Dear BBC, Kelhot, Henry, Deluxe, all the GEGE and Experts:

Let me RECAP and Organise it better again. Shall I make any mistake, pls do not hesitate to guide me along . My uncle also sharing with his classmate, pressure lah..

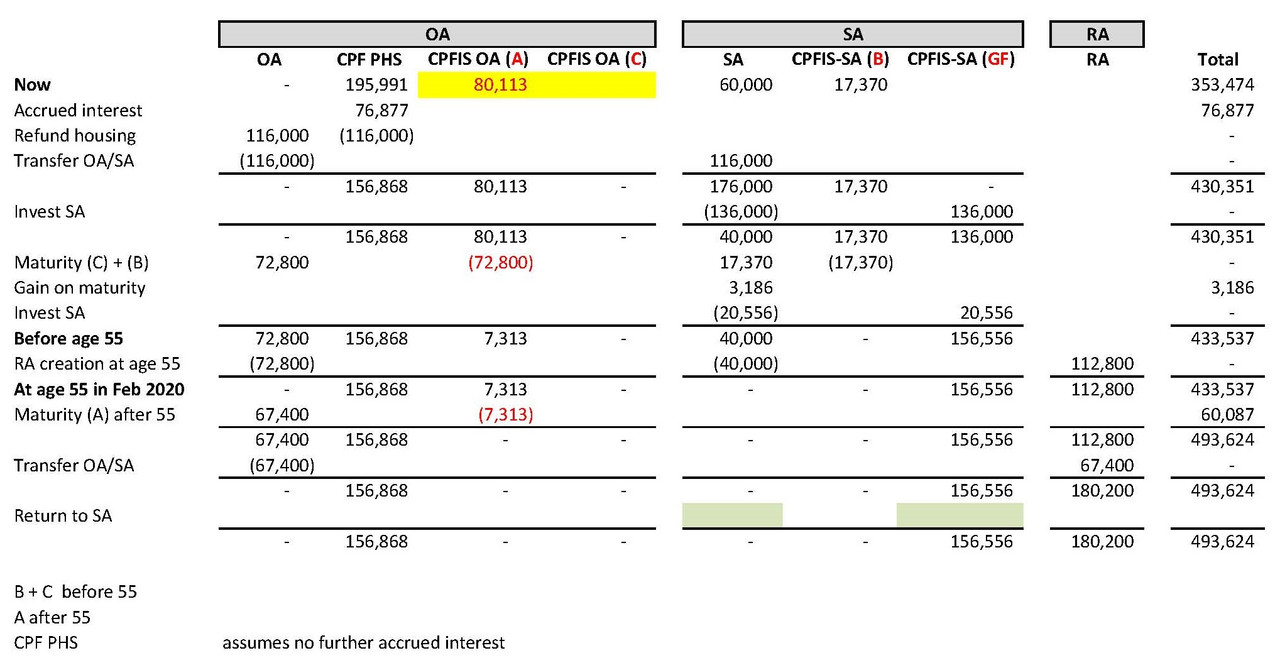

Now My Uncle have :

Now My Uncle have :

OA ZERO

SA 60,000

MA 31,000

Withdrawal for properties (OA:195,991 + 76,877 Interest + SA:17,502 + 3,186 Interest)

His CPF indicate that he used for Investment:

OA 80,113

SA 17,370

.... Which he use to purchase NTUC INCOME

(A) GROWTH CV 67,400 Mature 3/2020 from OA [Mature 2 week after his 55 birthday]

(B) GROWTH CV 36,300 Mature 2/2020 from SA [Mature before his 55 Birthday]

(C) HARVEST CV 72,800 Mature 3/2020 from OA [Mature 2 weeks before before his 55 Birthday]

He and spouse are covered by Enhanced Incomeshield Preferred

What he need to do immediately PHASE 1 now is:

1. Top up 116K to OA (to pay back his Hse OA). Current SA limit of 176k – 60K he has in SA

2. Immediately request 116K OA transfer to SA

3. Immediately use the 136K SA to get Lion Global All Seasons Fund – Standard via Peom

• He is working oversea, child in NS, hence no one could benefit from the Tax Relief Top Up?

Then, before he turn 55, maturity of his two NTUC Investment Policy (B) + (C) would go back to CPF become:

OA 72,800 (From C) …. Matured 2 weeks before he turned 55 .

SA 40,000 + 36,300 (From B) …… Matured in Feb 2020 before he turn 55

MA 31,000

Withdrawal for properties (OA:79,991 + 76,877 Interest + SA:17,502 + 3,186 Interest)

What he need to do later in PHASE 2 before turn 55 is:

1. Once NTUC (B) Maturity back to SA during Feb, Immediately use it to get more Global All Seasons Fund – Standard via Peom

2. Top up 136K to OA (to pay back his Hse OA+Interest). Current SA limit of 176k – 40K

3. Immediately use the 136K SA to get Lion Global All Seasons Fund – Standard via Peom

By 54 Birthday:

OA 72,800 (From C) + another NTUC (A) 67,400 [Mature 2 week after his 55 birthday]

SA 40,000

MA 31,000

Withdrawal for properties (OA:20,868 + SA:17,502+3,186 Interest)

>>> This would sufficient for FRS 181K

>>> In fact, he may Top up his OA Withdrawal for properties (OA:20,868 + SA:17,502+3,186 Interest), then transfer this excess amount to Top Up his spouse CPF for her to have better retirement payout?

By 55 Birthday :

OA ZERO (Transferred to RA)

SA 308.3 K (Sell off all his Lion Global All Season Fund, back to SA).

***

MA 31,000

RA 181,000 >>FRS

*** Question: This SA would exceed the max 176K, he could transfer to her spouse SA?

Before 65 Birthday:

>> IF he think , still fit to enjoy more years, Request CPF Defer Payout to 70

>> Choose STANDARD PAYOUT :

- As he could use his hard earned money this life

- If uplorry before 81, the balance FRS minus the cummulative Payout would left as bequest to family.

- If live beyond 81, cumulatively payout he has taken 259-287K more than his FRS (Based on CPF LIF Estimator), which is fair no more bequest for family. But he continue to get Standard Payout of 1.4-1.5K/Mthly till he happy to go.

Did I understand correctly and could execute this plan accordingly? Thank you all Expert's Guidance and Patience