Can you tell me which day in the last 52weeks was the price of IWDA 38.36?

From here

https://finance.yahoo.com/quote/IWDA.L/

Can you tell me which day in the last 52weeks was the price of IWDA 38.36?

Just google IWDA and see the graph generated by Google finance.

Which would you recommend?

- Sell A35 and use the proceeds to buy MBH

- Keep existing A35 and only buy MBH from here on

- Split the bonds component equally between MBH and A35

Hi Shiny, just wanted to check if you have any experience of is there any with holding tax on Muni Bonds ETF (IIM) and 20 years treasury bonds ETF (TLT) and if it is possible for a singaporean to purchase the USA treaury bonds directly instead of using an ETF.

The missus and I are actually using SSB to put aside our money (a grand a month) for the next 3 - 4 years to save up for our own place. We're only a few months into it. We got it because of the guaranteed capital when we redeem it and a nicer yield, rather than keeping it in our joint bank acct.

Would you recommend us just keeping to pumping money into SSB or get MBH instead?

Hi Shiny,

The MBH seems pretty illiquid...today there is only 1 trade and the trade value is only SGD19k.

The A35 is volume is also very low, only 4 trades, SGD35K.

Is this a concern? thanks

Hi Shiny and all,

How would you compare Vanguard's Index funds vs ETFs (e.g. VWRD/EIMI) ? which is better to invest?

Hello, I cant justify myself that an accumulating etf is better than a distributing etf.

Lmfao. Yeah figured, only banks can do LIBOR (or any. BOR) because they’re.. well.. banks.

Short term treasuries are lookig attractive but apparently in IBKR bond scanner i cant tell normal tbills apart from the zero coupon ones.

Hi Shiny Things,

IWDA is currently at its highest 54.39 and its lowest in the last 52w was 38.36, which seems rather volatile. Why is this counter still highly recommended at this price given its volatility?

What was its trend in the past?

Can we still buy at this price?

Are there any US ETFs that we could consider?

Thanks.

What's the amount to hit before using IB will be cheaper in terms of fees compared to SCB ?

SCB - 0.25%, min USD10

IB - At least USD10/mth

I would assume at least 4k USD / mth before IB starts to get cheaper? But why is it that ST recommended an earlier user who is investing 3k every 3 months to go with IB?

Hi Shiny,

- Muni bonds have no tax; the tradeoff is that the yields are (generally) lower than the headline yields on other bonds.

- TLT is a special case; BBCW has looked at this, and it doesn’t look like they report in a way that makes them exempt from withholding tax. I don’t think it’s appropriate for non-US investors.

- You can, but maintaining your own portfolio instead of just buying an ETF is kind of a pain?

I guess my questions are: why Treasuries in particular, why USD in particular, and why the long end in particular? Unless you have some particular special case for wanting to own those particular parts of the bond market, there’s no good reason not to just put it in LQDA (listed in London); higher yield, no withholding headaches, and a more widely diversified pool of issuers.

Option 2. A35 is a perfectly fine investment, there’s no pressing need to switch out of it, but for future investments you might as well go for MBH. (If you have a big lump of A35, and you seriously care about the extra yield, this may change; but for the vast majority of us, no, it doesn’t matter.)

Which would you recommend?

- Sell A35 and use the proceeds to buy MBH

- Keep existing A35 and only buy MBH from here on

- Split the bonds component equally between MBH and A35

Reminds me of the days (3-4 yrs ago) where funds were buying European banks’ loan books at steep discounts en masse. I think they had to shed their books to comply with Basel III. One DD fund acquired like 1.2b worth of Spanish real estate. Large swaths of land lol.Lol yeah basically; but sometimes there can be an advantage to not being a bank!

Um. Bills are always zero coupon?

I don't believe in having bonds unless you are in the withdrawal phase.Hi

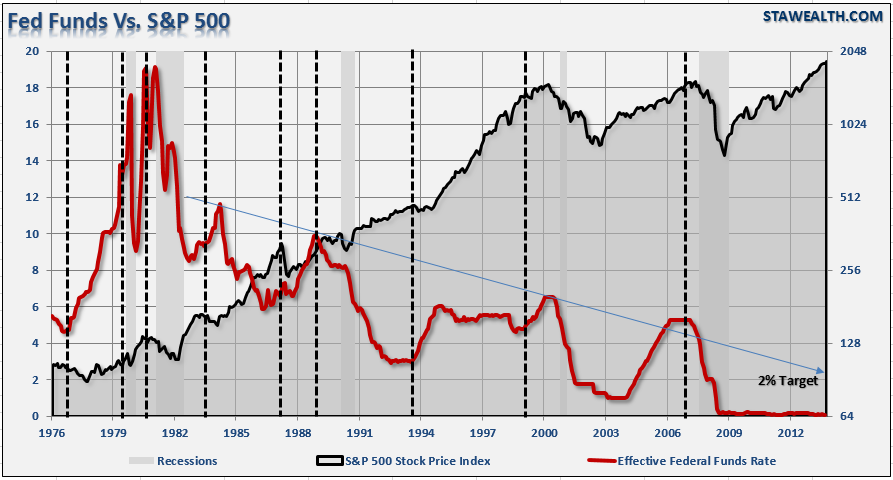

Not sure if this has been answered before but have a question on the logic to buy equities and bonds to protect against downturn.

Understand logic is bonds and equities should move in opposite directions. But in a rising interest rates scenario won’t both bonds and equities fall ..?

what is best investment to get if we expect interest rates to continue to rise ?

Yup they will be paying out dividends.Hi guys ... I'm new to this forum.

Regarding MBH, are they going to pay dividends like A35 or should we just expect higher NAV and accordingly higher market price over time?

Hi

But in a rising interest rates scenario won’t both bonds and equities fall ..?

what is best investment to get if we expect interest rates to continue to rise ?

Hi guys ... I'm new to this forum.

Regarding MBH, are they going to pay dividends like A35 or should we just expect higher NAV and accordingly higher market price over time?

Hi

Not sure if this has been answered before but have a question on the logic to buy equities and bonds to protect against downturn.

Understand logic is bonds and equities should move in opposite directions. But in a rising interest rates scenario won’t both bonds and equities fall ..?

what is best investment to get if we expect interest rates to continue to rise ?

Hi Shiny,

1. Why treasuries in particular? - This interest rate bet is part of my 10% portfolio where I am free to do what I want with the cash, Its like an insurance portfolio where I try to get some hedging against the market against the grain. So now when interest rates are set to rise, the current best bet for me is to buy what is unloved at the moment. kind of like the soothing the itchy fingers portfolio so I will at least limit the losses to 10% instead of my main portfolio.

2. Why the long end in particular ? -I might be wrong on this but the long end might have more upside if the rates goes against the market consensus, just what I thought

3. Why USD in particular ? - I tried doing a PH1S in sgx but it is too illiquid and I would need to pay too much spread to get in.

my current portfolio consists of ES3, VWRL and A35. moving forward, i'm leaning towards MBH for my future bond component.

similarly, IWDA seems a better options for the equities due to the reinvestment of the dividends. as such, will it be better to accumulate IWDA for my future equities or just stick to VWRL. might make things extremely complicated with 2 bond funds and 2 equities ETF when it comes to rebalancing.

ST, care to shed some light?

1) Oh derp, yeah, no worries, I do that as well. Real bond guys would be horrified.Ok I hate this, i always use T bills, notes, bonds interchangeably I now keep mixing things up. What i meant was, it was tough telling them apart in the bond scanner (am i using it wrong).

Do you recommend I just stuff my cash into LQDA and stop trying to be smart?

Understand logic is bonds and equities should move in opposite directions. But in a rising interest rates scenario won’t both bonds and equities fall ..?

what is best investment to get if we expect interest rates to continue to rise ?

They pay dividends. Welcome aboard!Hi guys ... I'm new to this forum.

Regarding MBH, are they going to pay dividends like A35 or should we just expect higher NAV and accordingly higher market price over time?

Just graduated and starting to figure out how to manage my money.

Planning to BTO next year's Nov launch. Just a quick question:

> I'm very very certain that it's safe to put my (our) BTO savings into SSB just to earn that small bit, both for the downpayment as well as the future renovations.

We've decided to put in all our BTO savings into SSB every year or so, and that's including the amount we're setting aside for when the flat is completed and we need to pay for renovations (~4/5 year timeline). That's a sound plan, right?

I'd just like reassurance from anyone who's familiar with such stuff about our plan really.