jq75

Honorary Member

- Joined

- Dec 5, 2000

- Messages

- 141,721

- Reaction score

- 4,461

Mar 6, 2010

HDB rules change

3 years before you can sell resale flats

By Joyce Teo

Related Link

WHAT'S CHANGING

BUYERS of non-subsidised HDB resale flats must now occupy their flats for at least three years before they can sell, under new rules unveiled yesterday.

This is up from 2-1/2 years for buyers with HDB loans and one year for buyers with bank loans or no loan.

The move, effective yesterday, is seen as a government effort to curb speculative buying and selling of public housing.

Home hunters have expressed dismay in recent months that speculators may be pushing up HDB resale flat prices.

Property consultants said the move is set to nip speculation in the bud but is not likely to result in lower flat prices.

The move comes after an HDB study found that a growing number of flat owners were selling flats within three years.

In late January, National Development Minister Mah Bow Tan flagged a review by HDB of its rules, with a view to stamping out possible speculation.

In Parliament yesterday, Mr Mah said said more flat owners had been selling flats as soon as the minimum period was up, although the numbers were not large.

He added: 'However, if the trend continues, buyers who genuinely need housing could be crowded out.'

He was responding to MP Ang Mong Seng's request for a review of the one-year minimum period applying to those with bank loans or no loan.

'HDB flats are provided primarily for owner-occupation and not speculative profit or rental return,' said Mr Mah.

HDB said in a statement that the change meant demand would more accurately reflect interest from buyers who wish to occupy flats.

Different rules apply to subsidised buyers who receive HDB grants.

Home hunter Sofian Buang, 33, a loading officer, said: 'My biggest concern is getting a roof for my family, now that I have a daughter. I am looking for a resale flat to settle in, not to sell or to rent out.'

ERA Asia-Pacific associate director Eugene Lim said the change would remove buyers who wanted to flip HDB flats after a year. 'With a smaller group chasing after HDB resale flats, price increases will slow down,' he said.

Demand for resale flats outweighs supply so prices will still rise, but perhaps at a slower pace, said C&H Realty managing director Albert Lu.

Mr Steven Tan, executive director of OrangeTee's residential division, said the change would cut speculation but that the Government should look at private property owners buying HDB flats to rent out right away.

If demand is growing and fewer people choose to sell because they want to lease their flats out, prices will rise, he said.

Mr Mah said that of the 682,000 flats that are eligible for subletting, only 3 per cent are sublet, suggesting that most flat owners are buying their flats for occupation, and not rental.

Amid concerns of runaway HDB prices, other MPs yesterday raised questions, including a possible ban on some buyers.

'There is a populist suggestion that we should ban private property owners from buying HDB flats,' said Mr Mah. But if the Government did so, what about HDB owners buying private property, he said.

Most resale flat buyers are citizens who do not own any private property, he said, adding that there was no evidence that specific buyer groups, like PRs and private property owners, were driving up prices.

He said buyers who did not want to pay very high prices could walk away.

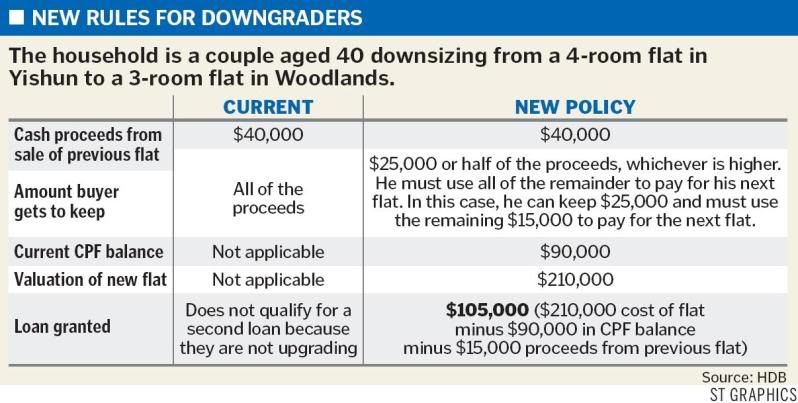

Some other key changes unveiled yesterday include allowing upgraders and those who downsize to apply for a second concessionary HDB loan. This could push up resale activity for smaller flats in the resale market, said PropNex chief executive Mohamed Ismail.

The HDB study found that last year, 9 per cent or nearly one in 10 resale flats sold had been owned for under three years. Between 2005 and 2007, the figure was just 6 per cent of sales.

HDB rules change

3 years before you can sell resale flats

By Joyce Teo

Related Link

WHAT'S CHANGING

BUYERS of non-subsidised HDB resale flats must now occupy their flats for at least three years before they can sell, under new rules unveiled yesterday.

This is up from 2-1/2 years for buyers with HDB loans and one year for buyers with bank loans or no loan.

The move, effective yesterday, is seen as a government effort to curb speculative buying and selling of public housing.

Home hunters have expressed dismay in recent months that speculators may be pushing up HDB resale flat prices.

Property consultants said the move is set to nip speculation in the bud but is not likely to result in lower flat prices.

The move comes after an HDB study found that a growing number of flat owners were selling flats within three years.

In late January, National Development Minister Mah Bow Tan flagged a review by HDB of its rules, with a view to stamping out possible speculation.

In Parliament yesterday, Mr Mah said said more flat owners had been selling flats as soon as the minimum period was up, although the numbers were not large.

He added: 'However, if the trend continues, buyers who genuinely need housing could be crowded out.'

He was responding to MP Ang Mong Seng's request for a review of the one-year minimum period applying to those with bank loans or no loan.

'HDB flats are provided primarily for owner-occupation and not speculative profit or rental return,' said Mr Mah.

HDB said in a statement that the change meant demand would more accurately reflect interest from buyers who wish to occupy flats.

Different rules apply to subsidised buyers who receive HDB grants.

Home hunter Sofian Buang, 33, a loading officer, said: 'My biggest concern is getting a roof for my family, now that I have a daughter. I am looking for a resale flat to settle in, not to sell or to rent out.'

ERA Asia-Pacific associate director Eugene Lim said the change would remove buyers who wanted to flip HDB flats after a year. 'With a smaller group chasing after HDB resale flats, price increases will slow down,' he said.

Demand for resale flats outweighs supply so prices will still rise, but perhaps at a slower pace, said C&H Realty managing director Albert Lu.

Mr Steven Tan, executive director of OrangeTee's residential division, said the change would cut speculation but that the Government should look at private property owners buying HDB flats to rent out right away.

If demand is growing and fewer people choose to sell because they want to lease their flats out, prices will rise, he said.

Mr Mah said that of the 682,000 flats that are eligible for subletting, only 3 per cent are sublet, suggesting that most flat owners are buying their flats for occupation, and not rental.

Amid concerns of runaway HDB prices, other MPs yesterday raised questions, including a possible ban on some buyers.

'There is a populist suggestion that we should ban private property owners from buying HDB flats,' said Mr Mah. But if the Government did so, what about HDB owners buying private property, he said.

Most resale flat buyers are citizens who do not own any private property, he said, adding that there was no evidence that specific buyer groups, like PRs and private property owners, were driving up prices.

He said buyers who did not want to pay very high prices could walk away.

Some other key changes unveiled yesterday include allowing upgraders and those who downsize to apply for a second concessionary HDB loan. This could push up resale activity for smaller flats in the resale market, said PropNex chief executive Mohamed Ismail.

The HDB study found that last year, 9 per cent or nearly one in 10 resale flats sold had been owned for under three years. Between 2005 and 2007, the figure was just 6 per cent of sales.