elvintay07

Arch-Supremacy Member

- Joined

- Jan 4, 2022

- Messages

- 12,231

- Reaction score

- 4,377

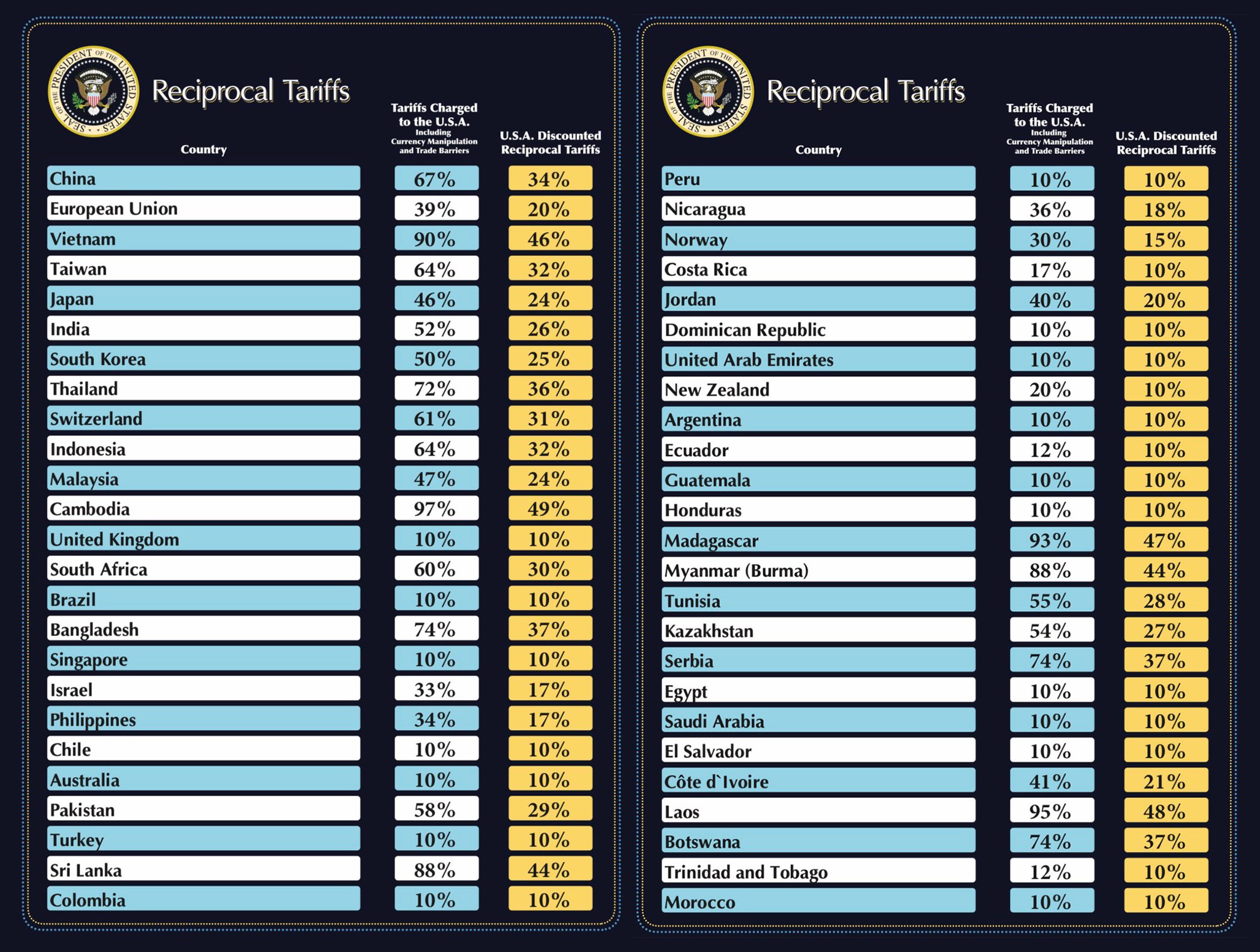

Countries like China, Canada, European Unions also have high tariffs for US goods. Why not US cannot tariff them back? I think trump got hard balls. Which US president halted funding to WHO? Only Trump got the balls to do that.Global economy is far bigger than the US economy, no country can afford to fight trade war with the whole world.

See whether HK, Europe or US market better, lol!