The 50% co-payment is on what ah? $350 on 10k seems quite little for a 50% co-payment?

ok to work it out for you

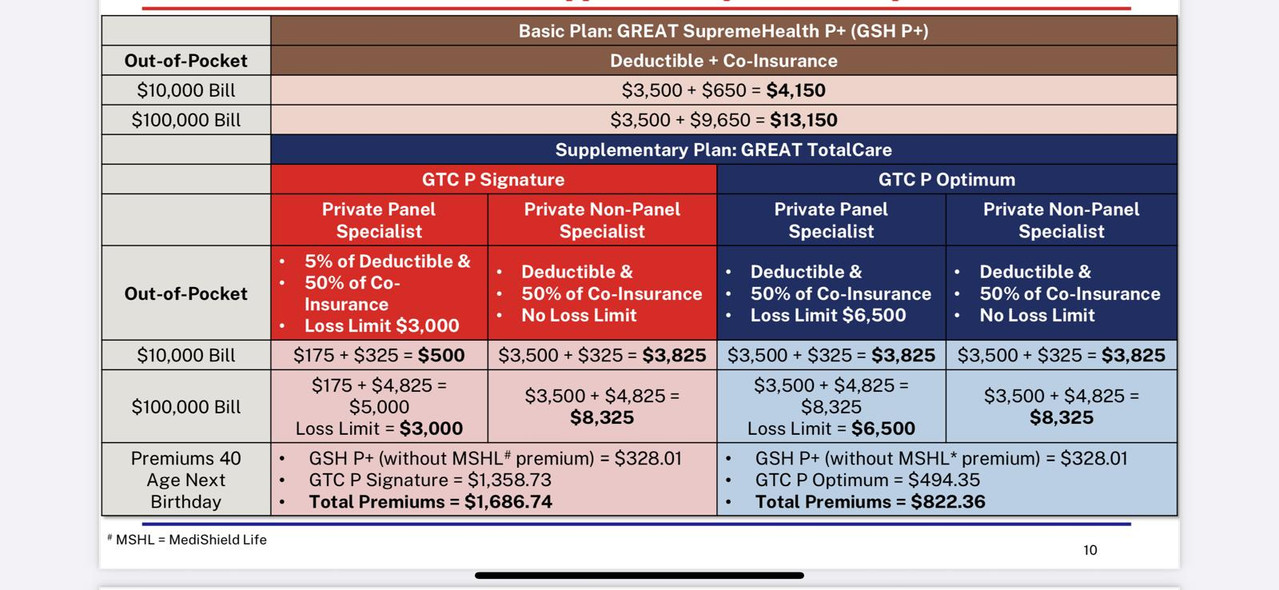

Using $10k bill example:

- Deductible = $3500 (based on what your policy states)

Remainder after deductible = $6500 (10000-3500)

- Co payment (co-insurance) for the Shield Basic plan (private) is 10%. = $650 (10% of 6500)

So normal circumstances without deductible rider, a person will pay $4150 (3500+650)

Based on GTC P Signature

With the rider for panel doctor:

-payable on deductible is 5% of the original (5% of 3500 = $175)

-then 50% of the co-insurance (50% of 650 = 325)

So end up pay $500 vs $4150

*You can work it out for the $100k bill example... just that the rider introduces a total payable cap of $3000

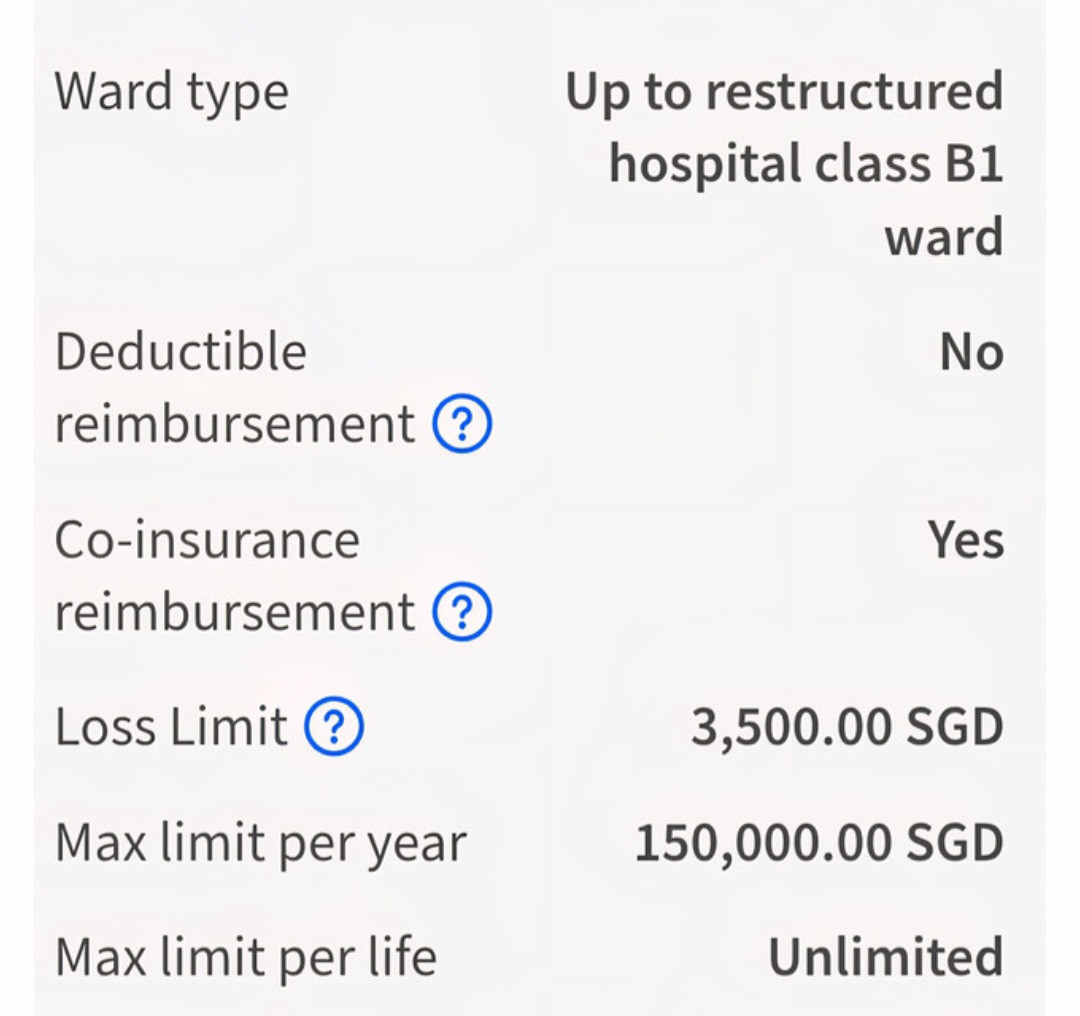

For the one i downgrade to

GTC P Optimum, i'll bare the full deductible and 50% of co-insurance, subject to cap of $6500.... so at least I know if i get something seriously injured or ill, then the bill cap at $6500. (basically this policy is to dissuade claiming for too minor stuff although u can still claim but patient bare more)

And like i mentioned, the Signature will escalate premium if there was a claim. I was told this Optimum wouldn't since policyholder already bearing more risk especially for minor stuff. Anyway I just signed it cosz i got ongoing stuff under investigation. Might downgrade to Govt A next year or later.