You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

YTD 2025 Networth tracking thread

- Thread starter revhappy

- Start date

More options

Who Replied?earlier you posted that since Goldman Sach says there will be a consumer recession, we should inverse goldman sachs and go long.Inverse the news principle.

Opp of soft = HARD.

Clock is ticking.

now you say that news says there is a consumer soft landing, we should inverse and prepare for consumer recession?

most people already know long ago that financial news like cnbc will have one article say no recession and one article saying got recession, so cnbc will can never be wrong, but it also means that such posts are only 'noise'.

Last edited:

For those in early years of accumulation, porftolio down better leh…..bestest to DcA during a lost decade

True, I was lucky to start investing "seriously" around the time of the GFC, so I could buy stocks at a discount.

After that, not many good sales until 2016 and then 2020. Between GFC and 2016, I focused mainly on paying off my housing loan.

DevilPlate

Arch-Supremacy Member

- Joined

- Nov 22, 2020

- Messages

- 12,143

- Reaction score

- 5,118

Yea, the year we born do matter in life as well....True, I was lucky to start investing "seriously" around the time of the GFC, so I could buy stocks at a discount.

After that, not many good sales until 2016 and then 2020. Between GFC and 2016, I focused mainly on paying off my housing loan.

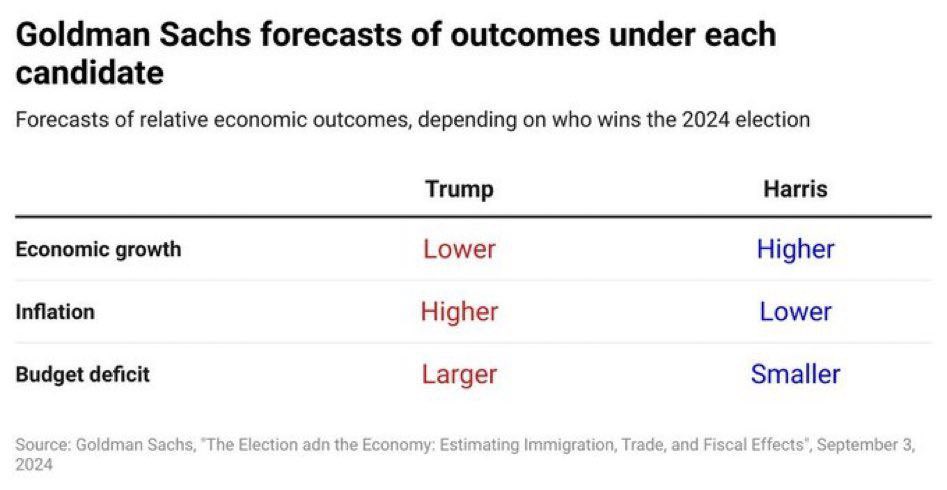

You are referring to the previous GS/JPM forecast back in early Sept:earlier you posted that since Goldman Sach says there will be a consumer recession, we should inverse goldman sachs and go long.

now you say that news says there is a consumer soft landing, we should inverse and prepare for consumer recession?

most people already know long ago that financial news like cnbc will have one article say no recession and one article saying got recession, so cnbc will can never be wrong, but it also means that such posts are only 'noise'.

which basically means Fed will cut rates to try to counter the consumer recession, thus acting to counter against the recession. That's what was meant by inversing.... what is feared will be countered by Fed to prevent from happening.Inverse Goldman Sachs to get the real result.

Inverse JPM as well.

https://finance.yahoo.com/news/ceo-jpmorgan-warns-us-economic-205558688.html

Conclusion: Recession in 2025 may be postponed according to these inverse results.

Reason: Fed regularly collects feedback from big banks like GS and JPM. So these big banks do influence Fed actions.

However, I still think there will be a big market pullback not due to full-blown recession but bad numbers from BLS causing algos to flip bearish (i.e. severe recession scare narrative).

That was on Sept 10. So Fed then cut rates by surprise 50bps (expected 25bps only) on Sept 18 FOMC.

XLY etf (Consumer Discretionary: composition AMZN 22%, TSLA 14%, HD 18%, BKNG 4%, MCD 4%, LOW 4%) is up +8.5% (outperforming SP500 +5%) from 9 Sept till 1 Nov.

This latest CNN news is at the end of Oct, nearly two months later.

So sell XLY, book the profits. That's basically what I am inferring here. This action is basically inverse this latest CNN news.

What do you think?

I don't trust GS at all, and biz news journalist report history only, not the future!

Last edited:

Now onto the subject of US elections, and what happens after that.earlier you posted that since Goldman Sach says there will be a consumer recession, we should inverse goldman sachs and go long.

now you say that news says there is a consumer soft landing, we should inverse and prepare for consumer recession?

most people already know long ago that financial news like cnbc will have one article say no recession and one article saying got recession, so cnbc will can never be wrong, but it also means that such posts are only 'noise'.

Elon Musk joined Trump's campaign officially in July, and started his DOGE idea (Dept of Govt Efficiency) on Sept 6th to slash Federal deficit by $2T.

This is brand new info I didn't know until recently. I think this will cause a sharp recession if executed properly. This also wasn't factored into the GS forecast on Sept 3, so the DOGE needs to be evaluated separately.

But then I expect the reaction from the Fed will be to keep cutting rates throughout 2025 (as mentioned earlier, they did start with a surprise 50bps in Sept FOMC), maybe faster than expected if things go real bad midway in 2025.

Last edited:

Mephist0pheLes

Supremacy Member

- Joined

- Mar 26, 2014

- Messages

- 8,897

- Reaction score

- 6,979

sharp unemployment maybe, but sharp recession?Now onto the subject of US elections, and what happens after that.

Elon Musk joined Trump's campaign officially in July, and started his DOGE idea (Dept of Govt Efficiency) on Sept 6th to slash Federal deficit by $2T.

This is brand new info I didn't know until recently. I think this will cause a sharp recession if executed properly. This also wasn't factored into the GS forecast on Sept 3, so the DOGE needs to be evaluated separately.

But then I expect the reaction from the Fed will be to keep cutting rates throughout 2025 (as mentioned earlier, they did start with a surprise 50bps in Sept FOMC), maybe faster than expected if things go real bad midway in 2025.

firstly, govt bureaucracy dont generate revenue, so i dun see how it would have significant impact on GDP.

2ndly, DOGE is aimed at cutting bureaucratic inefficiency, so if executed properly, it sld cut biz cost and improve productivity.

DevilPlate

Arch-Supremacy Member

- Joined

- Nov 22, 2020

- Messages

- 12,143

- Reaction score

- 5,118

Elon Musk and Trump both shrewd businessman so i dont think they will do smthing stupid to manufacture a recession.Now onto the subject of US elections, and what happens after that.

Elon Musk joined Trump's campaign officially in July, and started his DOGE idea (Dept of Govt Efficiency) on Sept 6th to slash Federal deficit by $2T.

This is brand new info I didn't know until recently. I think this will cause a sharp recession if executed properly. This also wasn't factored into the GS forecast on Sept 3, so the DOGE needs to be evaluated separately.

But then I expect the reaction from the Fed will be to keep cutting rates throughout 2025 (as mentioned earlier, they did start with a surprise 50bps in Sept FOMC), maybe faster than expected if things go real bad midway in 2025.

Elon Musk joined Trump's campaign officially in July, and started his DOGE idea (Dept of Govt Efficiency) on Sept 6th to slash Federal deficit by $2T.

This is brand new info I didn't know until recently. I think this will cause a sharp recession if executed properly. This also wasn't factored into the GS forecast on Sept 3, so the DOGE needs to be evaluated separately.

Did you read any of the comments on the $2T cut? If not, you can read some of them at the below link.

https://www.washingtonpost.com/business/2024/10/29/elon-musk-2-trillion-budget-cuts-trump-election/

Euqorab

Arch-Supremacy Member

- Joined

- Jul 8, 2001

- Messages

- 24,051

- Reaction score

- 4,220

They wil affect my networksthis is wrong thread for discussion about trump and elon musk. this thread is to share your networth / networth gains in 2024 YTD.....

The doomsayers are too smart for their good.

If the market crash, they will predict an even bigger crash.

As always, too many analysis but NO action.

I wonder where are they now.

I am quite happy with my ytd.

2 months to go, if I can push it over 200%, I will have 2 girls at a time.

YTD 188% LOL

It's glorious.

Unlike in 2021, this time I aggressively take profit.

188% definitely a good idea to take some profit, treat yourself to something nice.YTD 188% LOL

It's glorious.

Unlike in 2021, this time I aggressively take profit.

at the end of the day, the bulls earn more money than the bears

My portfolio paper gain increase by $300k just last week alone.

sibei scary... got 2 days is $100k per day.

is this market top liao?

Perhaps. Things are wild.

Time in the market bla2x is proven right again, and all the "smart" doomsayers got b*tch slapped into oblivion again.

They have gone quiet, hiding in shame, so I am selling. When they're noisy again, I am buying.

DevilPlate

Arch-Supremacy Member

- Joined

- Nov 22, 2020

- Messages

- 12,143

- Reaction score

- 5,118

Still waiting for BTC to hit 88k first then 99kMy portfolio paper gain increase by $300k just last week alone.

sibei scary... got 2 days is $100k per day.

is this market top liao?

Perhaps. Things are wild.

Time in the market bla2x is proven right again, and all the "smart" doomsayers got b*tch slapped into oblivion again.

They have gone quiet, hiding in shame, so I am selling. When they're noisy again, I am buying.

Also, can someone please request a wellness check for the bears and sideliners?

I am sure that they're super heartbroken now.

Such suffering so much WOW

The high price of being too "smart".

Mephist0pheLes

Supremacy Member

- Joined

- Mar 26, 2014

- Messages

- 8,897

- Reaction score

- 6,979

dont worry about them lah, they probably think every ATH is a bubble and they are "smart" for staying out of it.Also, can someone please request a wellness check for the bears and sideliners?

I am sure that they're super heartbroken now.

Such suffering so much WOW

The high price of being too "smart".

Important Forum Advisory Note

This forum is moderated by volunteer moderators who will react only to members' feedback on posts. Moderators are not employees or representatives of HWZ. Forum members and moderators are responsible for their own posts.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.