I do not own any of these, but may trade them.

In this context, one “safe” play could be to focus on state-owned enterprises trading below a 1.0 price-to-book (PB) value. With the government’s determination to back core assets—such as state-owned banks, insurance firms, and industrial companies—these undervalued core assets could become a safe bet. It is in China’s interest to “do everything” to support these core assets.

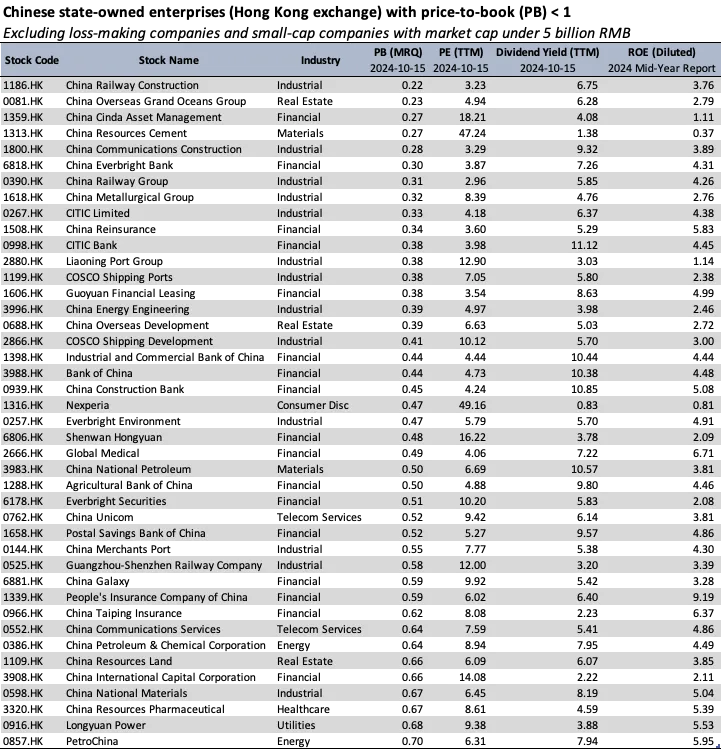

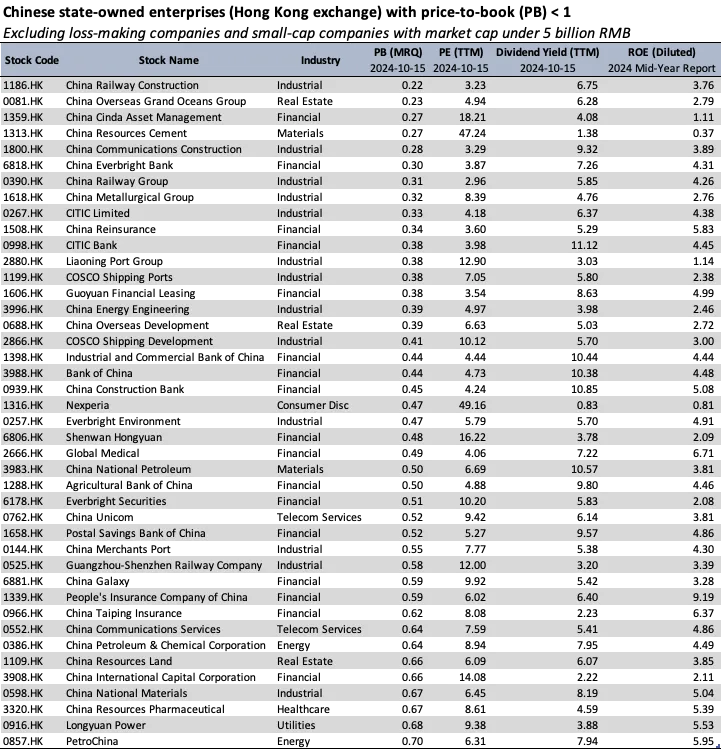

To exemplify this idea, I’ve included a summary of state-owned enterprises (excluding loss-making firms) currently trading below 1.0 PB. High-dividend-paying core assets may offer a compelling option, especially as interest rates decline in China.

*The chart is originally prepared by Li Bei (and I translated), the founder of Banxia Investment, a macro hedge fund in China, in her recent blog. She also recommended two ETFs with major exposure to these equities: 931231.CS and 031233 (the Shanghai-Hong Kong Stock Connect equivalent) (This is something to consider, but I do not recommend any specific investment advice here.)

Source: Baiguan substack

The “Safe” Play: State-owned equities with PB < 1

But one thing is certain from recent government communications: there is a frank recognition of ongoing economic challenges and a clear determination to prioritize and support growth. However, some sectors and companies may have doubts about how much and how quickly this growth can occur—for instance, whether domestic consumption will drive the Chinese economy after the real estate sector ebbs and exports face limits, and when that will happen. This means that the scenario after September 24, where everything went into a crazy bull run, is unlikely to recur. This is not the time to “buy everything China.”In this context, one “safe” play could be to focus on state-owned enterprises trading below a 1.0 price-to-book (PB) value. With the government’s determination to back core assets—such as state-owned banks, insurance firms, and industrial companies—these undervalued core assets could become a safe bet. It is in China’s interest to “do everything” to support these core assets.

To exemplify this idea, I’ve included a summary of state-owned enterprises (excluding loss-making firms) currently trading below 1.0 PB. High-dividend-paying core assets may offer a compelling option, especially as interest rates decline in China.

*The chart is originally prepared by Li Bei (and I translated), the founder of Banxia Investment, a macro hedge fund in China, in her recent blog. She also recommended two ETFs with major exposure to these equities: 931231.CS and 031233 (the Shanghai-Hong Kong Stock Connect equivalent) (This is something to consider, but I do not recommend any specific investment advice here.)

Internet: still room for valuation recovery

China's internet companies remain undervalued and are among the most profitable companies, even after the recent rally. The correction following October 8 may present a good buying opportunity for long-term. For instance, JD’s forward P/E ratio is 10.36 at the time of writing, compared to a median P/E of 40.2 over the past five years. Similarly, BABA’s forward P/E is 11.65 versus 25.08, and PDD stands at 10.48 compared to 23.21.Source: Baiguan substack

Last edited: