yperic

Greater Supremacy Member

- Joined

- Jan 14, 2003

- Messages

- 83,733

- Reaction score

- 31,328

NWC proposes pay rise of 5.5% to 7.5% for lower-wage workers in new guidelines

The recommendations have taken into consideration the current economic outlook and historical median income growth of 4.2 per cent per annum between 2016 and 2024. ST PHOTO: KUA CHEE SIONG

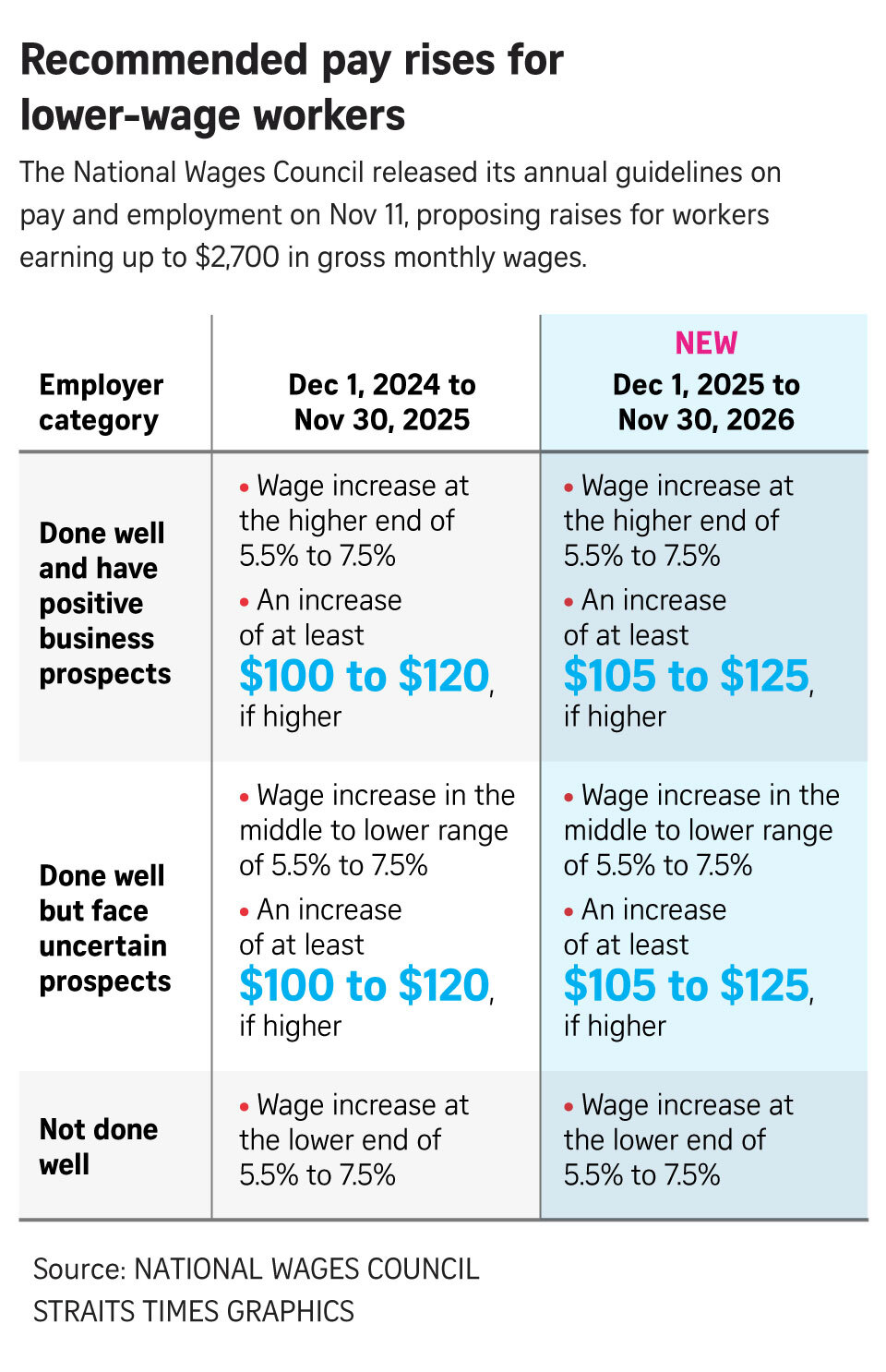

SINGAPORE - Lower-wage workers earning up to $2,700 a month should receive a pay bump of 5.5 per cent to 7.5 per cent from their bosses, said the National Wages Council (NWC) on Nov 11 in its annual guidelines on pay and employment issues.

Employers whose businesses have done well are recommended to give these workers a raise of at least $105 to $125, even if it is exceeds the percentage range provided, said the NWC.

For those who have not done well, it recommended giving lower-wage workers a built-in wage increase at the lower end of the range. Further wage increases should be considered if business prospects improve.

The recommendations have taken into consideration the current economic outlook and historical median income growth of 4.2 per cent per annum between 2016 and 2024, said the NWC.

Different industries are facing different challenges. Ministry of Manpower permanent secretary Ng Chee Khern said domestically oriented sectors like administrative and support services, and food and beverage services, are currently lagging in productivity.

“These sectors must press on with business transformation to become more competitive and productive. This will ensure wage growth for their workers,” he said.

NWC said employers should adopt a flexible rate wage system to maintain wage flexibility during adverse business conditions. This would sustain their businesses by cutting costs rather than jobs, and to retain talent, allow quick adjustments of wages during an upturn.

The council also called for all employers who have not done so to implement it in full, comprising both the annual variable component and monthly variable component.

More than 70 per cent of employers have adopted either the monthly variable or the annual variable components of the flexible wage system, although the proportion has dipped slightly from 77.3 per cent in 2023 to 76 per cent in 2024.

Mr Tan Hee Teck, president of Singapore National Employers Federation, noted that wage flexibility is not just a good to have, but is essential.

Added NTUC president K. Thanaletchimi: “Firms have to be fair and promote our workers in terms of company performance and share the productivity. That is very important so that workers can get motivated and increase their morale to continue contributing to the well-being of the company.”

The annual guidelines on pay and employment issues, which aim to narrow the wage gap between lower-wage and median-wage earners, were accepted by the Government. But they are not mandatory.

They cover the period from Dec 1, 2025, to Nov 30, 2026, and apply to all employees in unionised and non-unionised firms and in both public and private sectors.

At a press conference held at the MOM office on Nov 11, NWC chairman Peter Seah said even though the annual guidelines are not compulsory, most companies do wait for and pay close attention to them.

NTUC’s Assistant Secretary-General Patrick Tay added that these guidelines carry weight in discussions or negotiations on wage or salary increases, and can influence the direction of the mediation processes if cases are escalated to MOM.

The proportion of firms which adopted the recommended quantum of wage increase by NWC for their lower-wage workers was 26.2 per cent in 2024, while 60 per cent of firms gave wage increases of any amount to lower-wage workers.

NWC noted that the CPF monthly salary ceiling will be increased from $7,400 to $8,000 from January 2026 to keep pace with rising salaries. Employers can consider the rise in CPF salary ceiling from January 2026 when considering the quantum of wage increase.

Employer CPF contribution rates for older workers aged above 55 to 65 will also increase by 0.5 percentage points from January 2026, and the Government will offset part of employers’ increased CPF contributions for 2026.

Wage increases for administrators and drivers

The guidelines also recommend updating Occupational Progressive Wage requirements for administrators and drivers, including in the areas of career progressions, job descriptions and wage requirements.NWC recommended updating the job descriptions of administrators as these roles are increasingly reshaped by digital transformation, and expanding the job ladder for drivers to progress and upskill. These will come into effect in July 2026.

From July 1, 2026, the baseline gross wage requirements for administrative assistants will rise to at least $2,170, up from the current baseline of $1,980. The baseline will increase to $2,360 by 2027.

For drivers, depending on the role performed, a general or specialised driver can be reclassified into four sub-categories under the new guidelines.

A “group A level 1” driver will see their baseline gross wage requirements increase to at least $2,370 from July 1, 2026, up from the current baseline of $2,190. The baseline will increase to $2,550 by 2027.

These differentiated lower-wage worker recommendations take into account the business prospects and circumstances of different employers.

The council added there is “significant scope” for bosses and workers to invest further in training and upgrading, citing the declining proportion of employers who provided structured training for their employees. The figure dropped from 79.6 per cent in 2023 to 66.4 per cent in 2024.

Specifically, these happened in two sectors: wholesale trade and retail.

“With the proliferation of digital technology and artificial intelligence (AI), it is critical that employers and lower-wage workers stay adaptable and invest in transformation and their human capital,” said the NWC.

The guidelines come amid some signs of the labour market softening, with a drop in the number of job vacancies and weakened business sentiments.

Singapore’s GDP growth is still likely to remain weighed down by weak global demand as the US tariffs are expected to continue to dampen global growth and trade, said NWC.

Further tariff actions could lead to a renewed spike in economic uncertainty and potential escalations in geopolitical tensions.

Last edited: