You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

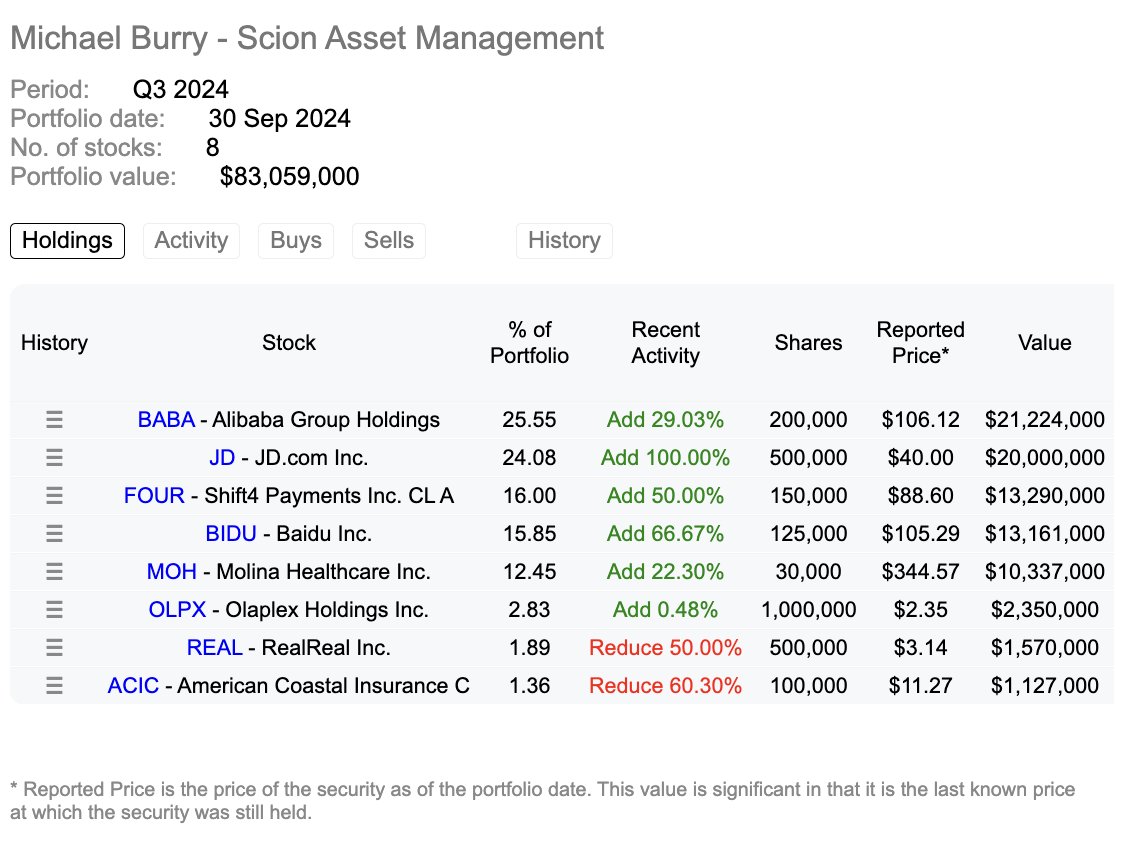

China & hk stocks/ etfs

- Thread starter dappermen

- Start date

More options

Who Replied?boringLife-

Supremacy Member

- Joined

- Aug 17, 2010

- Messages

- 9,927

- Reaction score

- 992

Tencent and jd all good earnings results

Si ang moh are just bias against chinese

Si ang moh are just bias against chinese

Tencent and jd all good earnings results

Si ang moh are just bias against chinese

Its not just China, EM is also mostly down, India is currently in a correction, down 10%.

US is sucking up global liquidity, dollar is a wrecking ball destroying everything.

Tiny Shrimp

Master Member

- Joined

- Sep 18, 2024

- Messages

- 3,448

- Reaction score

- 2,498

liddis will USD climb higher?Its not just China, EM is also mostly down, India is currently in a correction, down 10%.

US is sucking up global liquidity, dollar is a wrecking ball destroying everything.

US worry dragon throne kena taken lar so do all sorts to bring them down loser mindsetTencent and jd all good earnings results

Si ang moh are just bias against chinese

liddis will USD climb higher?

Who knows...

One thing I can tell you is that something weird is going on, possibly some institutions were short dollar big time and are now getting squeezed. If you dun need to put new money to work then better to just stay away.

Tiny Shrimp

Master Member

- Joined

- Sep 18, 2024

- Messages

- 3,448

- Reaction score

- 2,498

jialat moi need to hold some usd at all times oneWho knows...

One thing I can tell you is that something weird is going on, possibly some institutions were short dollar big time and are now getting squeezed. If you dun need to put new money to work then better to just stay away.

https://cnevpost.com/2024/11/14/neta-gets-relief-local-government-support/

Neta Auto, whose operations are facing challenges, is seeing relief as it gains support from a local government and moves forward with a major reorganization of its teams.

The Nanning Industrial Investment Group has entered into a strategic partnership with Neta's parent company Hozon Auto to provide supply chain financial support, local media Yicai said in a report today, citing a Neta source.

And they are still doing it...

Neta Auto, whose operations are facing challenges, is seeing relief as it gains support from a local government and moves forward with a major reorganization of its teams.

The Nanning Industrial Investment Group has entered into a strategic partnership with Neta's parent company Hozon Auto to provide supply chain financial support, local media Yicai said in a report today, citing a Neta source.

And they are still doing it...

Jirachi

Great Supremacy Member

- Joined

- Jan 17, 2010

- Messages

- 54,387

- Reaction score

- 2,884

He is about to create Common Misery through his “Common Prosperity” campaignYea, also China's youth unemployment has nearly doubled (according to national bureau of statistics of China) under XJP's reign. He isnt doing a good job if he is trying to lift the bottom.

Other than the old govt pensioners, most people, especially young people, simply arent doing well.

Jirachi

Great Supremacy Member

- Joined

- Jan 17, 2010

- Messages

- 54,387

- Reaction score

- 2,884

Bottom for long time.

Jirachi

Great Supremacy Member

- Joined

- Jan 17, 2010

- Messages

- 54,387

- Reaction score

- 2,884

The Chinese government is going to implode the world’s car market 1 day.https://cnevpost.com/2024/11/14/neta-gets-relief-local-government-support/

Neta Auto, whose operations are facing challenges, is seeing relief as it gains support from a local government and moves forward with a major reorganization of its teams.

The Nanning Industrial Investment Group has entered into a strategic partnership with Neta's parent company Hozon Auto to provide supply chain financial support, local media Yicai said in a report today, citing a Neta source.

And they are still doing it...

Important news just dropped today:

WASHINGTON – The U.S. Department of the Treasury delivered its semiannual Report to Congress on Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States. In this Report, Treasury reviewed and assessed the policies of major U.S. trading partners, comprising about 78 percent of U.S. foreign trade in goods and services, during the four quarters through June 2024.

In accordance with the Omnibus Trade and Competitiveness Act of 1988, the Report analyzed the practices of the United States’ major trading partners and concludes that no major U.S. trading partner manipulated the rate of exchange between its currency and the U.S. dollar for purposes of preventing effective balance of payments adjustments or gaining unfair competitive advantage in international trade during the four quarters through June 2024.

In this Report, Treasury found that no major trading partner met all three criteria for enhanced analysis under the Trade Facilitation and Trade Enforcement Act of 2015 during the four quarters ending June 2024.

The Biden Administration strongly opposes attempts by the United States’ trading partners to artificially manipulate currency values to gain unfair advantage over American workers.

“Treasury firmly advocates for our major trading partners to adopt policies that support strong, sustainable, and balanced global growth and reduce excessive external imbalances. Treasury continues to engage closely on currency-related issues to ensure a level playing field for America’s firms and workers,” Secretary of the Treasury Janet L. Yellen said today.

Seven economies are on Treasury’s “Monitoring List” of major trading partners that merit close attention to their currency practices and macroeconomic policies: China, Japan, Korea, Singapore, Taiwan, Vietnam, and Germany.

The Report also reiterated Treasury’s call for increased transparency from China. China’s failure to publish foreign exchange intervention and broader lack of transparency around key features of its exchange rate policy make China an outlier among major economies and warrant Treasury’s close monitoring. (Translation: loser US Treasury wants winner PBoC to show all their poker cards)

Today’s Report is submitted to Congress pursuant to Section 3005 of the Omnibus Trade and Competitiveness Act of 1988, 22 U.S.C. § 5305, and Section 701 of the Trade Facilitation and Trade Enforcement Act of 2015, 19 U.S.C. § 4421.

Source:

https://home.treasury.gov/system/files/136/November-2024-FX-Report.pdf

Treasury Releases Report on Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States

WASHINGTON – The U.S. Department of the Treasury delivered its semiannual Report to Congress on Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States. In this Report, Treasury reviewed and assessed the policies of major U.S. trading partners, comprising about 78 percent of U.S. foreign trade in goods and services, during the four quarters through June 2024.

In accordance with the Omnibus Trade and Competitiveness Act of 1988, the Report analyzed the practices of the United States’ major trading partners and concludes that no major U.S. trading partner manipulated the rate of exchange between its currency and the U.S. dollar for purposes of preventing effective balance of payments adjustments or gaining unfair competitive advantage in international trade during the four quarters through June 2024.

In this Report, Treasury found that no major trading partner met all three criteria for enhanced analysis under the Trade Facilitation and Trade Enforcement Act of 2015 during the four quarters ending June 2024.

The Biden Administration strongly opposes attempts by the United States’ trading partners to artificially manipulate currency values to gain unfair advantage over American workers.

“Treasury firmly advocates for our major trading partners to adopt policies that support strong, sustainable, and balanced global growth and reduce excessive external imbalances. Treasury continues to engage closely on currency-related issues to ensure a level playing field for America’s firms and workers,” Secretary of the Treasury Janet L. Yellen said today.

Seven economies are on Treasury’s “Monitoring List” of major trading partners that merit close attention to their currency practices and macroeconomic policies: China, Japan, Korea, Singapore, Taiwan, Vietnam, and Germany.

The Report also reiterated Treasury’s call for increased transparency from China. China’s failure to publish foreign exchange intervention and broader lack of transparency around key features of its exchange rate policy make China an outlier among major economies and warrant Treasury’s close monitoring. (Translation: loser US Treasury wants winner PBoC to show all their poker cards)

Today’s Report is submitted to Congress pursuant to Section 3005 of the Omnibus Trade and Competitiveness Act of 1988, 22 U.S.C. § 5305, and Section 701 of the Trade Facilitation and Trade Enforcement Act of 2015, 19 U.S.C. § 4421.

Source:

https://home.treasury.gov/system/files/136/November-2024-FX-Report.pdf

South America’s ‘made in China’ megaport prepares to transform trade

Ahead of the ribbon-cutting at the Port of Chancay — a Chinese-built megaport on Peru’s Pacific coast that is set to transform regional trade — Chinese-made ZPMC unmanned cranes line the quay. BYD pick-up trucks sit ready to shuttle engineers around, while Huawei 5G internet towers have been freshly constructed to handle the automated operation.

“Everything is made in China,” said a beaming Mario de las Casas, public affairs manager of the port for Cosco Shipping, the Chinese state-owned shipping giant that will operate Chancay once it opens on Thursday.

“This is a huge opportunity not just for Peru but for the whole region,” he added, as Peruvian and Chinese flags flapped from street lights. Peruvian officials argue the port, built by Cosco with local miner Volcan, will transform Peru — a big producer of copper and fruit — into the Singapore of South America, and will upend maritime trade along the continent’s Pacific coast as it can accommodate larger vessels in its deep waters.

“What Chancay will do is redirect a portion of cargo and send it directly to Asia.” Of the $3.6bn cost of construction, $1.3bn had been invested in the initial phase, Cosco said. The deepwater port can berth some of the world’s largest shipping vessels, with a capacity of 22,000 twenty-foot equivalent units, or TEUs, an industry standard for containers. No other port on the Pacific coast of South America can take ships of this size. Chancay will shave at least 10 days off what was previously a 35-day voyage to China from Peru, meaning vessels will no longer require a stopover at Mexico’s Manzanilla port or California’s Long Beach. Brazilian cargoes, which sometimes travel eastbound to Asia or via the Panama Canal, will also save at least 10 days of travel time, Cosco said.

https://www.ft.com/content/e6b74d70-91a7-4216-aadb-375c9343427b

Last edited:

Tiny Shrimp

Master Member

- Joined

- Sep 18, 2024

- Messages

- 3,448

- Reaction score

- 2,498

what is your view on this, for sg and china?Important news just dropped today:

Treasury Releases Report on Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States

WASHINGTON – The U.S. Department of the Treasury delivered its semiannual Report to Congress on Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States. In this Report, Treasury reviewed and assessed the policies of major U.S. trading partners, comprising about 78 percent of U.S. foreign trade in goods and services, during the four quarters through June 2024.

In accordance with the Omnibus Trade and Competitiveness Act of 1988, the Report analyzed the practices of the United States’ major trading partners and concludes that no major U.S. trading partner manipulated the rate of exchange between its currency and the U.S. dollar for purposes of preventing effective balance of payments adjustments or gaining unfair competitive advantage in international trade during the four quarters through June 2024.

In this Report, Treasury found that no major trading partner met all three criteria for enhanced analysis under the Trade Facilitation and Trade Enforcement Act of 2015 during the four quarters ending June 2024.

The Biden Administration strongly opposes attempts by the United States’ trading partners to artificially manipulate currency values to gain unfair advantage over American workers.

“Treasury firmly advocates for our major trading partners to adopt policies that support strong, sustainable, and balanced global growth and reduce excessive external imbalances. Treasury continues to engage closely on currency-related issues to ensure a level playing field for America’s firms and workers,” Secretary of the Treasury Janet L. Yellen said today.

Seven economies are on Treasury’s “Monitoring List” of major trading partners that merit close attention to their currency practices and macroeconomic policies: China, Japan, Korea, Singapore, Taiwan, Vietnam, and Germany.

The Report also reiterated Treasury’s call for increased transparency from China. China’s failure to publish foreign exchange intervention and broader lack of transparency around key features of its exchange rate policy make China an outlier among major economies and warrant Treasury’s close monitoring. (Translation: loser US Treasury wants winner PBoC to show all their poker cards)

Today’s Report is submitted to Congress pursuant to Section 3005 of the Omnibus Trade and Competitiveness Act of 1988, 22 U.S.C. § 5305, and Section 701 of the Trade Facilitation and Trade Enforcement Act of 2015, 19 U.S.C. § 4421.

Source:

https://home.treasury.gov/system/files/136/November-2024-FX-Report.pdf

Means harder for US govt to use the excuse of currency manipulation in trade negotiations.what is your view on this, for sg and china?

boringLife-

Supremacy Member

- Joined

- Aug 17, 2010

- Messages

- 9,927

- Reaction score

- 992

Alibaba shares erased gains in premarket trading, down around 1.5% after the results.

Henry RenEquities Reporter

look at pre market

Pre-market 93.32 +2.74 (3.02%)

Classic doomberg fake news

Henry RenEquities Reporter

look at pre market

Pre-market 93.32 +2.74 (3.02%)

Classic doomberg fake news

Important Forum Advisory Note

This forum is moderated by volunteer moderators who will react only to members' feedback on posts. Moderators are not employees or representatives of HWZ. Forum members and moderators are responsible for their own posts.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.