Euqorab

Arch-Supremacy Member

- Joined

- Jul 8, 2001

- Messages

- 24,020

- Reaction score

- 4,212

Nice!My XLV finally one big green candle.

What other ETFs do u buy?

Nice!My XLV finally one big green candle.

I am thinking of ETFs line finallyNice!

What other ETFs do u buy?

I thought last round you said you sold everything?My XLV finally one big green candle.

Alamak, you sold all then now come back higher price. AiyoI am thinking of ETFs line finally

If etf will be dca hence don’t matter to me lolAlamak, you sold all then now come back higher price. Aiyo

pls quote....don't anyhowI thought last round you said you sold everything?

Anthropic is likely to give AWS a boost in the coming quarters.Your BTD is validated by Shay Baloor.

If Amazon today drop 218 or below, I might just deploy my remaining few thousand to average downAnthropic is likely to give AWS a boost in the coming quarters.

Good plan, my friend. I nibbled a little at 219 yesterday.If Amazon today drop 218 or below, I might just deploy my remaining few thousand to average down

Now my unit price 228

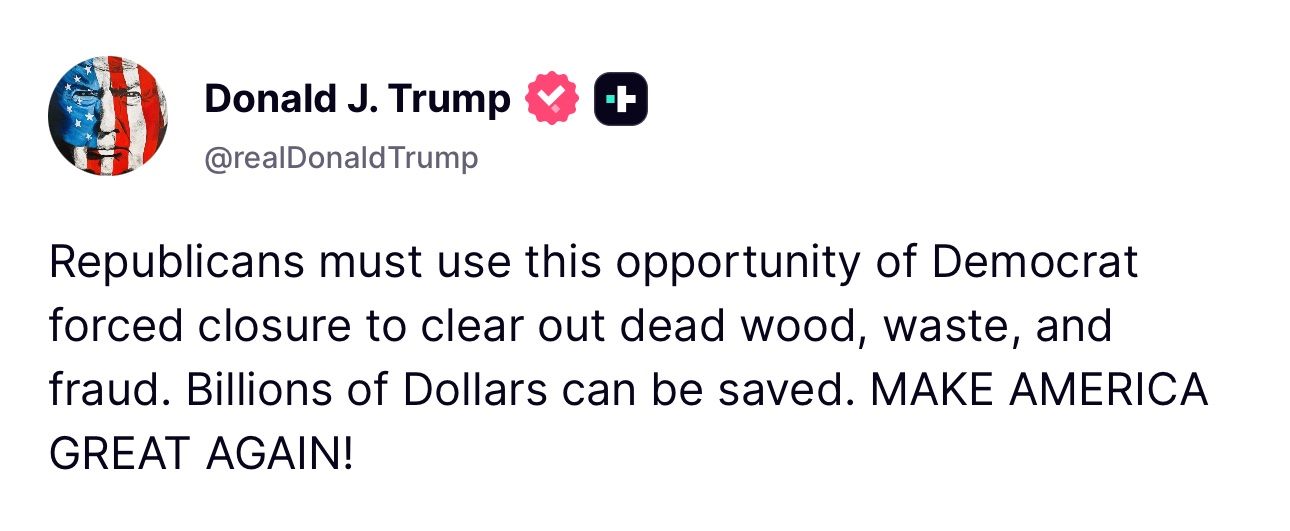

Likely like XJP. Flush out oppositions. Haha! Then ownself put ownself ppl and huat big big. Short term, xiaolang Trump will cause pain to the stock market.If the govt shutdown succeeds in getting DOGE 2.0, yields on UST will crater. REITS will do very well.

How can it be huh? Tio Jiak or software glitch? But if convert in 2050, i am not surprised left only left $1000From Jan (Deepseek) till now, my US profit near 3000 USD

But if I convert all my USD to SGD, profit is less than 2500 SGD

Wah lao leh! USD got so weak meh?