reddevil0728

Great Supremacy Member

- Joined

- Dec 16, 2005

- Messages

- 64,904

- Reaction score

- 5,408

MODERATOR NOTE:

Bidding low for T-bills is a legitimate strategy for consumers if they deem that it is the right investment strategy for them. This forum will not tolerate attacks, insults or the use of derogatory terms (including, but not limited to "low ballers") against people adopting such strategies. Infractions will be issued without further warnings against forum members that persist in such attacks.

Bidding low for T-bills is a legitimate strategy for consumers if they deem that it is the right investment strategy for them. This forum will not tolerate attacks, insults or the use of derogatory terms (including, but not limited to "low ballers") against people adopting such strategies. Infractions will be issued without further warnings against forum members that persist in such attacks.

Do not discuss this policy in this thread. If you must, open a thread in the feedback forum.

EDIT: "Low ball" has a few meanings, which can be found on Wikipedia, NONE of which applies to auction bidding. It is obvious that the offenders are abusing the negative connotation used for the "buyer" variant that happens on Carousell as a derogatory term that has no place here.

---

Creating a separate thread for T-bills instead of mixing discussion with the likes of SSB.

This would be a good alternative to consider if you are looking at banks FD.

Just think of it as either a 6m or 12m tenor. "Safer" and for now "higher interest".

https://www.mas.gov.sg/bonds-and-bills/Singapore-Government-T-bills-Information-for-Individuals

https://www.mas.gov.sg/bonds-and-bills/auctions-and-issuance-calendar

Frequency: Application typically closes a day before the auction date and varies from bank to bank. so please make sure you check the bank internet banking you are applying with.

When you can start applying: Typically in the evening on the day it is announced. So check in the evening.

How to apply: If you refer to the link only can only apply through the 3 local banks. would suggesting using browser webpage to apply cause their apps may not supported.

DBS: Invest > Singapore Government Securities (SGS) > T-Bill >

Deadline to apply: Refer to the application page on ibanking for confirmation.

Outcome and refund: you will know the outcome of the auction on the day of the auction after it happens (auction takes place around 1 pm, so you should know not too long after that so just be patient to wait). if you are successful, the "interest" (or discount) will be refunded to you the same day by around 5pm. if you are unsuccessful, the amount should also be refunded to you by 5pm same day.

It has been reported that if you are successful

OCBC will send you a text and email to inform you

DBS will only send you a letter after the t-bill has been issued (see the issuance calendar for that)

UOB will send you a text

but in any case this is not really important as a refund of the interest already mean you are successful.

Credit: you can see the t-bill in CDP around 5pm (might take longer if overwhelming subscription) on the issue date. it isn't like SSB where there is an additional seperate portal you can log in to see. in any case seeing it in CDP is the most important since that's where it is held

in CDP you should be seeing 10 units if you applied for 1,000, as the face value is 100 per t-bill

End of Tenor: the face value will be credited to your bank account linked to CDP

If you need to sell before maturity:

i did it before in OCBC.

must go to bank, any branch, no need main branch. there is no other option. confirm cannot do online. not all in branch know, must ask and ask. they will ask you to fill up a form and then they help you sell the tbill, will take a few working days.

Multiple applications: users have reported that you can submit multiple applications, e.g., non comp, comp @ 2.5%, comp @ 3%.

CPFIS Application: can be done online via internet banking.

only the amount AFTER discount is deducted.

So e.g., apply 10k in the most recently concluded auction, where cut-off price is 98.577.

only $9,857.70 gets deducted.

Unlike cash, where 10k gets deducted, followed by a credit of 142.30.

deduction takes place sometime after auction and before issuance date.

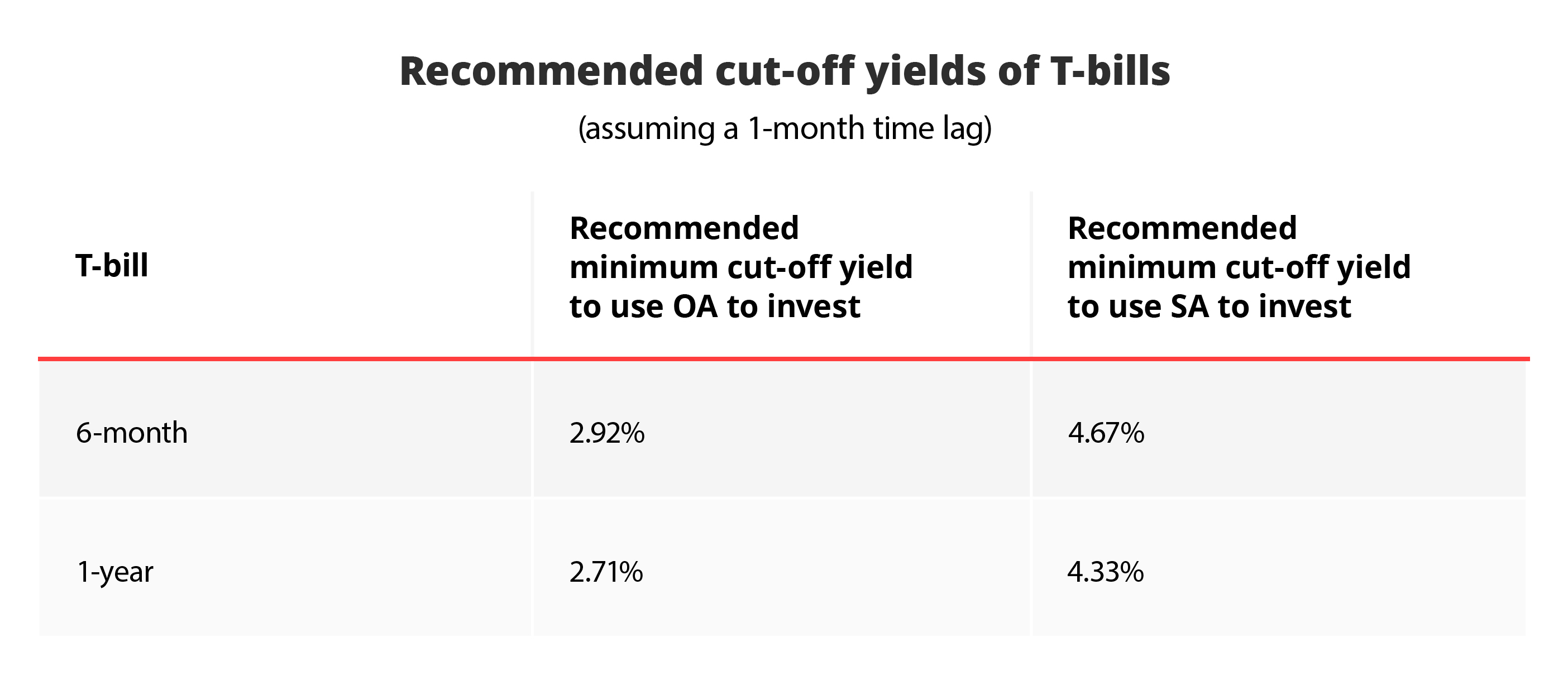

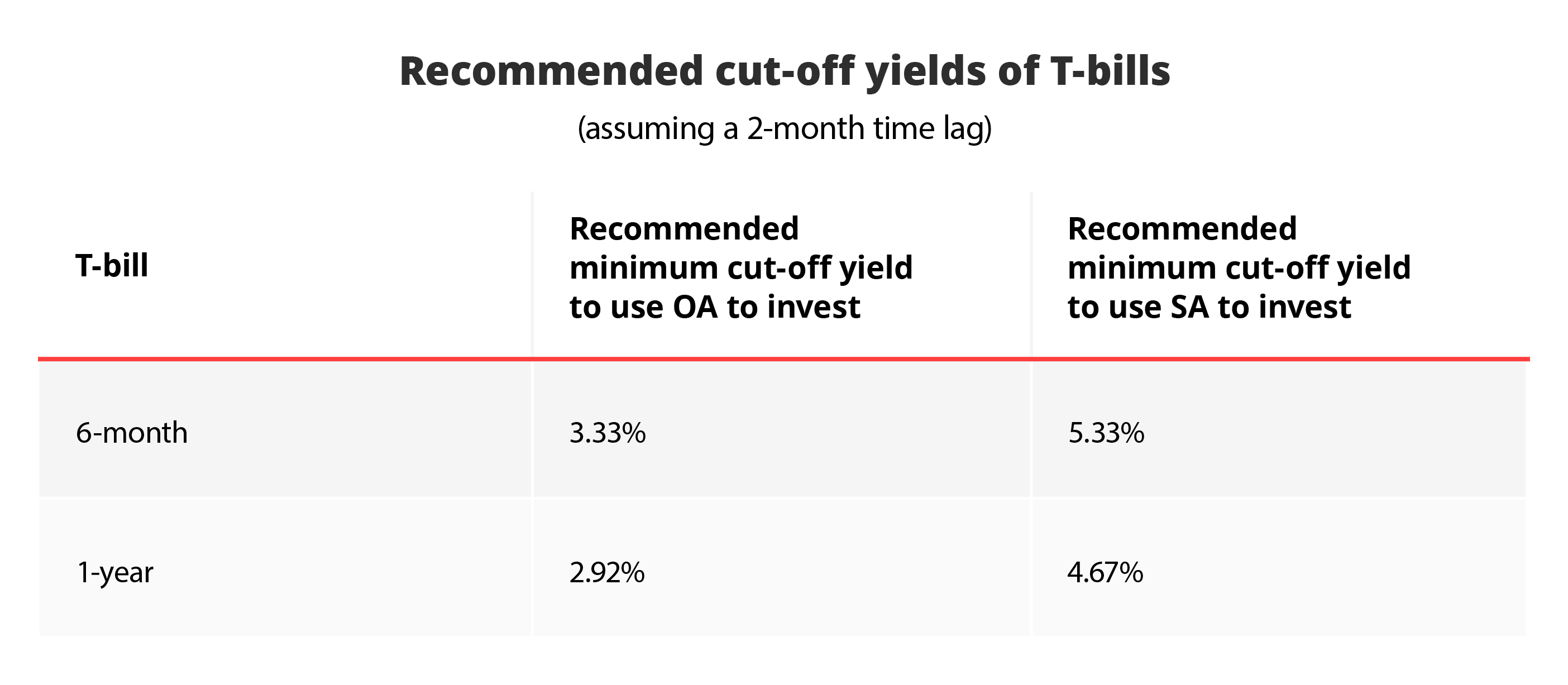

Losing CPF Interest... 7 (1m lag) or 8 (2m lag) months...

Lets use two examples...

BS24102S

Auction date01 Feb 2024Issue date06 Feb 2024

Maturity date06 Aug 2024

The above will not earn CPF interest for 7 months. cause

CPF gets deducted AFTER auction date but before issue date. so will deduct in feb 2024. hence no interest earned starting feb 2024

matures in aug 2024. you initiate. transfer back to CPF, interest start to earn sep 2024

Feb

Mar

Apr

May

Jun

Jul

Aug

7 months no interest earned in CPF

BS24106W

Auction date 27 Mar 2024Issue date 02 Apr 2024

Maturity date 01 Oct 2024

Caveat: this i can't be for sure when they deduct CPF (someone who got this can share), but i am assuming 28th Mar.

So in this case, deduct 28 mar, so mar no more interest from CPF

mature oct, transfer back to cpf. start to earn Nov

Mar

Apr

May

Jun

July

Aug

Sep

Oct

8 months no interest earned in CPF

Additional useful reference:

https://www.dbs.com.sg/personal/articles/nav/investing/investing-in-t-bills

https://investmentmoats.com/saving-...y-singapore-treasury-bills-t-bills-sgs-bonds/

Last edited: