You

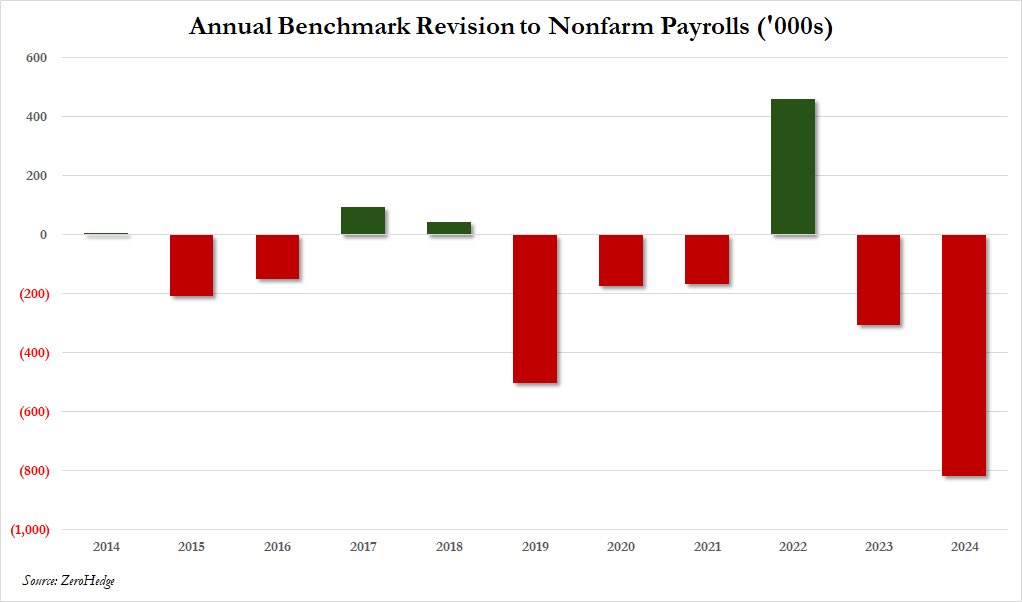

1. said revisions are normal, whereas this -818k revision is ABNORMAL compared to past TEN YEARS

2. said CONSPIRACY THEORY that BLS fabricating data (jobs overestimated by statistical manipulation) but the latest revision supports this theory

3. the video of the change in retail traffic and shops open at

Louisiana Boardwalk, one of the largest retail outlet in Louisiana, is not relevant indication of LABOUR MARKET because it is in the MIDDLE OF NOWHERE

And also you said in April 2024, that the JOBS MARKET IS BOOMING and regular 401k is boosting the stock market.

Now you suddenly change your tune as say, economy should slow down quickly and Fed is behind the curve.

The difference between you and me as I'm making statements about what is coming ahead, whereas you're making statements about the present or past, and then framing my statements as incorrect.

Of course, my forward-looking statements appear wrong now. How to be an investor if you cannot run to where the puck skates to? Run to where the puck is at now? You'll miss the puck.

Yeah.. conspiracy theory ends like this: Market is going to crash during Trump's presidency as the statistics will be manipulated to be as bad as possible. BoJ hiking rates thus stopping further JPY carry trades will further withdraw liquidity from US market.