That wont affect your div strategy at allso which is better to store div stock long term?

cdp or custodian?

Choose the broker which u love most…

That wont affect your div strategy at allso which is better to store div stock long term?

cdp or custodian?

cdp only for sg stocks.so which is better to store div stock long term?

cdp or custodian?

yes, paidIs the nikko sti etf dividend paid out already?

Agree. I started buying thru third party cos dbs vickers super ex for srs....cdp only for sg stocks.

if you intend to go international, then have to use custodian.

anyway, cdp/custodian shouldn't be a deciding factor when choosing to invest.

my own view only.

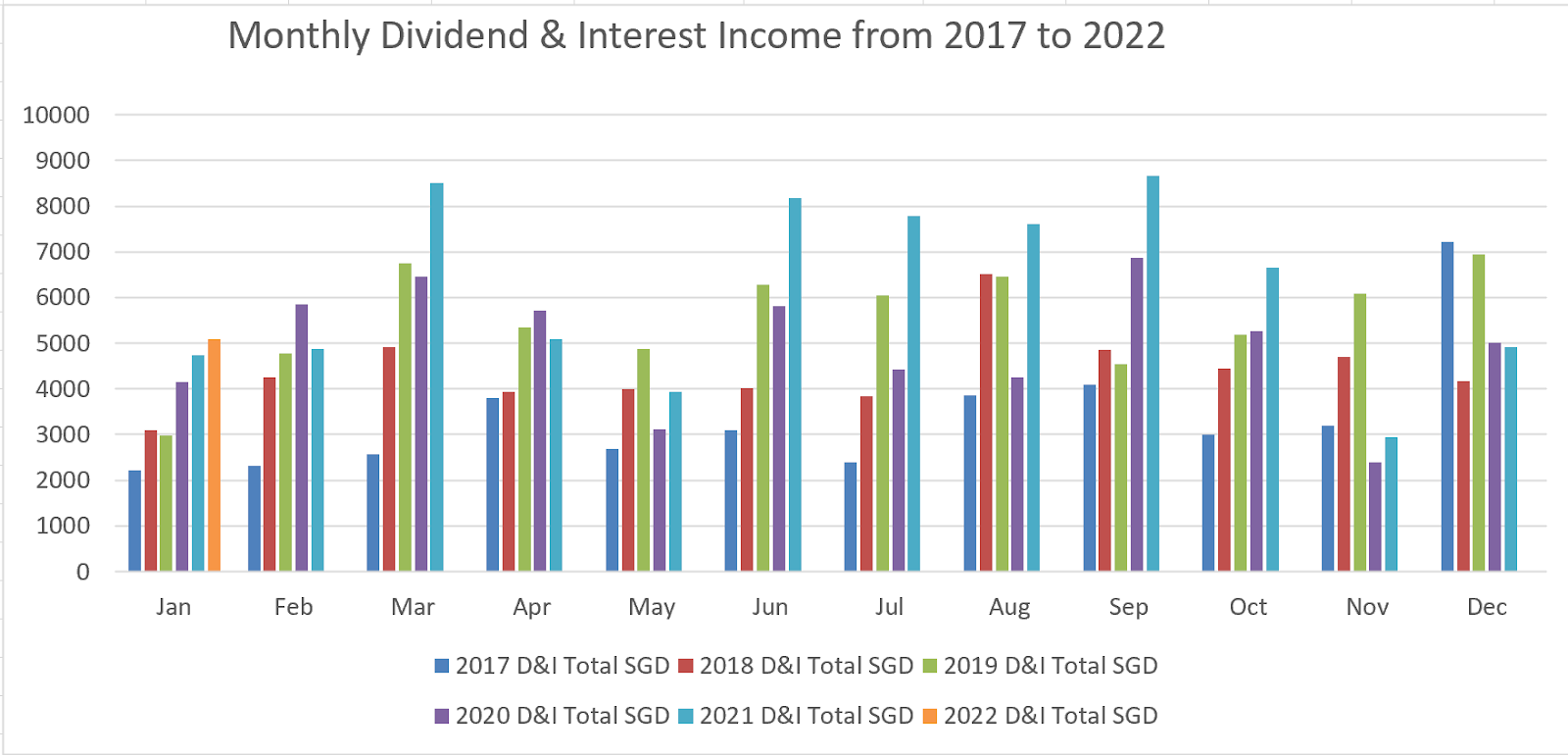

Majority from local REITs ?My dividend income come in like a clockwork every month ..still going on in my 6th years of tracking.

No, I have 47% mainly in LSE/HKSE/US dividend stocks , 27% in SGX Reits and 26% in fixed income(bond/preferred)Majority from local REITs ?

I put "I" as investment grade bondIs I bonds: international bond?

Bonds: sg based bonds?

47+26+27=100%

So all your stks (excld reits) r all dividends stocks?

none r non-div type?

cos u mentioned u have stks 47% non div

There are 2 sti etf, which one you bought?STI ETF dividend is paid out on 25 Feb right? I haven’t received mine that is bought via SRS.

I bought ES3There are 2 sti etf, which one you bought?

Should have received it by now, which brokerage did you use to purchase by srs?I bought ES3