~sabaisabai~

Arch-Supremacy Member

- Joined

- Sep 12, 2016

- Messages

- 22,059

- Reaction score

- 3,482

Wah MISP x3 tomorrow

So you collected PAMP?They only intend to invite limited ppl. Only 1st 5000 pax. If they invite me I'll give a shout here. But i may not participate la. I only believe in holding real solid gold

I don't collect any except a small pamp won via lucky draw. But my fam hold a few 100g last time vested in now defunct Gold Label. Went to BullionStar to ask but they need cert which we only have hard copy agreement with Gold Label but no cert. Not sure if they'll slash the price off 6% to classify as jewellery sale. A year or 2 back we go check the price is 11k+ but now should be 18k+. If they don't acknowledge the agreement as cert then may need to shave off 6% it'll be a waste. Anyway off topic here liao.So you collected PAMP?

Yes, as a physically backed gold investment there is annual fee. Since it's UT, these are already priced in.I don't collect any except a small pamp won via lucky draw. But my fam hold a few 100g last time vested in now defunct Gold Label. Went to BullionStar to ask but they need cert which we only have hard copy agreement with Gold Label but no cert. Not sure if they'll slash the price off 6% to classify as jewellery sale. A year or 2 back we go check the price is 11k+ but now should be 18k+. If they don't acknowledge the agreement as cert then may need to shave off 6% it'll be a waste. Anyway off topic here liao.

Back to Mari Gold. If only to buy to make that $18 I think is ok so long overall still earn. But if it's for Invest i prefer hold solid gold cos I don't like the idea of paying monthly service fee just to hold it in paper with banks. Previously I hold paper silver with UOB. Even market drop still need keep pay and pay the service fee just for holding. Eventually i close the account.

Does mari also have monthly service fee?

U go for cast gold it doesn't have to be sealed. But make sure u don't lost the cert.was considering physical gold too but found out it has to be sealed to preserve selling value. lost the fun of touching and smelling it.

Tomorrow pay day for MII but 29th price is only 9.60

Hope next month can rise above 9.65

The paper silver i traded with UOB i don't think is silver backed. I'm not sure. But the monthly fee really makes me think eventually it'll become $0.Yes, as a physically backed gold investment there is annual fee. Since it's UT, these are already priced in.

Was considering physical gold too, but knowing there is premium over spot price during sale and resell makes me rethink gold ETF instead.

I usually decide on the last day whether to collect cash like 包租婆 or to reinvest. Usually if I see the amount dip below my original amount I'll reinvest.Thanks to DCA strategy. Life jacket taken out to wipe off the mould to standby jump ship.

Tot ppl invest in mii is for regular fixed income?Thanks to DCA strategy. Life jacket taken out to wipe off the mould to standby jump ship.

Payday is also the laosai day?Tomorrow pay day for MII but 29th price is only 9.60

Hope next month can rise above 9.65

No worries, Mii is supposed to use the payout to offset nav loss, giving net yield of abt 4%.

(Vested in Mii)

not an expert but Mii not really for buy low sell high. it is more for getting payout every mth end. my strategy is to invest all my savings (with payout reinvest) to get the 4% net yield.

with $10k, u can get abt $53 per mth or 6.3% pa.

yes, i keep record of my principal $19k to compare it against the current market value.

@Jorgensen asked abt payout and strategy, so i replied only based on his enquires. i did not state that the 6.3% is the yield. the 4% net yield isnt my calculation. it's shown on mari app/webpage. u should maintain your own record.

the payout is 6% while the net yield is 4%. do expect 2% to be "eaten" every year.

I am not good at explaining the 6% and 4%. maybe someone else can help.MII payout in liao

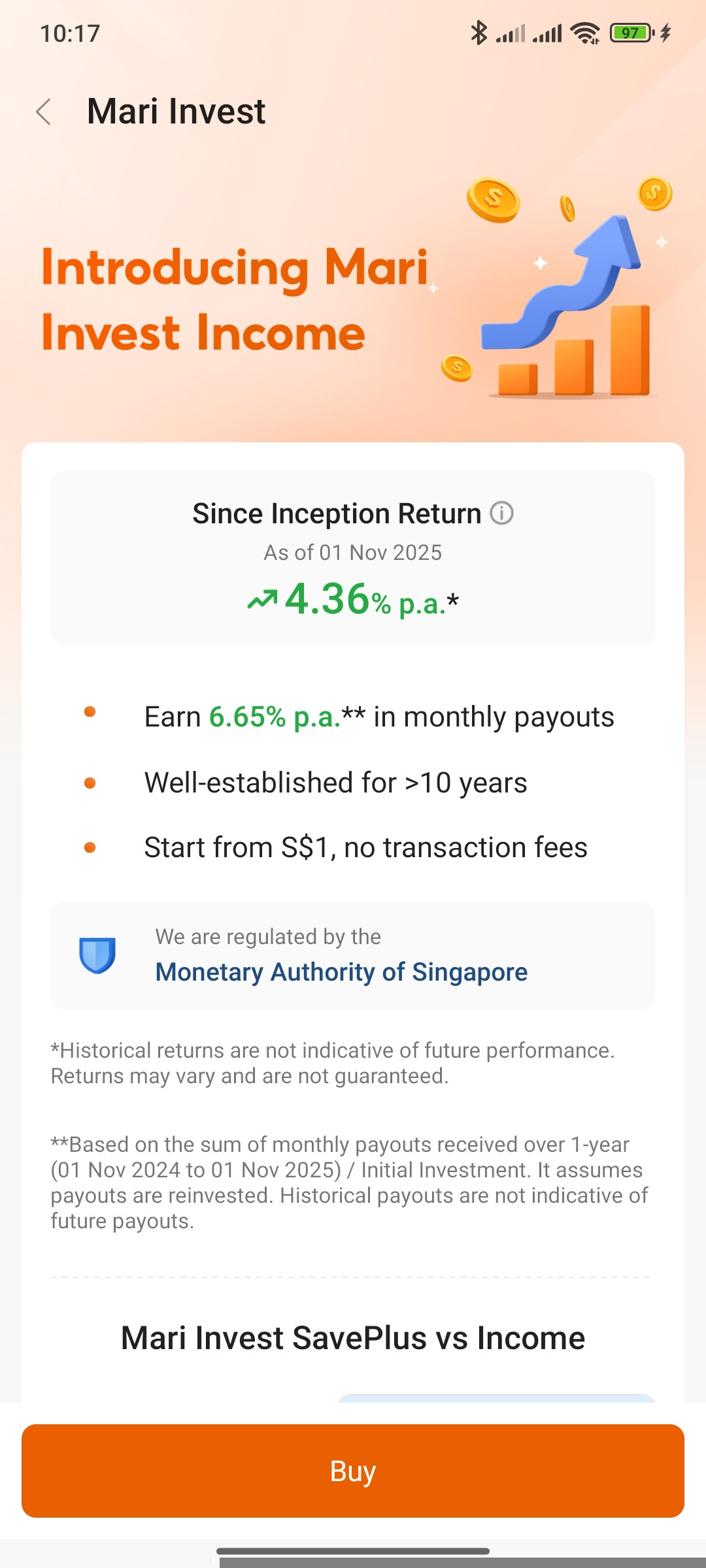

BTW why the mii listed 4.36% pa whereas I received 6.xx monthly payout?

@wutawa

@peppermint7

MII payout in liao

BTW why the mii listed 4.36% pa whereas I received 6.xx monthly payout?

@wutawa

@peppermint7

Mii 9.55