You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

United Oil IPO targeted at 11 July 2016 (SGX:43P)

- Thread starter Amigogo

- Start date

More options

Who Replied?MrSinkie95

Honorary Member

- Joined

- May 20, 2015

- Messages

- 144,611

- Reaction score

- 1,920

private only right?

Sinkie

Greater Supremacy Member

- Joined

- Jan 20, 2009

- Messages

- 86,040

- Reaction score

- 20

private only right?

Yeah, private and only by invitation

ccostagmont

Great Supremacy Member

- Joined

- Jul 18, 2007

- Messages

- 72,636

- Reaction score

- 3,447

Yeah, private and only by invitation

got lobang?

Yeah, private and only by invitation

Normally, what is the common reason for private invitation only?

MrSinkie95

Honorary Member

- Joined

- May 20, 2015

- Messages

- 144,611

- Reaction score

- 1,920

Not known to public Ma means less marketing..

Sinkie

Greater Supremacy Member

- Joined

- Jan 20, 2009

- Messages

- 86,040

- Reaction score

- 20

http://singapore-ipos.blogspot.sg/2016/07/united-global-limited.html?m=1

Valuation

AP Oil is one of the peer comparison and it is currently trading at historical PER of around 9.4x PE. While UGL seemed attractively priced at historical PER of 8.3x. Assuming it trades up to that of its peers, this will mean a price of around 28 cents. However given the lower guidance for FY2016, if it trades based on forward PER, then UGL is likely to be worth less than its IPO price of 25 cents

My Chilli ratings

Since there is no public tranche, my IPO ratings is probably meaningless. While the Company is established with some nice tie up with CNOOC, it is probably too early to tell if that will work out. However, i don't like the potential conflicts arising from related party transactions, lack of dividend guidance and the FY2016 profit guidance.

Given the small float of 42.8m shares, it is also not difficult to place out the shares to friends and family of the founding family. I would expect the shares to be tightly controlled and likely to open above its IPO price if market sentiments continue to improve next week.

How it perform over the longer term will depend on how the tie up with CNOOC works out and whether the Related Party transactions is a non issue.

Based on the reasons above, I will give it a one chilli rating. Do note that I am vested.

Happy Oiling

Valuation

AP Oil is one of the peer comparison and it is currently trading at historical PER of around 9.4x PE. While UGL seemed attractively priced at historical PER of 8.3x. Assuming it trades up to that of its peers, this will mean a price of around 28 cents. However given the lower guidance for FY2016, if it trades based on forward PER, then UGL is likely to be worth less than its IPO price of 25 cents

My Chilli ratings

Since there is no public tranche, my IPO ratings is probably meaningless. While the Company is established with some nice tie up with CNOOC, it is probably too early to tell if that will work out. However, i don't like the potential conflicts arising from related party transactions, lack of dividend guidance and the FY2016 profit guidance.

Given the small float of 42.8m shares, it is also not difficult to place out the shares to friends and family of the founding family. I would expect the shares to be tightly controlled and likely to open above its IPO price if market sentiments continue to improve next week.

How it perform over the longer term will depend on how the tie up with CNOOC works out and whether the Related Party transactions is a non issue.

Based on the reasons above, I will give it a one chilli rating. Do note that I am vested.

Happy Oiling

ccostagmont

Great Supremacy Member

- Joined

- Jul 18, 2007

- Messages

- 72,636

- Reaction score

- 3,447

http://singapore-ipos.blogspot.sg/2016/07/united-global-limited.html?m=1

Valuation

AP Oil is one of the peer comparison and it is currently trading at historical PER of around 9.4x PE. While UGL seemed attractively priced at historical PER of 8.3x. Assuming it trades up to that of its peers, this will mean a price of around 28 cents. However given the lower guidance for FY2016, if it trades based on forward PER, then UGL is likely to be worth less than its IPO price of 25 cents

My Chilli ratings

Since there is no public tranche, my IPO ratings is probably meaningless. While the Company is established with some nice tie up with CNOOC, it is probably too early to tell if that will work out. However, i don't like the potential conflicts arising from related party transactions, lack of dividend guidance and the FY2016 profit guidance.

Given the small float of 42.8m shares, it is also not difficult to place out the shares to friends and family of the founding family. I would expect the shares to be tightly controlled and likely to open above its IPO price if market sentiments continue to improve next week.

How it perform over the longer term will depend on how the tie up with CNOOC works out and whether the Related Party transactions is a non issue.

Based on the reasons above, I will give it a one chilli rating. Do note that I am vested.

Happy Oiling

everything secretive ****...

how mripo get placement???

MrSinkie95

Honorary Member

- Joined

- May 20, 2015

- Messages

- 144,611

- Reaction score

- 1,920

He hnw one...

everything secretive ****...

how mripo get placement???

sherman1213

Senior Member

- Joined

- May 19, 2016

- Messages

- 1,152

- Reaction score

- 0

everything secretive ****...

how mripo get placement???

his remiser bah

heard lim and tan and cimb also have

admin, can turn this to official thread?

Sinkie

Greater Supremacy Member

- Joined

- Jan 20, 2009

- Messages

- 86,040

- Reaction score

- 20

http://www.theedgemarkets.com/sg/ar...tes-placement-new-shares-raise-92-million-ipo

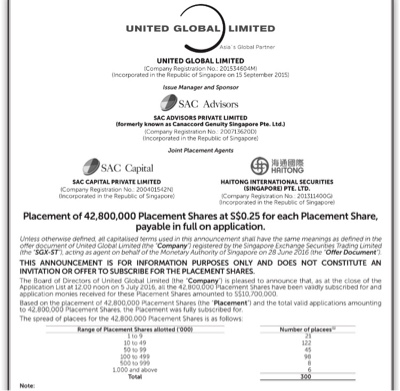

SINGAPORE (July 7): Lubricant manufacturer and trader United Global announced that its initial public offering of 42.8 million new shares has been successfully placed out.

Each share was priced at 25 cents, according to a press release issued on Thursday.

(See: 8 reasons to like United Global’s Catalist listing)

Following completion of the shares placement, United Global’s market capitalisation stands at $70.7 million with a total issued share capital of 282.8 million shares.

Of the net proceeds of $9.2 million, $7.4 million will be used for business expansion through investments, acquisitions and strategic alliances, while the remaining $1.8 million will be used for general working capital, including expanding into new and existing geographical markets.

“We will work towards our business expansion plans as well as developing new markets in Asia Pacific,” says Jacky Tan, United Global’s Executive Director and CEO.

United Global will debut on Catalist on Friday.

SINGAPORE (July 7): Lubricant manufacturer and trader United Global announced that its initial public offering of 42.8 million new shares has been successfully placed out.

Each share was priced at 25 cents, according to a press release issued on Thursday.

(See: 8 reasons to like United Global’s Catalist listing)

Following completion of the shares placement, United Global’s market capitalisation stands at $70.7 million with a total issued share capital of 282.8 million shares.

Of the net proceeds of $9.2 million, $7.4 million will be used for business expansion through investments, acquisitions and strategic alliances, while the remaining $1.8 million will be used for general working capital, including expanding into new and existing geographical markets.

“We will work towards our business expansion plans as well as developing new markets in Asia Pacific,” says Jacky Tan, United Global’s Executive Director and CEO.

United Global will debut on Catalist on Friday.

Sinkie

Greater Supremacy Member

- Joined

- Jan 20, 2009

- Messages

- 86,040

- Reaction score

- 20

http://www.theedgemarkets.com/sg/article/8-reasons-united-global’s-catalist-listing

INGAPORE (July 5): United Global, the lubricant maker and trader for the automotive, industrial and marine industries, is expected to be listed on the Catalist board on Friday.

The company is raising some $10.7 million in its IPO, with 42.8 million new shares at 25 cents each. That is nearly seven times the group’s earnings per share of 3.6 cents for FY15 ended Dec 2015.

(See United Global to sell 42.8 mil new shares at 25 cents each in IPO)

According to a DBS Vickers Security report on Monday, the global lubricant market is projected to grow to 43.87 million tonnes by 2022, at an estimated compound annual growth rate of 2.4%.

High demand from automotive, industrial machinery and construction sectors are expected to drive the industry’s growth over the forecast period.

World demand for lubricants is expected to rise 2.0% yearly through 2019, and the fastest gains are expected in the Asia-Pacific region, DBS adds.

Here are 8 reasons why United Global is worth a look:

1) Established track record

United Global has established a reputation as a reliable and responsive service provider in the lubricants industry.

The company’s subsidiary, United Oil Company, started business back in 1999 and has built up a portfolio of lubricants under its own brands – United Oil, U Star Lube, Bell1 and HydroPure – as well as those belonging other third-party principals.

It has grown to be known for its growth, reliability and profitability, and is registered with the American Petroleum Institute, an internationally recognised institute for standards of quality for lubricants.

2) Quality products and services

United Global has an in-house laboratory, complete with its own team of chemists to ensure a high and consistent standard of product quality, as well as equipment to carry out tests.

3) Diverse product portfolio

On top of manufacturing and trading in lubricants, United Global also provides a wide range of high quality, well-engineered products and value-added services, including assisting in certification processes, designing of packaging material and storing of lubricants.

4) Global network

United Global has an extensive network of distributors and a diverse geographical network that provides support for long-term growth.

The company now sells to more than 30 countries, with customers coming from automotive, industrial and marine applications as well as metal working fluids. In 2015, more than 88% of its total sales were derived from outside Singapore.

5) Well-established business relationships

More than 80% of United Global’s FY2015 revenue came from repeat customers. The company also enjoys long-standing relationships with suppliers and distributors.

6) Expansion, diversification, M&A, and JVs

United Global said it may explore mergers and acquisitions, joint ventures, and/or strategic alliances that complement its operations.

The company looks to expand and diversify business through potential acquisitions and joint ventures that will provide synergistic value to existing business.

7) Adapt to competitive landscape

Company is committed to keep up with developments in the lubricants industry through research and development.

This is particularly important as United Global is exposed to fluctuations in base oil prices and costs of raw materials, and shortages in the supply of base oils. It is also dependent on the growth and outlook of multiple sectors, and is indirectly exposed to the uncertainties and business fluctuations of these sectors.

8) Expand into new markets; entrench presence in existing markets

United Global has the potential to expand into new markets and increase its presence in existing markets, through the entry into distributorship agreements and exploring possible collaboration opportunities in Myanmar and Bangladesh.

“In the years ahead, we will keep abreast of new developments in the lubricant industry, as well as expand into new markets, particularly exploring collaboration opportunities in developing countries,” says executive director and CEO Jacky Tan, in a statement on June 13 when the company lodged its preliminary offer document for the Catalist listing.

(See Lubricant maker United Global plans Catalist IPO)

INGAPORE (July 5): United Global, the lubricant maker and trader for the automotive, industrial and marine industries, is expected to be listed on the Catalist board on Friday.

The company is raising some $10.7 million in its IPO, with 42.8 million new shares at 25 cents each. That is nearly seven times the group’s earnings per share of 3.6 cents for FY15 ended Dec 2015.

(See United Global to sell 42.8 mil new shares at 25 cents each in IPO)

According to a DBS Vickers Security report on Monday, the global lubricant market is projected to grow to 43.87 million tonnes by 2022, at an estimated compound annual growth rate of 2.4%.

High demand from automotive, industrial machinery and construction sectors are expected to drive the industry’s growth over the forecast period.

World demand for lubricants is expected to rise 2.0% yearly through 2019, and the fastest gains are expected in the Asia-Pacific region, DBS adds.

Here are 8 reasons why United Global is worth a look:

1) Established track record

United Global has established a reputation as a reliable and responsive service provider in the lubricants industry.

The company’s subsidiary, United Oil Company, started business back in 1999 and has built up a portfolio of lubricants under its own brands – United Oil, U Star Lube, Bell1 and HydroPure – as well as those belonging other third-party principals.

It has grown to be known for its growth, reliability and profitability, and is registered with the American Petroleum Institute, an internationally recognised institute for standards of quality for lubricants.

2) Quality products and services

United Global has an in-house laboratory, complete with its own team of chemists to ensure a high and consistent standard of product quality, as well as equipment to carry out tests.

3) Diverse product portfolio

On top of manufacturing and trading in lubricants, United Global also provides a wide range of high quality, well-engineered products and value-added services, including assisting in certification processes, designing of packaging material and storing of lubricants.

4) Global network

United Global has an extensive network of distributors and a diverse geographical network that provides support for long-term growth.

The company now sells to more than 30 countries, with customers coming from automotive, industrial and marine applications as well as metal working fluids. In 2015, more than 88% of its total sales were derived from outside Singapore.

5) Well-established business relationships

More than 80% of United Global’s FY2015 revenue came from repeat customers. The company also enjoys long-standing relationships with suppliers and distributors.

6) Expansion, diversification, M&A, and JVs

United Global said it may explore mergers and acquisitions, joint ventures, and/or strategic alliances that complement its operations.

The company looks to expand and diversify business through potential acquisitions and joint ventures that will provide synergistic value to existing business.

7) Adapt to competitive landscape

Company is committed to keep up with developments in the lubricants industry through research and development.

This is particularly important as United Global is exposed to fluctuations in base oil prices and costs of raw materials, and shortages in the supply of base oils. It is also dependent on the growth and outlook of multiple sectors, and is indirectly exposed to the uncertainties and business fluctuations of these sectors.

8) Expand into new markets; entrench presence in existing markets

United Global has the potential to expand into new markets and increase its presence in existing markets, through the entry into distributorship agreements and exploring possible collaboration opportunities in Myanmar and Bangladesh.

“In the years ahead, we will keep abreast of new developments in the lubricant industry, as well as expand into new markets, particularly exploring collaboration opportunities in developing countries,” says executive director and CEO Jacky Tan, in a statement on June 13 when the company lodged its preliminary offer document for the Catalist listing.

(See Lubricant maker United Global plans Catalist IPO)

Sinkie

Greater Supremacy Member

- Joined

- Jan 20, 2009

- Messages

- 86,040

- Reaction score

- 20

tml ipo lo, any butties press ?

Private placement how to press?? Questions is gonna open what price

Amigogo

Master Member

- Joined

- Nov 20, 2006

- Messages

- 3,716

- Reaction score

- 0

Private placement how to press?? Questions is gonna open what price

open at 25c?

Sinkie

Greater Supremacy Member

- Joined

- Jan 20, 2009

- Messages

- 86,040

- Reaction score

- 20

open at 25c?

ipo price is 0.25, open 0.25, waste time sia ! lol !

Important Forum Advisory Note

This forum is moderated by volunteer moderators who will react only to members' feedback on posts. Moderators are not employees or representatives of HWZ. Forum members and moderators are responsible for their own posts.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.