wongdawson

Senior Member

- Joined

- Nov 28, 2004

- Messages

- 607

- Reaction score

- 79

Tom Lee say ETH will hit 20k this year lolI got xrp, Eth and BTC but not those early buyers so won't huat big big yet

Hope xlm will have big movement too

Tom Lee say ETH will hit 20k this year lolI got xrp, Eth and BTC but not those early buyers so won't huat big big yet

Hope xlm will have big movement too

Sounds like siaolang. HahaTom Lee say ETH will hit 20k this year lol

Sounds like siaolang. Haha

Whats yr bull thesis for XRP?Not as siaolang as those tht say xrp at least 2500

Xrp is my biggest holding, I hear liao I also roll eye

If anyone say I don't believe but Tom Lee I believe last year Jan 2024 when BTC at 50-60k he say by Dec 20 BTC will 88K true enough I hit 88kSounds like siaolang. Haha

You got add BMNR recently?Tom Lee say ETH will hit 20k this year lol

M Saylor is the spokesman for BTC and now Tom Lee pumpX10 Ether to the moonIf anyone say I don't believe but Tom Lee I believe last year Jan 2024 when BTC at 50-60k he say by Dec 20 BTC will 88K true enough I hit 88k

The problem with ETH is it high gas fees Solana is much cheaper but not very stable when very huge activity moving on the same times most of the meme coins is on Solana Blockchain. Bank and stable coins most likely will be on ETH Blockchain as it the biggest and stable BlockchainWhats yr bull thesis for XRP?

I keep seeing Solana a threat to Ether nia….

Whats yr bull thesis for XRP?

I keep seeing Solana a threat to Ether nia….

https://www.fool.com/investing/2025/08/15/better-crypto-buy-xrp-vs-eth/Mine was very simple

From what I read,

Among the top, BTC and xrp are steered towards institutional targets and looking at how much BTC has grown, I picked xrp cause more growth headroom

I might b wrg but at least thts what I read and thought tht time

I got BTC ETF but I dca part of my monthly savings, so small portion compared to xrp

https://www.fool.com/investing/2025/08/15/better-crypto-buy-xrp-vs-eth/

U got own some ether as well?

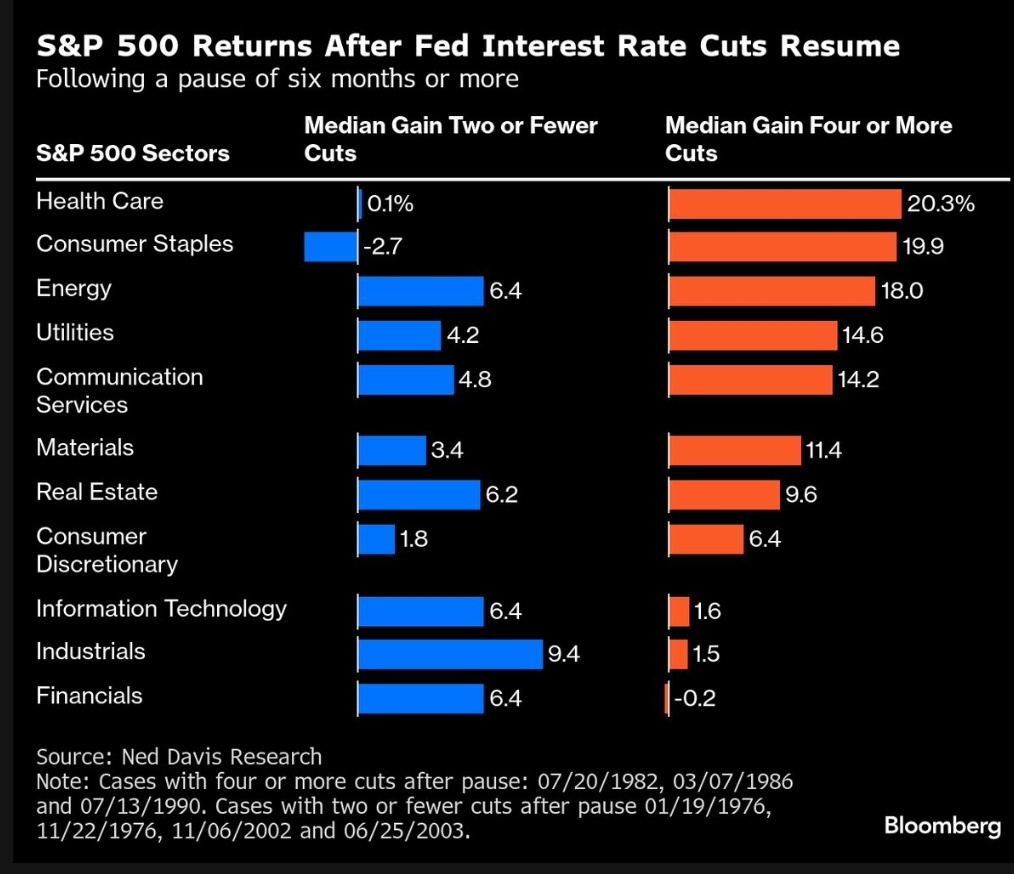

My theory is that the market is front-running the Sept Fed rate cut but already fully priced it in, i.e. all the major players have already taken their position.Why crypto gng up?

U nvr say I also dnt knw, check my acct and see huat

Another billionaire is born?Not as siaolang as those tht say xrp at least 2500

Xrp is my biggest holding, I hear liao I also roll eye

He said small caps will gain and catch up with S&P500. Where is the catch up?If anyone say I don't believe but Tom Lee I believe last year Jan 2024 when BTC at 50-60k he say by Dec 20 BTC will 88K true enough I hit 88k

He say this based on fed cut interest rates maybe after 17 SEP FOMC it comes true small caps now is starting to perform very well Russell 2000 ETF IWM has been gaining momentumHe said small caps will gain and catch up with S&P500. Where is the catch up?

I'm looking at the orange bars.