That is Biden's domain. Trump doesnt give 2 hoots about that. All he has talked about is the trade deficit.

For me, the official position that all of this is just to generate trade surplus doesn't make much sense. My hypothesis is that what we are seeing is a continuation of Trump 1.0 with lessons learned. The key policy objectives are

1) Detente with Russia

2) Open European markets to US goods and services

3) Contain China

The current tariffs are to achieve 2) and 3).

1) and 2) are related. If the US is in a posture of confrontation with Russia, then the US needs European allies. If however the US has friendly relations with Russia, it opens the door for US to take a more hardline approach with Europe with regard to economic policy. Bonus is that with Russia's blessings, the US can take action in Iran to address what they see as the biggest threat to the US in the Middle East.

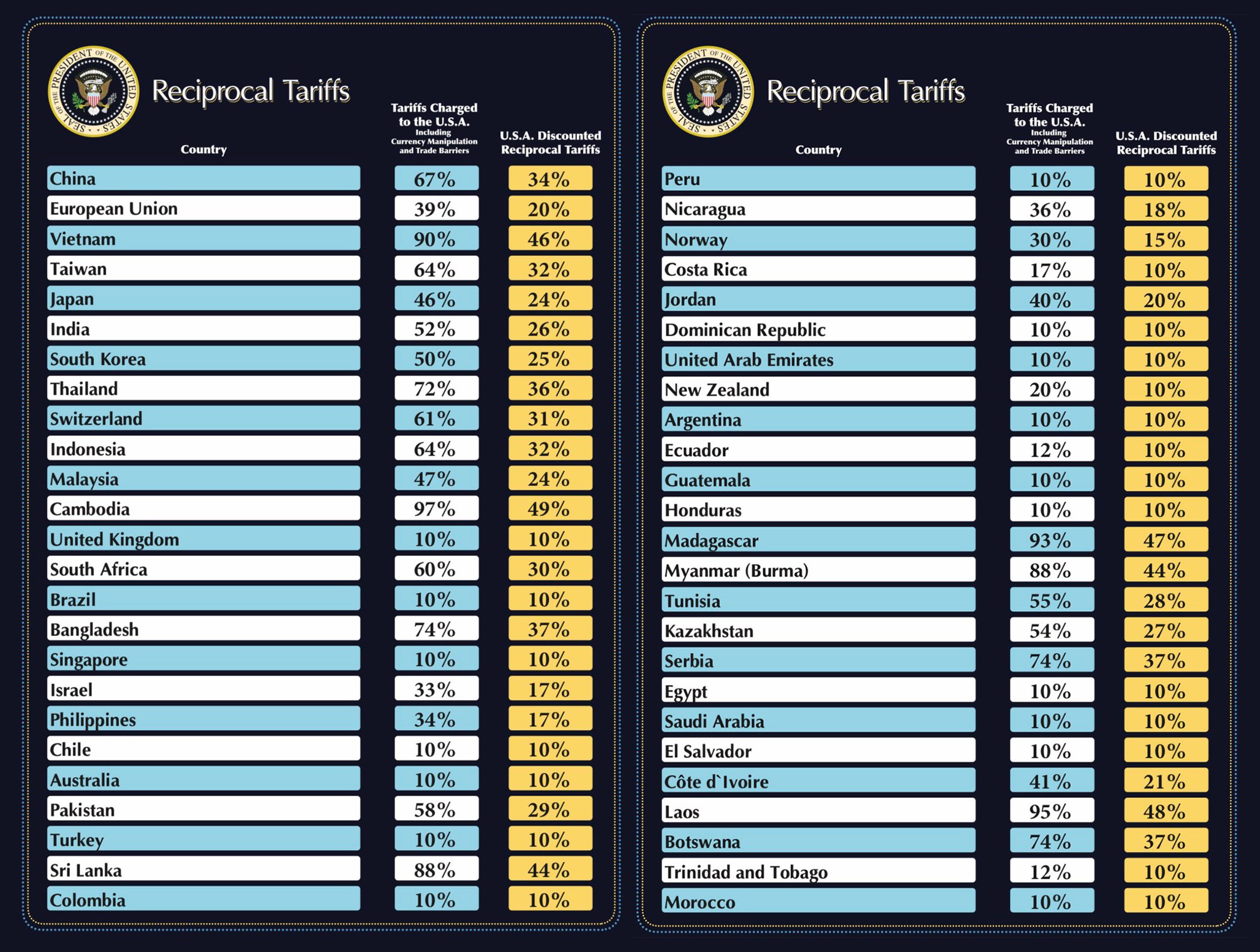

On China, the Chinese have been preparing for Trade War 2.0 for years. The main tool is geo-laundering and trans shipment. As long as these back doors are not addressed, any attempt to contain China with tariffs will fail. I am not familiar with the rest of the world so I shall limit to just SE Asia, If you look at the countries in SE Asia with the larger tariffs, many are well known to be countries Chinese companies have set up shop in anticipation of US tariffs. Even SG was not spared the 10% even though we have a FTA with the US. Our home team were surprised by the move as on top of the FTA, they had carefully engineered a trade deficit with the US through lumpy government item purchases like the F-35s. Whoever is running policy on this in US obviously studied us carefully and understood what we were doing.

In managing Trump 2.0, there are two approaches we can take. We can assume that it is a clown show or we can take the approach that there is a deeper geopolitical strategy at work. I am positioning on the assumption that it is the latter that will shape the world for decades to come. If it is the former, then nothing of consequence will emerge and we will be back to business as usual after 4 years.