yperic

Greater Supremacy Member

- Joined

- Jan 14, 2003

- Messages

- 82,897

- Reaction score

- 30,668

A man with a brain tumour had his S$100,000 AIA critical illness claim denied. Why?

"But no insurance agent, at point of sale, would sit down with you for one hour to read through the 70-over pages," he said.10 years ago, Frankie Yee was diagnosed with a brain tumour.

At the time, the tumour was small and relatively unobtrusive. His doctor told him that it was benign and not aggressive; a major surgery wouldn't be worth the risk.

Yee agreed. But as the years went by, the tumour grew. He suffered more and more headaches.

Finally, in November 2024, the doctor said that the tumour was on a dangerous trajectory. If left alone and allowed to keep growing, it'd begin to affect his memory and cause him migraines.

"The neurosurgeon told me, it's better for me to take it out before it becomes life-threatening...he advised me to remove it," he said.

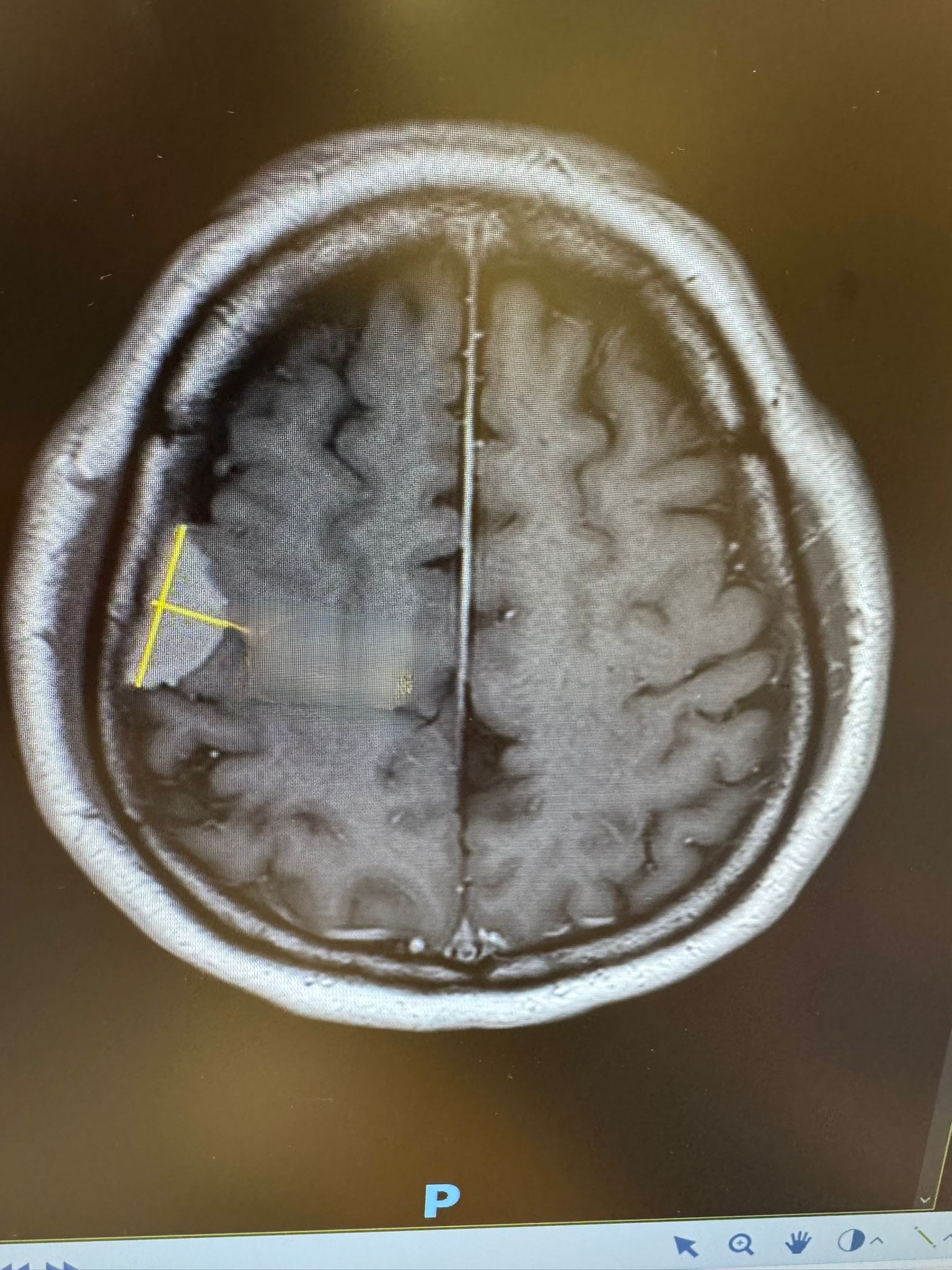

So he did. At 57 years old, he went through brain surgery to remove the tumour. It measured 3.1cm in diameter.

After surgery. Photo by Frankie Yee

Denied claims

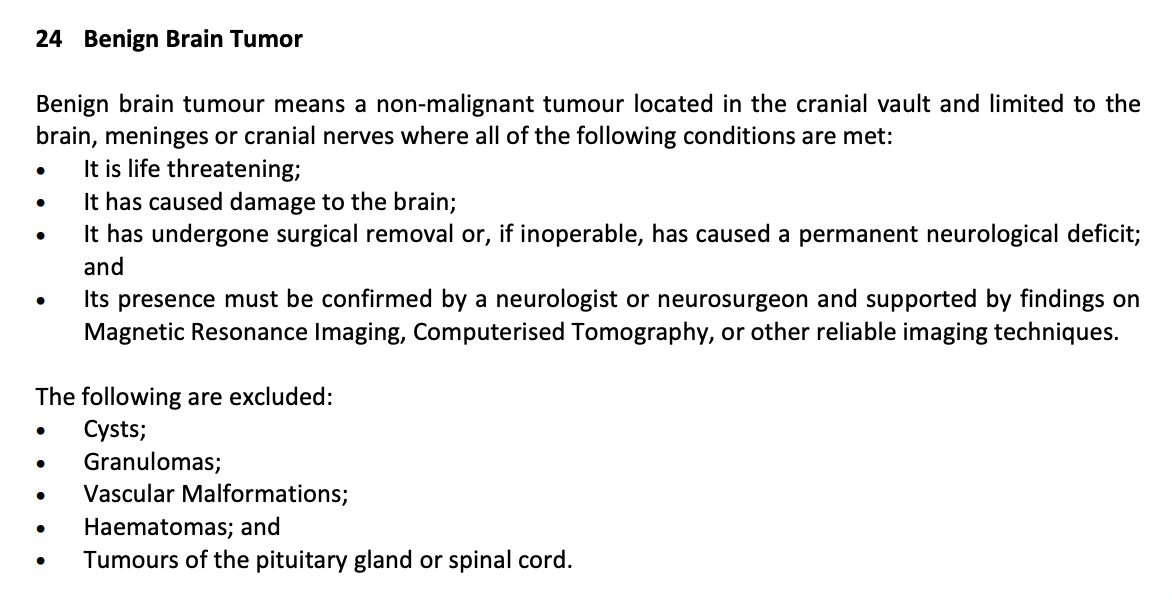

There are 37 critical illnesses covered by a standard critical illness insurance plan.It was under number 24, "Benign Brain Tumour", that Yee filed his insurance claim after being discharged from his two-week hospital stay.

But to his surprise, his S$100,000 claim was rejected as his insurance provider, AIA, deemed his tumour to be "not life-threatening" at the time of surgery.

Speaking to Mothership, Yee said he was "baffled" by the response.

"To me, since you say the plan covers critical illness. Stroke, to me, is critical illness. Cancer, to me, is critical illness, even if it's stage one.

When I bought the policy, all I saw were the words 'critical illness'. I don't believe any insurance agent in Singapore...will tell you [that their plan covers] critical illness, [but only if it's] life-threatening."

He added that he did not know exactly what would happen if he allowed the tumour to continue to grow, but "no person of sound mind" would delay surgery to that point.

"If you know that there is a tumour growing in your head, wouldn't you want to take it out, when advised to by the neurosurgeon?"

What's in a critical illness policy?

In Singapore, the illnesses covered by a critical illness policy — regardless of the insurance provider — are determined by the Life Insurance Association (LIA) Singapore.Similarly, LIA sets out the definitions of each illness and the terms and conditions as to whether it is claimable.

As of May 2025, a Benign Brain Tumour is defined as such:

"A non-malignant tumour located in the cranial vault and limited to the brain, meninges or cranial nerves where all of the following conditions are met:

It has undergone surgical removal or, if inoperable, has caused a permanent neurological deficit, and;

Its presence must be confirmed by a neurologist or neurosurgeon and supported by findings on Magnetic Resonance Imaging, Computerised Tomography, or other reliable imaging techniques."

You'd notice that being "life-threatening" is not a requirement.

In hopes of figuring out why Yee's claim was rejected, I turned to the insurance company itself, AIA.

While AIA declined to comment on Yee's specific case, they explained that definitions change over the years to reflect changes in medical knowledge.

A spokesperson said:

"Whenever someone buys an insurance policy, the terms and conditions are set out in the product summary, which is then given to the client and explained to the client.

[So] the definition at time of purchase typically will apply, because when the conditions are being updated, or where the definitions are being updated, it may be [done so] in a way that has not been explained to the customer."

In other words, what was binding was the definition of a Benign Brain Tumour over 10 years ago, when Yee first bought the plan.

And in 2014, a Benign Brain Tumour that can be claimed under the policy does have a few extra conditions.

The fine print

But how many insurance agents actually go through the fine print at such a level of detail?I spoke to Cathie Chew, a former veteran insurance agent at Prudential of over 23 years.

Chew left her workplace to take care of her husband, who fell critically ill in the 2015 raw fish outbreak, and lost his hearing permanently.

Ironically, when she tried to claim for her husband's disability, she ran into similar struggles, with the insurance company pointing to the fine print — despite her years of experience.

When a person makes a claim, Chew explained, the decision by the insurance company is largely based on the doctor's assessment.

But insurance agents, as the middlemen without any medical training, may or may not understand the situation fully.

"In a lay person's understanding and an insurance company's understanding [of an illness], there's a very big difference," she said.

"You buy one policy, it's 50 pages long. Who will read the 50 pages?...And the words are very technical, very hard to understand, very robotic.

...So the customer is in distress, the agent is in distress trying to help the client. And then the insurance company is quite far away...they may not see the challenge of agent who's facing the client."

She added that as a non-medical professional, she would go through the 37 critical illnesses as listed under the insurance company's product summary.

"But even though I try my best to explain, I'm also not too sure, because it's too technical," she said.

Chew also pointed out that ultimately, as an insurance agent, her responsibility is to the insurance company — not the client.

So when a client runs into struggles with their claim, whether or not an agent goes out of the way to help is largely up to them.

The need for empathy

As of now, Yee has brought his case to the Financial Industry Disputes Resolution Centre (FIDReC), which provides affordable mediation between individuals and financial institutions.He does not have any remaining medical debt, as he managed to claim for his hospitalisation and surgery under his Prudential policy.

But he hopes that insurance companies will not fall behind technicalities to deny their clients' claims.

"Now they are telling me that [the exact definition] was on page 30 [of my policy summary," he said.

"But no insurance agent, at point of sale, would sit down with you for one hour to read through the 70-over pages."

Chew also pointed out that when dealing with clients who may be battling illness, there's a need for greater empathy and greater education.

As a caregiver herself, she remembers the days in which she had to fight for her husband's insurance claims while looking after her husband — an "agonising" battle that took three years to win.

Photo from Cathie Chew

"The [issue] is how to close the gap, so the consumer knows exactly what they're buying. Educating the agent, and educating the public when they want to make a purchase.

...[And] insurance companies must have empathy. Using the term 'not life-threatening', it's a phrase without empathy towards the policyholder with a failed insurance claim. It's a phrase that I'd never use."

Top image from Frankie Yee