http://www.businesstimes.com.sg/companies-markets/brokers-take-uob-hay-kian-issues-buy-on-gl

Tue, Oct 31, 2017 - 11:07 AM

Broker's take: UOB Hay Kian issues 'buy' on GL

UOB Hay Kian issued a "buy" call on GL Ltd citing a weakened sterling, the UK hotel market's high performance, and the potential asset disposal of GL's casino and Hawaii properties.

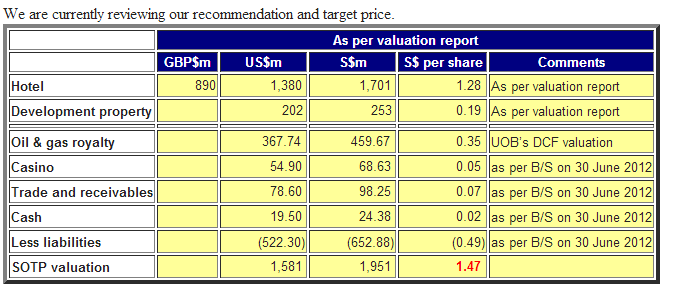

UOB has set a target price of S$1.185, or a 30.9 per cent increase from its current valuation.

GL, formerly known as GuocoLeisure or BIL International, is the mainboard-listed hospitality arm of Guoco Group. It invests mainly in hotel management and operations in the leisure industry.

The broker is initiating coverage as GL's "established status as a major player in the London hotel market and its diverse array of offerings near tourist hotspots only underline the quality of its portfolio and the massive discount of its share price to its fair value".

It added that the weakened sterling, which has made travel and accommodation cheaper in the UK, has a positive effect on hotel performance, with more growth expected in 2018.

"We think the potential sale of Clermont Club and Molokai Island will unmask the true potential of GL's hospitality assets and trigger a re-examination of its fair value." the broker said

UOB said that GL's new group managing director Tang Hong Cheong, also Guoco Group's president and CEO, was a catalyst in speeding up the process of selling these properties.

The broker said that the potential sale of these properties could streamline assets for a potential privatisation.

"Moreover, the upward momentum in big-ticket transactions in the London hotel market and continued strong investor demand for trophy assets might highlight the substantial hidden value in GL."

With GL's healthy balance sheet and steady dividends, investors can get paid to wait for positive share price catalysts, the broker said.

However, UOB noted that oil prices may affect GL's earnings, largely due to the sizable profits generated from its Bass Straits royalty.

Intensifying competition in the London hotel market and geopolitical risks and external events affecting tourism and property development were also highlighted as risks going forward.

On the Singapore Exchange on Tuesday, GL's shares were trading up 0.6 per cent at S$0.91 per share, as at 10.51am.