But to me just like a repackgg of Ari from (Global ARI has )11 different risk levels ranging from 5% downside risk to 25% downside risk. To 3 risk level now....by adding 2k more stocks which could be totally similar eg kweb v msci......is “more” really better? I believe less is More!

In short, just trying to increase mkt share- for syfe!

Gd for those who hve not diy into their own china’s etf or the existing popular robo’s options

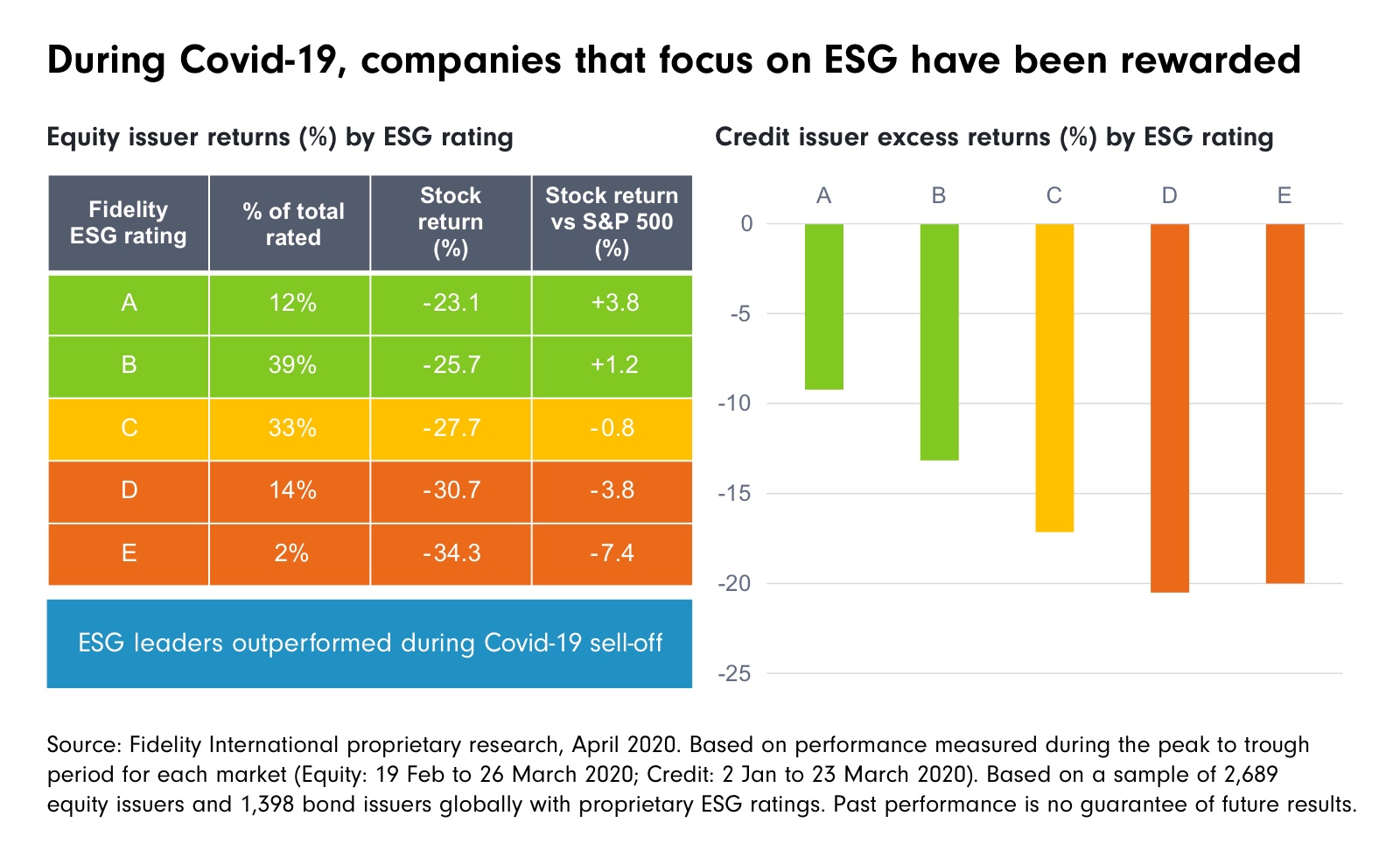

If talking abt long term fi planning, it should be on Esg and esg....it not zoom in on particular mkts u wanna to focus on

In short, just trying to increase mkt share- for syfe!

Gd for those who hve not diy into their own china’s etf or the existing popular robo’s options

If talking abt long term fi planning, it should be on Esg and esg....it not zoom in on particular mkts u wanna to focus on

So looks like syfe core is to address those who dont want ARI but prefer more static allocation

So is it gd? Didnt really read. Where does it rank among all the robo offerings

https://www.syfe.com/magazine/understanding-our-core-portfolio-strategy/

Last edited:

typical ah neh style

typical ah neh style