Dividends Warrior

Arch-Supremacy Member

- Joined

- Nov 7, 2010

- Messages

- 23,720

- Reaction score

- 1,691

So this means you sitting back to watch the show, or you planning to buy too?

I have never been interested in IPOs.

But it is interesting to watch.

So this means you sitting back to watch the show, or you planning to buy too?

I have never been interested in IPOs.

But it is interesting to watch.

I have never been interested in IPOs.

But it is interesting to watch.

Thats true, but then again, this is Mapletree!

No fear .

Mapletree or Mapleleave IPO or not , many IPOs are still

worth punting .

The truckloads of scrips putting aside for public is comparable to that of Hutchison Port Trust (185.185mil) which is more than sufficient to satisfy all applicants.

Unless the Mapletree brand-name warrants more upside by way of instant capital appreciation on March 7, I see this as another boring overseas REIT that's merely overhyped. Let's not forget MCT's lackluster debut. In actual fact, yield for overseas REIT can only go up if it's priced too expensive, vice versa.

Take a look at Perennial, the failed attempt by ARA Dynasty, the rocky start by Ascendas Hospitality despite offering >8pct yield, the tanking of CRCT months after, the doomsday first-day trade of Religare, the disgusting performance of Hutchison since Day 1.

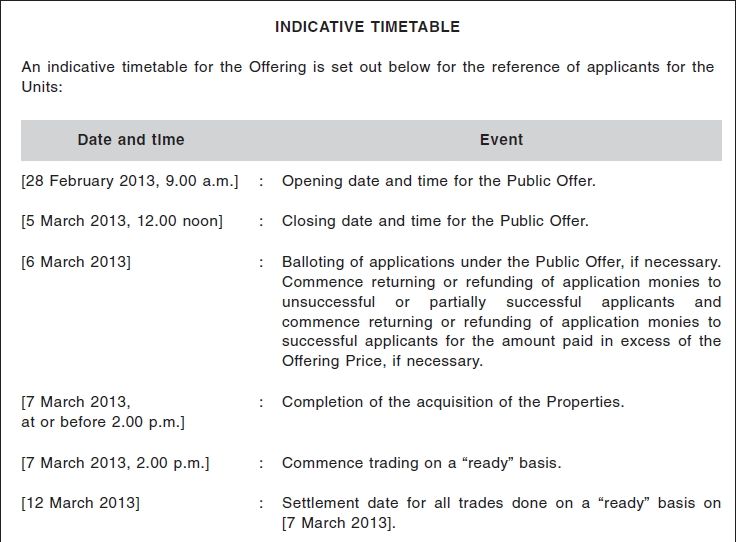

Keep your fingers crossed over the next 2 weeks.

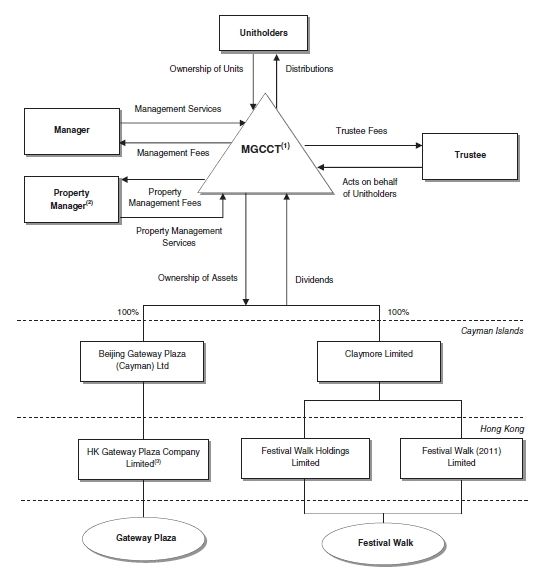

This is a trust, not a REIT wor.

Check post 1's hyperlink, where yesterday's lodged prospectus was filed under Opera's typical REIT section, unlike business trust offerings.

A commercial REIT is still considered a "trust" from real estate

investments though.

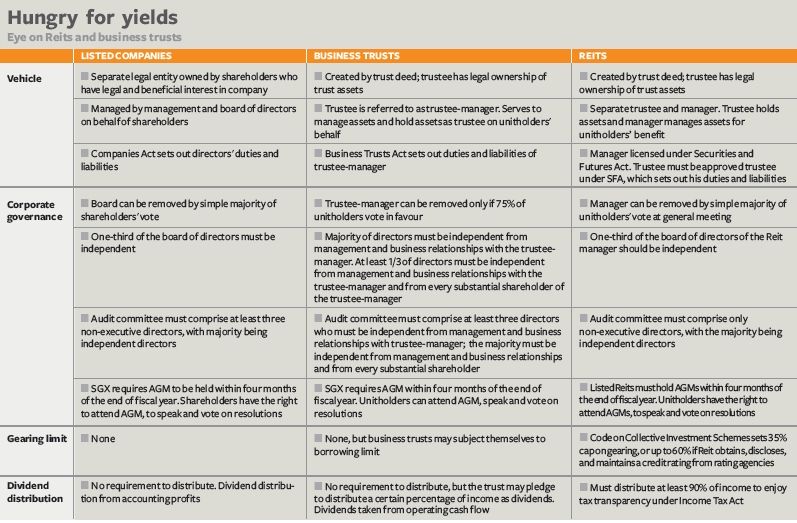

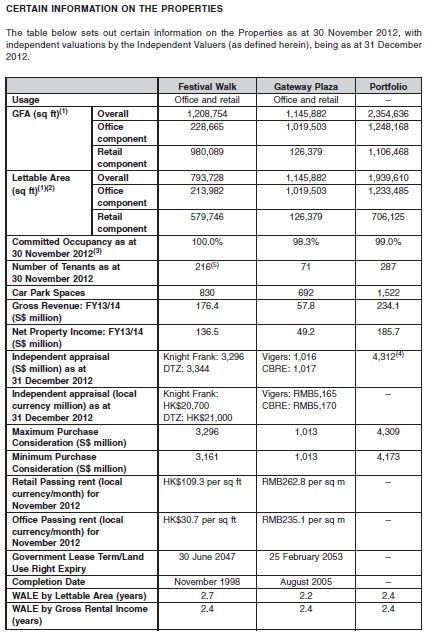

(Page 1)MGCCT is a Singapore real estate investment trust (“REIT”) established with the investment strategy of principally investing, directly or indirectly, in a diversified portfolio of income-producing real estate in the Greater China region which is used primarily for commercial purposes (including real estate used predominantly for retail and/or office purposes), as well as real estate-related assets.

so this IPO a must buy?

still holding on MCT since IPO...just notice the price is 1.445 now