Most of the YouTubers making videos on REITs have not seen normal interest rates. Including Josh Tan, who looked a bit senior to me. But even he is 39. So I think he also started his investing in QE era.

So just like boomers were proved too conservative during QE era, it is possible that the millennials maybe proved too much of risk takers in this post covid era.

But there is no way to tell if interest rates will fall or rise going forward.

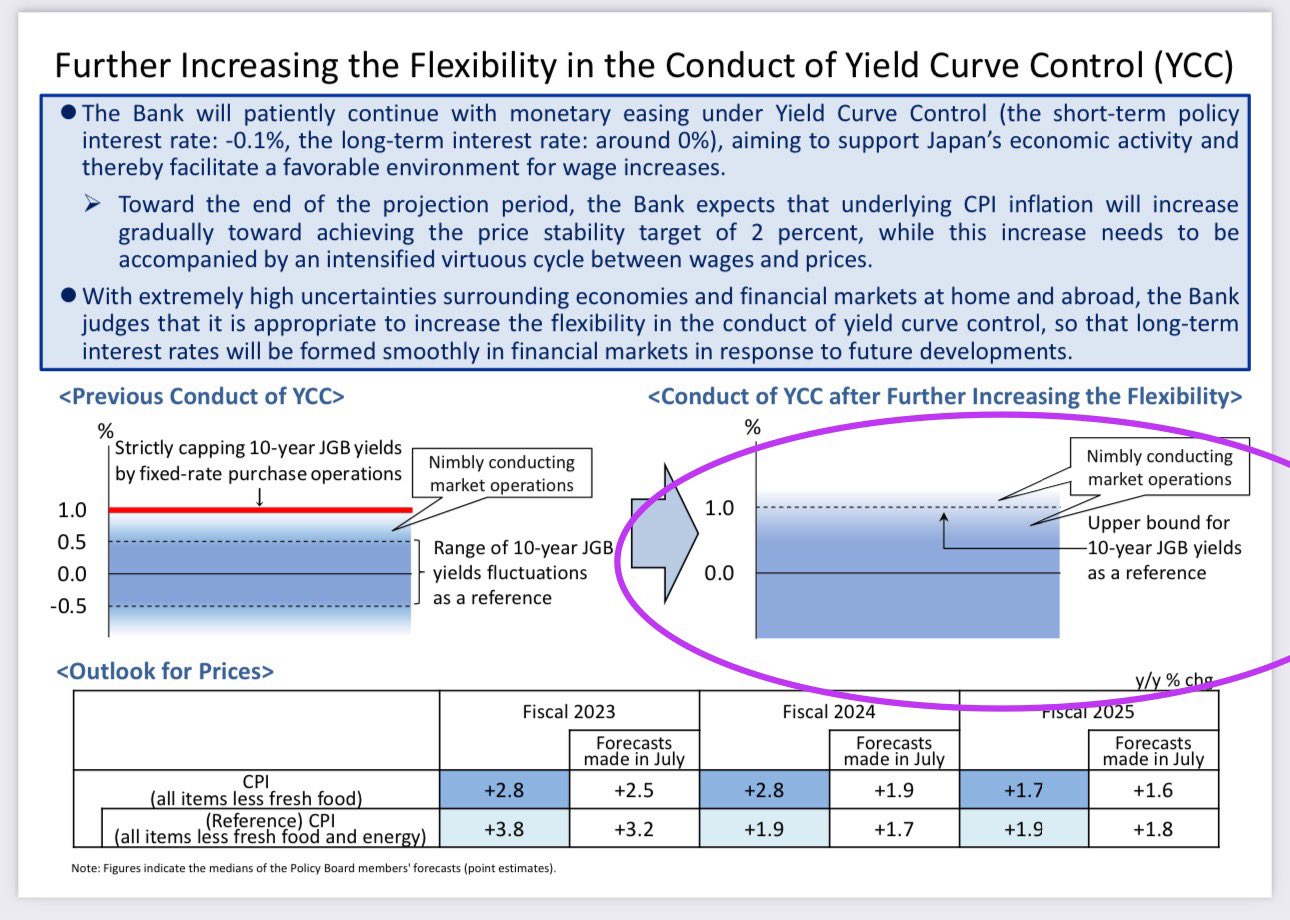

In 2024: UST 10yr yield will go above 5%. JGB10 yr yield will go above 1%.

Reason: US economy will still be in positive but declining GDP, sustained by govt spending (govt jobs, govt contracts, govt subsidies for Democrats vision of green future) which in turns maintain the state of UST oversupply (whether short end or long end). So, UST yield curve will continue to uninvert (i.e. normalise) with short duration rates pinned at 5.5% by good old Jay Powell. (Ouch!!)

BoJ will slowly be forced to exit YCC (by end of 2024) after USDJPY causes painful inflation faster than wage growth (both about the same now). Just watch the USDJPY and JGB10yr yield, both still rising post BoJ monetary policy meeting.

For those reasons, the future looks bleak for the rates that REITS will undertake in their 2024 loan refinancing cycle (refinancing for loans with 2025 maturities).

None of the REITS manager breathe a single word about this potential refinancing strains. Looks like they are macro-agnostic and continue to paint a rosy world in the presentation.