Shion

Senior Mentor

- Joined

- Oct 24, 2008

- Messages

- 360,026

- Reaction score

- 110,122

Sentosa Cove property prices buck mainland uptrend as loss-making deals rise

https://www.straitstimes.com/singap...ck-mainland-uptrend-as-loss-making-deals-rise

SINGAPORE – In July, a condominium unit at Marina Collection in Sentosa Cove was resold for $4.95 million, over 40 per cent below the price paid in 2008.

The seller had bought the 3,272 sq ft unit from the developer at $8.63 million.

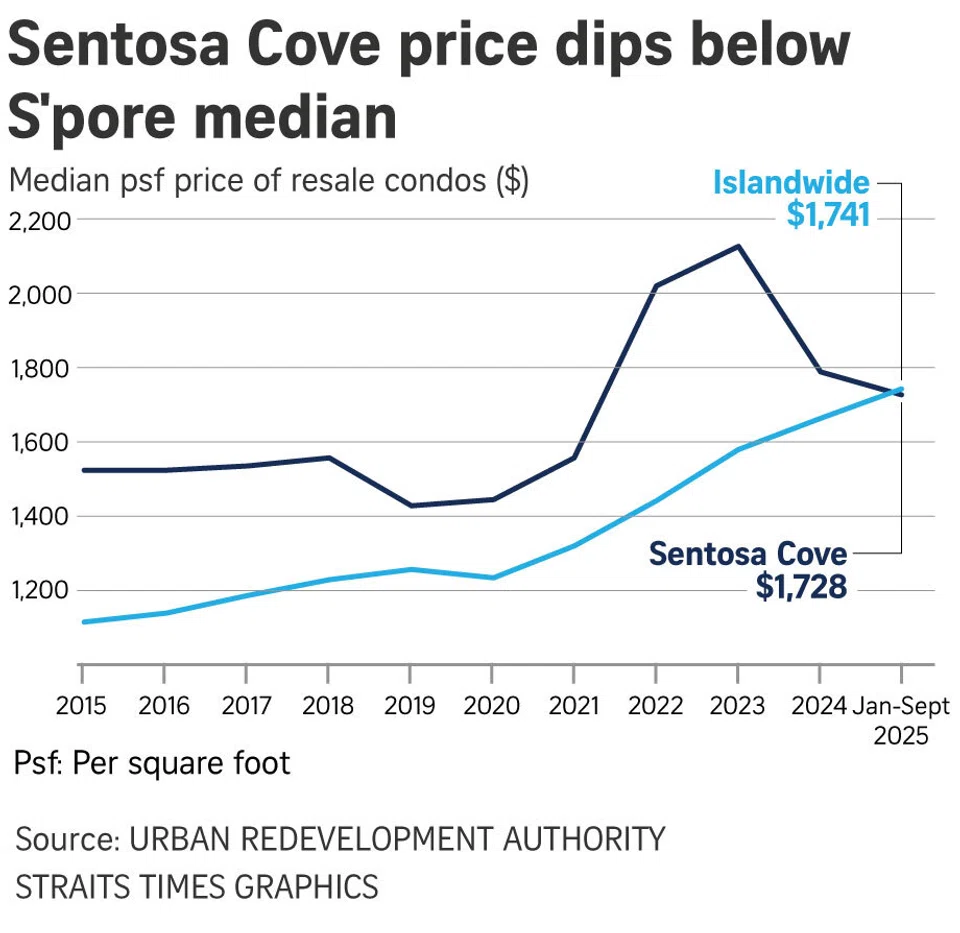

While the latest data from the Urban Redevelopment Authority (URA) showed Singapore’s overall private residential prices continuing to rise, Sentosa Cove prices have moved the other way.

Data compiled by property analysts shows that Sentosa Cove’s resale market softened in 2024 and 2025, with more than half of the deals changing hands at a loss.

In 2024, about 59 per cent of landed and non-landed resale transactions in Sentosa Cove were loss-making. So far in 2025, this proportion rose to about 66 per cent, noted data from the research and market intelligence unit of property agency ERA Singapore.

Prices for non-landed homes in Sentosa Cove fell 18.7 per cent, from $2,125 per sq ft (psf) at the 2023 peak to about $1,792 psf in 2024 and $1,728 psf in the first nine months of 2025. Landed home prices on the island also dropped – by about 13.1 per cent, from $2,210 psf in 2023 to $1,842 psf in 2025, the Urban Redevelopment Authority (URA) figures showed.

In comparison, overall median prices of resale condominium units in the Core Central Region (CCR) on the mainland rose from $2,081 psf in 2023 to $2,111 psf in 2024 and $2,186 psf from January to September 2025.

The URA’s release on Oct 24 showed that the overall private residential property price index rose 0.9 per cent from the second to the third quarter of 2025. Prices of landed properties increased by 1.4 per cent, while those of non-landed homes rose by 0.8 per cent.

The outlier performance underscores how the waterfront enclave, which has 2,160 private homes, remains driven by a niche, lifestyle-oriented buyer pool, said property analysts.

Asked why Sentosa Cove prices diverged from the mainland’s, property analysts pointed to the absence of new projects to set pricing benchmarks.

ERA Singapore’s key executive officer, Mr Eugene Lim, said the lack of fresh launches in Sentosa Cove has left the resale market without reference points, noting that the last Sentosa residential plot was sold in 2008.

“In contrast, mainland Singapore continues to see a steady stream of new sites through the Government Land Sales (GLS) programme, which has helped support residential price growth amid rising land costs,” said Mr Lim.

He added that “a smaller supply of homes on Sentosa also meant that transaction volume is lower compared with the mainland”, reinforcing softer pricing.

Figures from URA show that sales volume islandwide rebounded strongly in the third quarter of 2025 as developers ramped up launches to 4,191 private residential units, excluding executive condominiums. Developers sold 3,288 units islandwide from July to September, and 4,116 private residential units also changed hands in the resale market.

Currently, all transactions on Sentosa are resale units, and resale prices usually do not move as fast as new properties, noted Ms Christine Sun, chief researcher and strategist of property firm Realion (OrangeTee & ETC) Group.

Demand is another factor, and foreign buyers traditionally play a significant role in supporting the Sentosa property market, she said.

Since the hike in additional buyer’s stamp duty (ABSD) to 60 per cent in April 2023, “there has been a noticeable drop in the number of private homes bought by foreigners, which may have impacted properties in Sentosa Cove more than other areas”, added Ms Sun.

Citing URA caveats, she highlighted that the median price of resale condominium units in Sentosa Cove was also higher, at above $3 million in both 2024 and 2025, compared with the $1.6 million to $1.7 million islandwide.

Sentosa’s higher price quantum also narrows the buyer pool, while the relative lack of schools and everyday amenities make the location less compelling for many local families, said Ms Sun.

Sentosa Cove, which began as a residential zone in 2006, is the only enclave where foreigners can buy landed property, subject to approval.

Foreign buyers reportedly snapped up landed homes between 2009 and 2011, which led to a spike in prices. The median price psf for non-landed properties in Sentosa Cove rose to $2,110 in 2011.

In 2012, SC Global Developments’ Seven Palms set a record of $4,200 psf for a 99-year leasehold development when Australian mining magnate Gina Rinehart paid $57 million for two units.

However, after the ABSD was introduced in December 2011 – applying to foreigners buying any residential property and Singaporeans buying their third and subsequent properties – to moderate demand for homes, the median price psf fell below $2,000 in 2012.

For almost the next decade, it hovered around $1,500 psf and $1,600 psf.

But the Covid-19 pandemic sparked a turnaround for Sentosa Cove homes. Prices for non-landed homes there started rising in 2021, hitting a median of $2,125 psf in 2023, supported by the sale at Cape Royale.

The upscale development, completed in 2013, hit the market only in 2022, nine years after the project was completed. The units were sold at between $2,000 psf and $2,300 psf. The developer held back units after sale prices fell following two rounds of property cooling measures in 2013.

With Cape Royale excluded, URA data shows the median psf price for a resale 99-year leasehold condo unit in Sentosa Cove to be $1,577.

In April 2024, unsold units at The Residences at W Singapore Sentosa Cove were relaunched for sale at more than 40 per cent off their initial 2010 launch price, with prices starting from $1,648 psf.

Mr Mohan Sandrasegeran, head of research and data analytics at real estate agency Singapore Realtors, said the adjusted price points could open a window for buyers who had been waiting to enter the enclave.

Mr Lim said set against CCR prices on the mainland, Sentosa offers relative value for buyers who prioritise waterfront living and space over connectivity and convenience.

Ms Sun said that in the longer term, limited stock on Sentosa may continue to appeal to investors looking for properties that are exclusive and rare.