Jirachi

Great Supremacy Member

- Joined

- Jan 17, 2010

- Messages

- 54,362

- Reaction score

- 2,877

Where are you looking at the options flow?Sorry hor ... I do order flow, not alphatbet soup analysis.

Mahiam V,W,U,M,N ...

Where are you looking at the options flow?Sorry hor ... I do order flow, not alphatbet soup analysis.

Mahiam V,W,U,M,N ...

Where are you looking at the options flow?

See how long this lastMarket seems to be reacting more to Bessent than Trump now.

Oh I see. Thought it was the options flowI am looking at the ES futures order flow.

Oh I see. Thought it was the options flow

I look at chart, dma, volSorry hor ... I do order flow, not alphatbet soup analysis.

Mahiam V,W,U,M,N ...

See how long this last

Narrative also keep flip flopping

High CP entertainment value to keep retirees entertainedGood mah ... like that can see our favourite youtubers chut all sort of pattern to explain what is going on

At least get educated on NVDA and AI theme?I sold about 1.3mil worth of nvda between 2023 till end of 2024.

Still got about 1.5mil in there. Whatever trump stuff come, it is what it is.

As far as I am concerned, I already made bank. The value of the remaining shares can go to 0 and I will still already made 1.3mil out of an investment of sgd12k so I think it's pretty good deal all things considered.

Where do you look at this?I look the ES options chains too to understand what the market is pricing.

Where do you look at this?

Oh. Thought you are using something like CheddarFlowES option chains are available on IBKR.

Sibei chimAt least get educated on NVDA and AI theme?

Here's my recommendation for reading (need to pay for sub to read everything, but I think you got the money).

https://www.citriniresearch.com/p/thematic-primer-artificial-intelligence

Thematic Primer: Artificial Intelligence, Phase 2

Our last update to the AI theme generated some controversy. Some felt DeepSeek would be a “nothingburger” and should not serve as a signpost to position ourselves short in the AI Semiconductor complex. We know how that turned out.

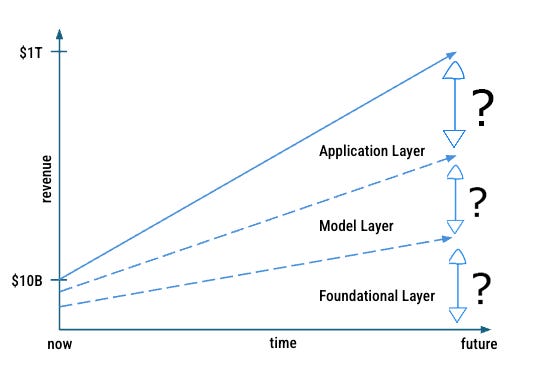

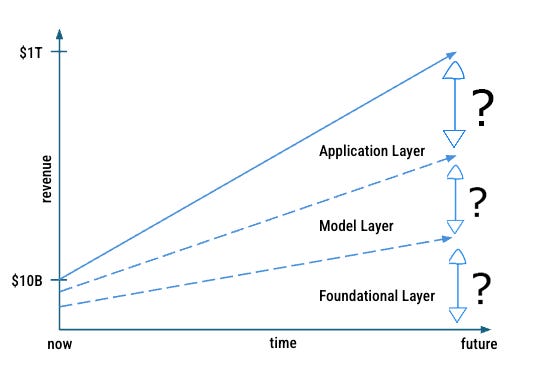

So far, the first phase has been scaling-centric. After ChatGPT’s debut, a moment that embodied the “tipping point” of investor awareness to generative AI, capital flowed primarily towards the foundation models and the infrastructure necessary to scale them. We called this race to LLM commoditization and the hardware revolution underlying it “Phase 1."

The thesis was simple: because these models would scale in a linear fashion with compute power, the pace and magnitude of capex spending would end up beating all current street estimates. We focused on the picks and shovels (Nvidia, SuperMicro, Dell, Broadcom, SK Hynix, etc.), the bottleneck wideners (Credo, Monolithic Power, Lumen, Coherent, Ciena, Constellation Energy etc.) and the enablers (Meta, Amazon, Microsoft, Alphabet, Oracle).

Our Phase 1 AI basket more than doubled over the following 18 months.

On December 8th 2024, at $140, we exited Nvidia entirely for the first time since we laid out the bullish thesis on AI infrastructure. On January 24th 2025, for the first time since 2022, we went short SMH (the semiconductor ETF) and NVDA, which we sized up prior to NVDA earnings and elaborated on in our “DeepSeeking Answers” piece.

Because of this short and our allocation shifts since January 24th, our dynamic AI basket outperformed our original AI Infrastructure basket and avoided a 20%+ drawdown in the first quarter.

The reasoning going forward for pivoting is even simpler: All shortages lead to gluts—and now the AI revolution is happening in a world of cheap inference and zero marginal compute constraints. If Phase 1 was about who could get a GPU, Phase 2 is about who knows what to do with one.

As we stated in January, our near-term bearishness on NVDA did not mean we are bearish on AI. In fact, we’re more bullish than ever on the advancement and adoption of the technology. Rather, in the near-term, we felt that the AI infrastructure trade had gotten so crowded that catalysts with even slight potential to be negative posed a risk.

More importantly, we believe it is time that the opportunities for alpha expand beyond just the physical infrastructure necessary for AI.

We’re unconcerned with questions like “when will we reach AGI?” and much more concerned with “when will companies begin seeing a durable benefit from utilizing AI?”. As the AI conversation inevitably shifts from the "what" of capabilities to the "how" of reliable implementation, the companies implementing this infrastructure will move from being perceived as tangential to the AI revolution to becoming its primary beneficiaries.

LLM scaling is great, and as it becomes commoditized it’s important to realize that the model doesn’t matter if no one sees it. The AI layer that wins is the one closest to the user, not the one buried deepest in a cluster. We’ve seen this movie before: Apple charges $100 for $20 of NAND because it owns the interface. In Phase 2 AI, whoever utilizes the model wins the margins.

Thesis: The winners of Phase 2 AI won’t be those building agents, but those with the preconditions to make them useful.

“The model doesn’t matter if no one sees it.” → The user interface and use case matter most now.

Potential Long-Term Winners (Application Layer — Phase 2)

These companies already have the infrastructure and are now layering AI into their core products:

Tech Giants with Strong Platforms

- Microsoft (MSFT) – Huge investment in OpenAI, integrating GPT into Office (Copilot), Azure, Teams, and GitHub.

- Alphabet (GOOGL) – DeepAI + Search + YouTube personalization + Google Workspace. Their Gemini model will be applied across services.

- Meta (META) – Strong moves in AI-driven recommendation systems (Instagram, Facebook), AI ads, and Llama models.

- Amazon (AMZN) – Applying AI to AWS, Alexa, logistics, and advertising. Their Bedrock service powers custom AI for enterprise clients.

- Apple (AAPL) – Quiet but strong: expect them to apply AI in iOS, Siri, Apple Health, and Vision Pro. They focus on UX, which will be critical in Phase 2.

These are platforms businesses use every day — and AI upgrades can meaningfully drive retention and upsell:

Enterprise SaaS Players (AI-Powered Workflow Tools)

- Salesforce (CRM) – Rolling out Einstein GPT into its CRM platform.

- ServiceNow (NOW) – Automating enterprise workflows with AI, strong moat in large corporates.

- Adobe (ADBE) – Firefly and AI integrations in Creative Cloud and Experience Cloud.

These are still earlier-stage or mid-cap companies that natively build around AI:

Emerging AI-First Application Companies

- UiPath (PATH) – AI + RPA (Robotic Process Automation). Making enterprises more efficient by automating repetitive tasks.

- Duolingo (DUOL) – Integrating AI tutors into language learning. Great engagement and network effects.

- Palantir (PLTR) – Their AI-powered decision platforms are gaining traction in government and private sectors.

- DataDog (DDOG) / Snowflake (SNOW) – Infrastructure monitoring and data warehousing companies turning increasingly AI-native.

How to Think About It

- Phase 1 = picks and shovels (Nvidia, SMCI, Broadcom).

- Phase 2 = apps and utility layer (who can use the picks and shovels the best?).

Humans lie but the price action never lies. We made a strong V shaped recovery at the halfback and is now headed back to test the upper bound. This is the second attempt. The first one didn't even come close before the test fizzled out. This market has been fairly brutal to both bulls and bears. Both sides have been mauled by the sharp reversals.

For those who hold US Treasury bonds, you may want to here this podcast:

Although I'm bearish after all the saga that happened, Trump's tariff has washed and deleveraged the market significantly. Powell will be forced to cut rates, whether he likes it or not.

Here's the bull prediction:

The bond market will take rates down regardless of what Powell does. We're likely to see the Fed ease in either May or June as the Fed wakes up to the slowing economy/recession & lower inflation but rates are headed lower whether he cuts or not.

@d9lives, got chance to earn back!