Paul Lee

Supremacy Member

- Joined

- Jan 1, 2000

- Messages

- 5,667

- Reaction score

- 162

OMG! Another REIT IPO!

While I'm a REIT investor, its getting a little disconcerting when it seems like every tom, dick and harry is looking at reit-ing their asset.

Are there really so much liquidity in the market still? Are we looking at the potential REIT bubbles? Its starting to feel like 2008 all over again.

Viva Industrial Trust said to offer 8.8% yield for S’pore IPO

SOURCE: TodayOnline

While I'm a REIT investor, its getting a little disconcerting when it seems like every tom, dick and harry is looking at reit-ing their asset.

Are there really so much liquidity in the market still? Are we looking at the potential REIT bubbles? Its starting to feel like 2008 all over again.

Viva Industrial Trust said to offer 8.8% yield for S’pore IPO

SINGAPORE — Viva Industrial Trust plans to offer a 2014 dividend yield of about 8.8 per cent in an initial public offering that will raise as much as S$375 million in Singapore, according to people with knowledge of the matter.

The trust, which will be backed by three industrial properties, kicked off its pre-marketing process yesterday and plans to list on the Singapore Exchange next month, they said.

They added that more than half of the planned offering has been taken up by institutional buyers who agreed to act as cornerstone investors.

These investors usually commit to hold their shares for a specific period and often make an IPO more attractive to other investors.

Viva’s proposed cornerstone investors are likely to commit to holding their stakes for at least six months, they said.

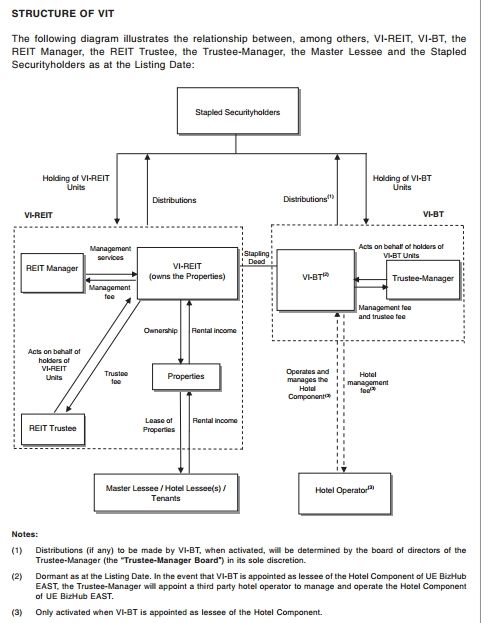

Viva’s initial portfolio — 78 per cent of which is to be business park property — is slated to include UE BizHub East, a mixed-use development comprising two business park buildings, a 251-room hotel and a convention centre.

In July, the trust signed a conditional S$518-million deal to buy UE BizHub East from United Engineers. The deal would go through only if the trust successfully lists, United said in July.

This property, together with two other developments in the Tuas and Chai Chee areas, will be included in the trust’s holdings, the people said. Standard Chartered, Bank of America’s Merrill Lynch unit and HSBC Holdings are working on the share sale.

Mr Wilson Ang, Chief Executive Officer of the trust’s manager, declined to comment.

Viva’s IPO plan is the latest in a series of REIT and business trust listings on the Singapore bourse, which has dominated Asia’s trust listings and where REITs and business trusts this year have accounted for US$3.76 billion (S$4.7 billion) out of a total US$4.24 billion of new share offerings. AGENCIES

SOURCE: TodayOnline