You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Discussn : Anyone here already achieved FRS $213K or ERS $426K ?

- Thread starter socratesg

- Start date

More options

Who Replied?RandomPancake

Great Supremacy Member

- Joined

- Jun 6, 2012

- Messages

- 64,781

- Reaction score

- 11,950

In before crimsontactic come in say he frs with SA at 32 years old

is the pledging done online???

need to submit what documents???

dunno, haven't research

U how old only? Use OA to buy HDB and wipe out OA is normal.

My time lagi worse, don't have the $20,000 "pad", if say wipeout, really is wipe until $0 one.

Rebuild your OA again, can be done one. Work hard, drop by drop, you will get there.

late 40 ady

I am OK not to rebuild the OA cause have other investments like stocks, ETF, SSB liao

RandomPancake

Great Supremacy Member

- Joined

- Jun 6, 2012

- Messages

- 64,781

- Reaction score

- 11,950

For me wipe out plus monthly loan repayment continue to wipe it out until loan end at 60 years old. OA will simply be empty all the way, at most if got bonus will have little extra niaU how old only? Use OA to buy HDB and wipe out OA is normal.

My time lagi worse, don't have the $20,000 "pad", if say wipeout, really is wipe until $0 one.

Rebuild your OA again, can be done one. Work hard, drop by drop, you will get there.

socratesg

Senior Member

- Joined

- Sep 11, 2024

- Messages

- 2,327

- Reaction score

- 3,587

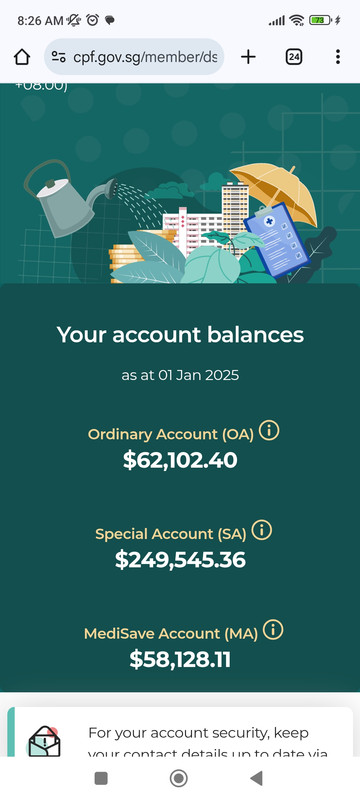

As I was working as a corporate rat for quite number of years before I quit at 35yo to start my own biz, I managed to reach FRS at $213K.I am turning 40 soon and wondering if anyone here managed to reach either the CPF Full Retirement Sum (FRS) $213K or better still Enhanced Retirement Sum (ERS) $426K before you reach 55yo ?

Can share ? Thanks ya.

PS : I'm asking coz I run my own biz. Though Medisave contribution is compulsory by CPF, FRS or ERS contribution is own time own target.

But am now thinking of volunteer top up to EHS $426K so I can withdraw at least $3K to $4K/mth for life when I turn 65yo.

Is it worth it to top up ? Anyone in similar situation as me ?

yokine3a

Arch-Supremacy Member

- Joined

- Aug 20, 2008

- Messages

- 17,929

- Reaction score

- 12,363

You dun have SA?If someone dumps all OA saving into property…Their OA CPF will be always like empty…so not easy to reach FRS.

is the pledging done online???

need to submit what documents???

https://www.cpf.gov.sg/service/arti...irement-account-savings-via-property-pledging

need to do over the counter

wutawa

Arch-Supremacy Member

- Joined

- Jan 25, 2003

- Messages

- 12,327

- Reaction score

- 3,799

55yo can withdraw some, 64yo up lorry can withdraw all.If up lorry at 64yo then withdraw zero $.

easier for employe people to reach FRS. Because if medisave max out, cpf deduction continues and the extra $ goes into SA. Not sure about self employed whether you $ will be refunded when your medisave max out.I am turning 40 soon and wondering if anyone here managed to reach either the CPF Full Retirement Sum (FRS) $213K or better still Enhanced Retirement Sum (ERS) $426K before you reach 55yo ?

Can share ? Thanks ya.

PS : I'm asking coz I run my own biz. Though Medisave contribution is compulsory by CPF, FRS or ERS contribution is own time own target.

fandango

Great Supremacy Member

- Joined

- Dec 4, 2003

- Messages

- 67,288

- Reaction score

- 22,304

Achieved alreadyI am turning 40 soon and wondering if anyone here managed to reach either the CPF Full Retirement Sum (FRS) $213K or better still Enhanced Retirement Sum (ERS) $426K before you reach 55yo ?

Can share ? Thanks ya.

PS : I'm asking coz I run my own biz. Though Medisave contribution is compulsory by CPF, FRS or ERS contribution is own time own target.

inmyopinion

Arch-Supremacy Member

- Joined

- Jan 15, 2018

- Messages

- 15,727

- Reaction score

- 6,907

As I was working as a corporate rat for quite number of years before I quit at 35yo to start my own biz, I managed to reach FRS at $213K.

But am now thinking of volunteer top up to EHS $426K so I can withdraw at least $3K to $4K/mth for life when I turn 65yo.

Is it worth it to top up ? Anyone in similar situation as me ?

you are below 55, u cannot top up to ERS.

fandango

Great Supremacy Member

- Joined

- Dec 4, 2003

- Messages

- 67,288

- Reaction score

- 22,304

Yes I am in the same situation as you. Try to hit ERSAs I was working as a corporate rat for quite number of years before I quit at 35yo to start my own biz, I managed to reach FRS at $213K.

But am now thinking of volunteer top up to EHS $426K so I can withdraw at least $3K to $4K/mth for life when I turn 65yo.

Is it worth it to top up ? Anyone in similar situation as me ?

eyz

Arch-Supremacy Member

- Joined

- Jul 10, 2002

- Messages

- 11,743

- Reaction score

- 1,972

FRS can withdraw $1.6K to $2K per month upon 65 yo and ERS can withdraw double of that. It's actually quite good.

how and when can topup to ERS?

4k per month, + my boon keng 4rm rental 4k. go retire in thailand or jb, woon woon jiak tom yum

jumpthepig

Arch-Supremacy Member

- Joined

- Feb 27, 2015

- Messages

- 12,849

- Reaction score

- 6,359

SA alone meets FRS?…. Possible, like those people whose salary reach CPF Annual Limit $37.7k…. But many sinkies don’t have such good salary.You dun have SA?

Hearsay 1.5M sinkies earn less than 34k p/a….

yokine3a

Arch-Supremacy Member

- Joined

- Aug 20, 2008

- Messages

- 17,929

- Reaction score

- 12,363

If cannot meet then top up cash. Once frs is met, one burden less on your mind.SA alone meets FRS?…. Possible, like those people whose salary reach CPF Annual Limit $37.7k…. But many sinkies don’t have such good salary.

Important Forum Advisory Note

This forum is moderated by volunteer moderators who will react only to members' feedback on posts. Moderators are not employees or representatives of HWZ. Forum members and moderators are responsible for their own posts.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.