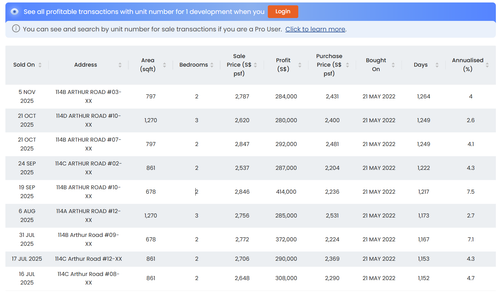

I didn't cherry pick on numbers, I think there are a few who made a bigger profit, and there are some who made lesser, but the thing is these people mostly sold before even TOP, or just on TOP. If they wanted to make more they could have just waited for awhile more for better profits, probably sold for because they need to sell for whatever reasons, but the thing is I don't think anyone of them made a loss after the deductibles. Willing seller willing buyer.

If you buy a resale and rent out - you pay for

- Interest fees

- Maintenance fees

- Property tax

- Agent fees for rental

- Possible repairs, usually 2 years rental up you will definitely need to spend a few hundreds at least to repair, by 4-5 years likely a big ticket item will spoil

- Income tax on yields

- End up month on month you only earn a few hundred dollars on yield, this is highly dependent on the interest rates, if its based on this period it is good to buy to rent out, but imagine when sora was like 3.5%+, you will be bleeding money just by holding on to the property unless the loan you take is very little

- If you want to partition and rent out, how are you going to get the tenants for every single room. It is not easy, plus you need to handle a lot of loose ends, if you rent out to co-living, it will be very hard to sell in the future

I don't know where you get the 290k for most people from, again these people sold just before TOP or on TOP, it is not like they held the product for 5 years and is unable to sell, they exited almost right when their SSD is up, this hows how strong the buyer market demand is. These people, if they felt the price isn't they, they could have held on for more money.

2.8k yields per month isn't it very good based on the amount of money put in? Which investment product gives you this amount of yield. perhaps a moneymind guru can come out and explain for the amount put in is the yields good or not. I am not sure how people calculate the yields for selling property, using the example that i listed, i googled how to calculate annualize yields and use this formula : [(Ending Value / Beginning Value)^(1 / Number of Years)] - 1, i also verified against chatgpt, the annualized yield for that property is ~7.9%. You can go moneymind or whereever and ask, 7.9% is much higher than most of the investment products out there.

-----

There is no right or wrong, you are free to invest in what you want