Cashflow202

Supremacy Member

- Joined

- Feb 24, 2012

- Messages

- 8,296

- Reaction score

- 1,626

+158.49

Hello from hong kong

Hello from hong kong

Wow how you earn so much in less than half a day?+596.36 so far

Crude and gasWow how you earn so much in less than half a day?

Is your trading fully automated now?

Is your trading fully automated now?

do you have to spend anytime everyday?

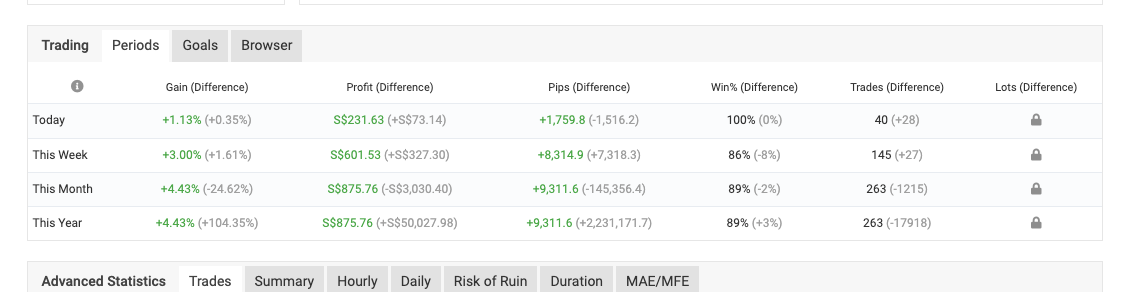

I intend to start an experiment. Day trading just indices. Will spend just less than 30min doing pre market analysis. Will try to day trade the first 1-1.5hours of market open. I realised some days once market open price move fast liao, some days will chop. I wanna catch those days where it will move fast within first 5-10min. Straight hit my tp by 1035pm or latest by 1045pm n then can done for the day. Wanna try n see after one year how’s the results.

of cuz I will continue my swing trades. But for day trading maybe just indices.

to followup on the question (sorry for the seperate reply cause was enjoying sunday outdoors)Is your trading fully automated now?

do you have to spend anytime everyday?

I intend to start an experiment. Day trading just indices. Will spend just less than 30min doing pre market analysis. Will try to day trade the first 1-1.5hours of market open. I realised some days once market open price move fast liao, some days will chop. I wanna catch those days where it will move fast within first 5-10min. Straight hit my tp by 1035pm or latest by 1045pm n then can done for the day. Wanna try n see after one year how’s the results.

of cuz I will continue my swing trades. But for day trading maybe just indices.