Isn't this just gambling? Why do a synthetic long when you can do a real life actual long? You just wanna gamble why taking on some time limited risk isn't it?

without giving too much credence to the banned bloke, this is a fair question.

Generally you wouldn't: instead of a synthetic long equity (long call/short put, same strike), you'd almost always prefer to go long the underlying cash equity on margin, which gets you to roughly the same place.

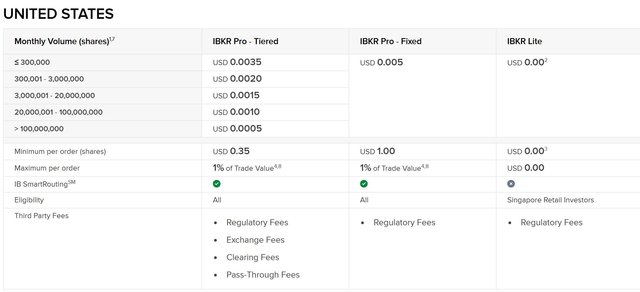

In US equity markets, where margin is cheap and cash equity markets are liquid, you'd usually only get long through the options when you think there's a mispricing (like, the stock is cheaper synthetically through options, or you think the dividend's about to get cut and the market hasn't realized it). If your broker charges a lot for margin, it might also be cheaper to get long through the options and pay the embedded margin cost than to pay your broker's margin cost.

In Indian and Korean equity markets, options are

way more liquid than cash, so you might trade the underlying through options instead.