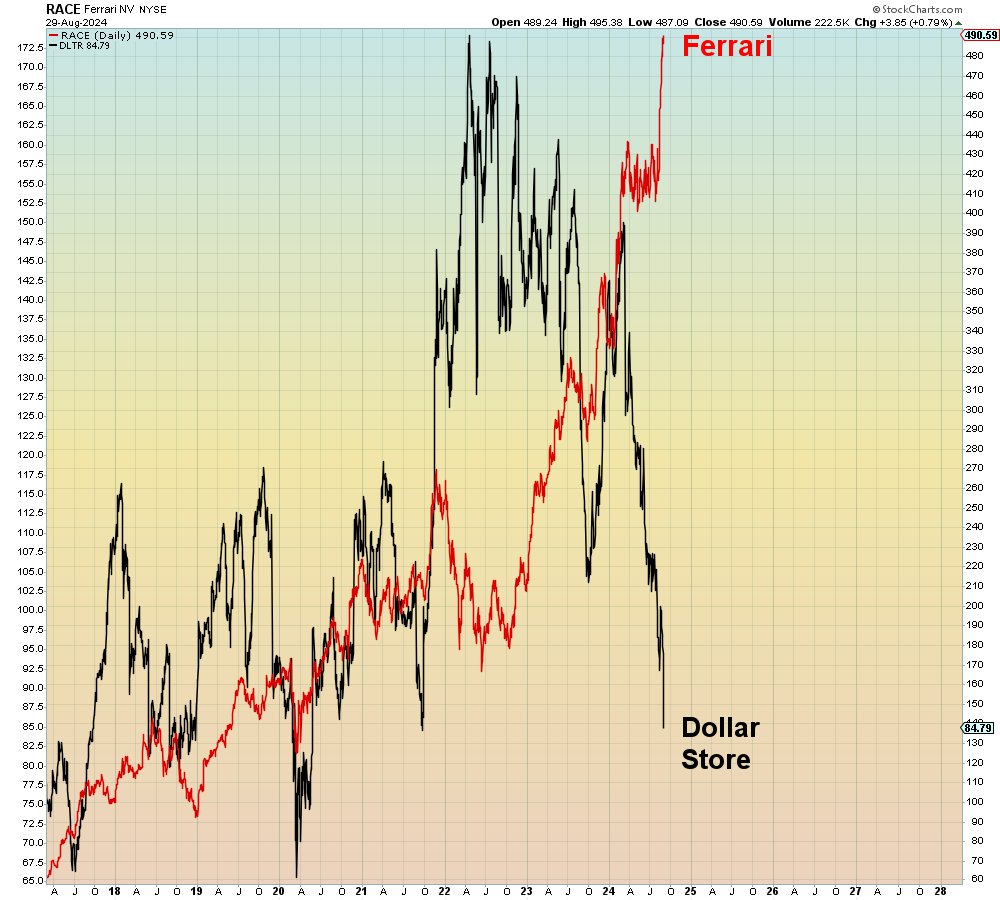

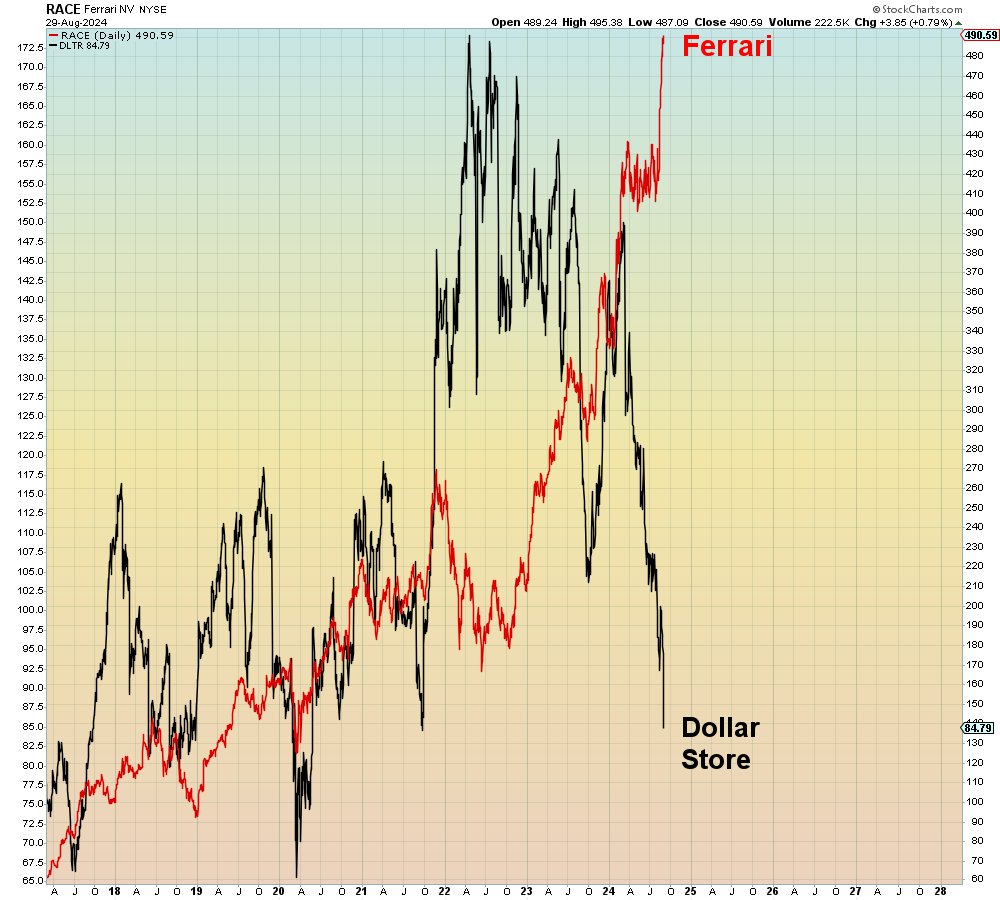

State of American consumer: split into 2 tracks

A: Asset rich: benefit from high rates, high stock prices (stock options, bonuses), and low mortgage rates.

B: Asset poor: disposable income obliterated by high prices due to cumulative inflation effect since post-Covid.

This is known as the K-shaped economy.

https://corporatefinanceinstitute.com/resources/economics/k-shaped-recovery/#:~:text=A K-shaped recovery is,and technologies during the recession.

Record 401(k) account balances reported by Fidelity Investments

Desperation of job-seekers

A: Asset rich: benefit from high rates, high stock prices (stock options, bonuses), and low mortgage rates.

B: Asset poor: disposable income obliterated by high prices due to cumulative inflation effect since post-Covid.

This is known as the K-shaped economy.

https://corporatefinanceinstitute.com/resources/economics/k-shaped-recovery/#:~:text=A K-shaped recovery is,and technologies during the recession.

Record 401(k) account balances reported by Fidelity Investments

Desperation of job-seekers

Last edited: