theft since more circulating dollars means less buying power per dollar- an erosion of the hard earned savings of the average man.

- Chief printers of $$$ in this world are USA, China and Japan, everyone follows, that is why the M1 money supply (and other wider measures of $ (M2, M3 etc) is increasing annually too).

- Devalueing one's currency beyond international average e.g. Japan Yen/ (Abenomics) can make a nation's exports cheaper and its imports more expensive so the citizens have to produce more goods (work harder) for the usual amount of foreign imported goods (consumption).

- Tighten $$$ policy means print relatively less $$$ or lend printed $ at higher interest rates ( so that the value of one's currency increases relative to world currency/ gold prices etc.)

- The IMF finds that Singaporeans are working too hard and consuming too little. ("The island, which has a population of just 5.4 million people, enjoyed a current account surplus of $51.4 billion last year, which was a massive 18.6 percent of gross domestic product (GDP).")- Singapore island overproduced by $51.4b last year. IMF thus feels that Singaporeans need to enjoy themselves more by importing more foreign goods and asks that the Singapore government facilitate this by stealing less money from hardworking Singaporeans- more imports into SG can also help out with European joblessness, some of which exceed 50%(youth unemployment)- so as to assist the IMF with balancing out the world economy I suppose.

IMF "Singapore should consider tightening monetary policy further by letting the local dollar rise at a faster pace to aid external rebalancing"

Reference: 'QE: 'Hidden theft' or 'primary tool' for economy?'

PS: For brevity, this opinion is written based SOLELY on economic logic. Moral considerations/ nationalist fervour however have been scheduled to the later discussion.

Tags: inflation, quantitative easing, finance, money supply, Singapore,IMF says Singapore needs to narrow current account surplus

SINGAPORE | Thu Nov 14, 2013 9:05am EST

By Kevin Lim

SINGAPORE (Reuters) - Singapore needs to narrow its huge current account surplus further and the International Monetary Fund supports the government's plans to raise public spending on infrastructure and social services, the IMF said on Thursday.

"Singapore's external position appears to be stronger than warranted by fundamentals, suggesting the importance of further efforts to narrow the current account surplus over the medium term," the IMF said on Thursday in its annual review of economic developments and policies in the wealthy Southeast Asian city-state.

A few IMF directors even felt Singapore should consider tightening monetary policy further by letting the local dollar rise at a faster pace to aid external rebalancing, the fund said.

The IMF, in a separate report, also said Singapore's financial regulation and supervision frameworks were among the best globally, with stress tests indicating its financial institutions would be able to cope in the event of adverse developments such as a sharp drop in property prices.

IMF carries out annual reviews of most member countries. In the case of systemically important jurisdictions such as Singapore, the fund also conducts a thorough financial sector assessment program once every five years.

Singapore, unlike many developed economies, enjoys huge current account surpluses. This is partly due to the government routinely posting budget surpluses and its success in developing the city-state's wealth-management industry, which has attracted large capital inflows.

Singapore is also Asia's number one foreign exchange trading center as well as a key Asian base for commodities traders and fund managers.

The island, which has a population of just 5.4 million people, enjoyed a current account surplus of $51.4 billion last year, which was a massive 18.6 percent of gross domestic product (GDP).

CREDIT, REAL ESTATE

The IMF, however, warned that Singapore needed to be wary of risks arising from the rapid growth of credit and real estate prices in recent years, noting the city-state's economy has become increasingly sensitive to macroeconomic shocks and interest rate cycles.

"Significant risks have built up under very low interest rates, but appear manageable, although confirmation will come only once the cycle has turned," the IMF said.

The IMF recommended that Singapore impose a countercyclical capital buffer on banks as well as step up its monitoring of banks' credit risks and foreign currency liquidity practices.

Other suggestions by the IMF include ensuring the city-state's banking industry "adequately contributes to the cost of resolving failed banks and further develop recovery plans for Singapore Exchange (SGXL.SI)".

Singapore has been grappling with higher-than-normal inflation in recent years as low global interest rates boosted property prices, even as ongoing measures to make it harder for firms to bring in cheap foreign workers pushed up the wages of lower-skilled residents.

The Monetary Authority of Singapore, the city-state's central bank, last month warned that core inflation was likely to accelerate in 2014 as it stuck to its tight monetary policy stance of allowing a "modest and gradual" appreciation of the local dollar.

The fund forecasts Singapore's core inflation will rise from 1.9 percent this year to 2.8 percent next year, which would make it the highest since 2008.

Core inflation excludes the cost of cars and accommodation since these are more influenced by government policy.

Home prices, however, have stabilized this year after a series of government measures to cool the housing market.

(Editing by Jacqueline Wong)

http://www.reuters.com/article/idUSBRE9AD0QU20131114

Last edited: