Yeah, things are, shall we say,

interesting over here. Can y'all believe it's only been eight weeks since the Rose Garden press conference? "Why are you tariffing penguins?" was less than two months ago!

Let's start with where that difference comes from: the difference is basically that VWRA's index includes emerging markets, while IWDA's doesn't. (If you look at VWRA's geography list, you'll see China, India, Taiwan, and South Korea—making up about 8.5% of the fund between the four of them.)

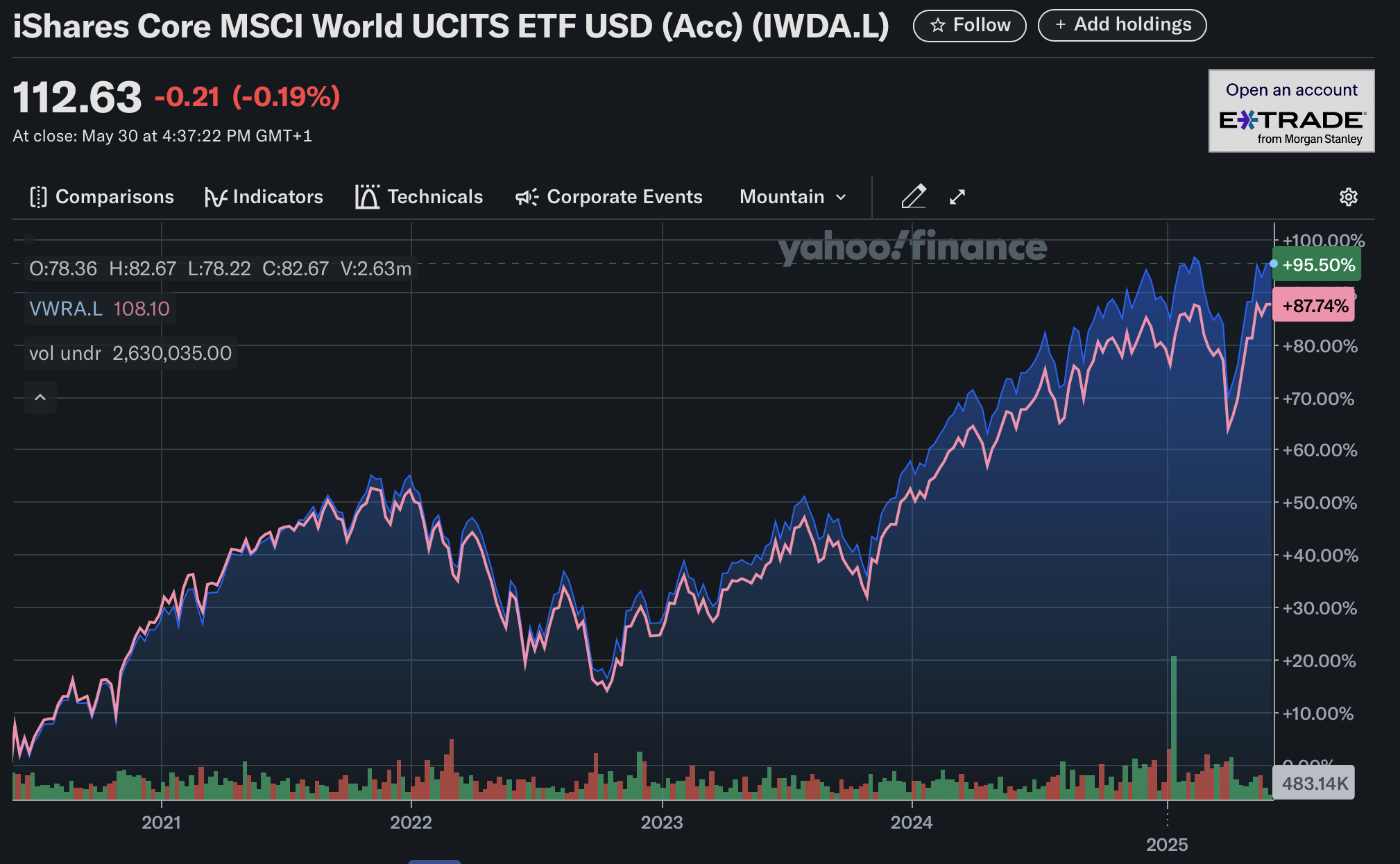

Does that make a difference? Yes, it does, but it's not a huge difference, and it's not something that you need to invest a lot of time and brain-damage to have an opinion on. In short: IWDA and VWRA follow each other pretty much tick-for-tick, as you'd expect when their portfolios are 90% identical (and the other 10% is pretty highly correlated as well).

Over very long terms—more than a year—they can drift apart a little, because of differing performance in that remaining 10% of the portfolio. Here's a fun quiz: knowing what you know about the difference between IWDA and VWRA's portfolio (VWRA has more emergings, IWDA has more USA), which one would you guess has done better over the last year? How about the last five years?

Take a guess before you scroll down...

And there you go. (In both of these charts, IWDA is the blue line; VWRA is the pink line.)

Over the last five years, IWDA (with its heavier weight in the go-go US equity market) has outperformed VWRA (with its heavier weight in emergings) by about 0.8% per year. This

doesn't mean IWDA is a better fund, though: it just means that IWDA has been a little heavier-weighted in a market that's performed better. And over one year, they've gone basically tick-for-tick.

The question is, what will happen in the future? Will IWDA or VWRA be a better investment? I don't know—if I knew, I'd be writing this from a beach in the Caymans.

I will say that overweighting emergings—specifically China—has been a terrible trade for the last few years, and it's been a predictably terrible trade: anyone could've seen this coming. The Chinese government has been explicitly sitting on top of equity markets for years, trying to rebuild banks' capital buffers and local governments' balance sheets at the expense of shareholder profits.

But markets move in cycles. If you were around long enough ago, you'll remember the 2000–2007 period, when the US was uninvestible and emerging markets were the only place to be; or even the mid-90s. And right now, developed markets ex-US have beaten the S&P 500 by ~10% so far this year. (This is why broad diversification is good!)

On the whole, though: both IWDA and VWRA are great ETFs—low cost, broadly diversified, all the things you'd want in a key part of your portfolio. Either is fine.