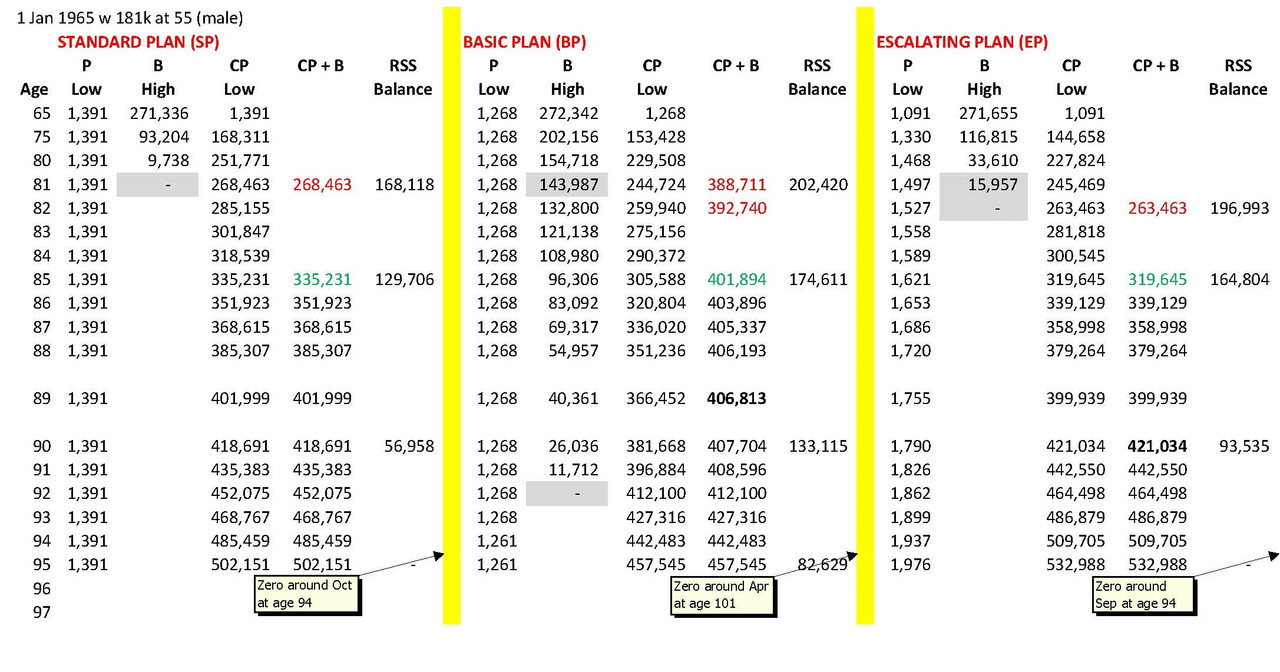

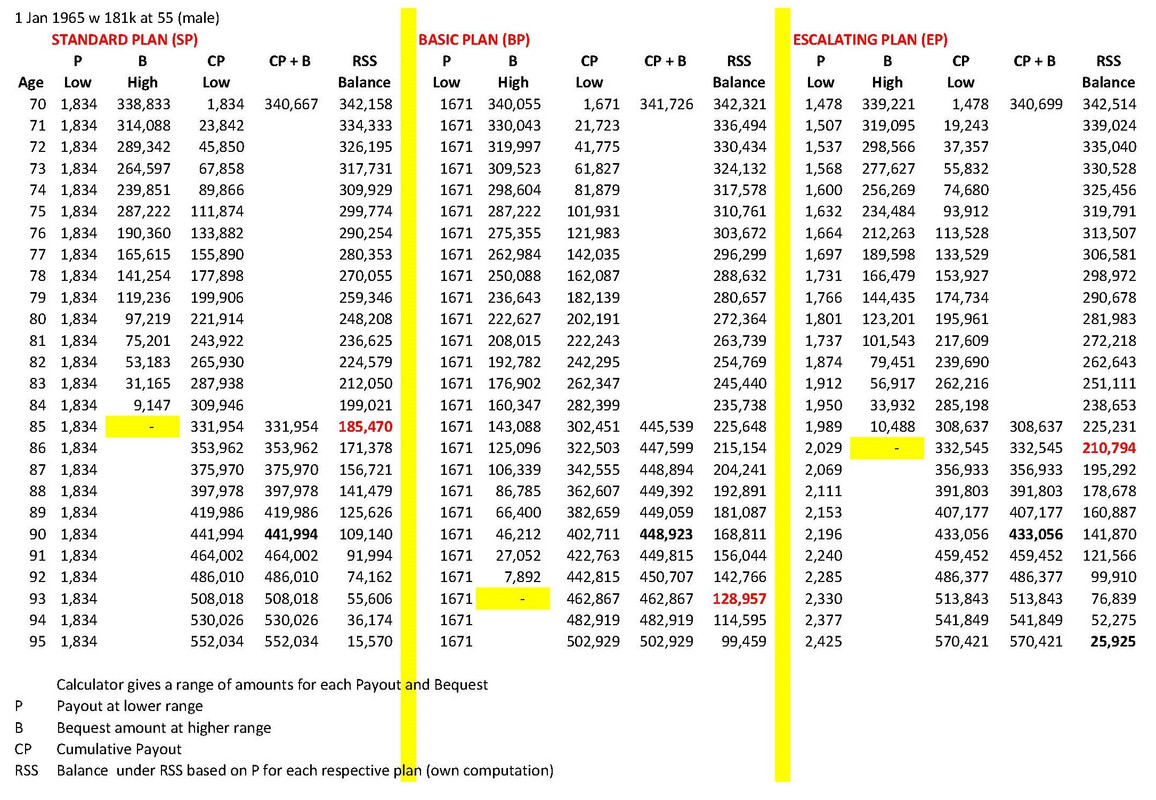

The table shows the payouts under the 3 plans, of a male born 1 Jan 1965 with 181k at age 55.

The payout (P), bequest (B) and cumulative payouts (CP) are taken from CPF Life Payout Estimator.

For payout, I picked the lower payout in the range given and for bequest, I have picked the highest in the range.

The fourth column (CP + B) under each plan is the cumulative payout plus bequest.

The fifth column (RSS balance) is the balance under the old Retirement Sum Sum based on the payout under the respective plans.

Observations –

What matter is the cumulative payouts plus bequest at time of demise? And does delaying payout matter?

BP is the best all the way to about age 90, followed by SP. From age 90, EP is the clear winner. The numbers does not take into account time-value of money and assume no future changes.

Up to about age 94, all plans would lose out to the previous RSS.

Above age 95, SP and EP would better of under CPFL than under RSS, whilst BP would have to be more than age 101 to be better of under CPFL than RSS.

Conclusion –

Up to you to decide when you are likely to uplorry and how much you are to prepared to lose or gain in selecting one of the plans