Hopefully it is. Then every where else can increase in price hahaAfter today’s Orie sales, developer will feel confident to price high. I would expect average price to be $2400psf! Which is crazy for Tampines if you asked anyone 12 months ago!!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Parktown Residence

- Thread starter youskevitch

- Start date

More options

Who Replied?After today’s Orie sales, developer will feel confident to price high. I would expect average price to be $2400psf! Which is crazy for Tampines if you asked anyone 12 months ago!!

I don't think it is crazy, you have to look back to the past few launches in the east.

E.g, at the time when all the condos were selling at 1.3-1.5k PSF, Pasir Ris 8 hit 2k PSF on launch day for certain stacks.

The last 2 EC launches in Tampines, Parc Central and Tenet, on launch, were the most expensive EC compared to the competitors, they were almost completely sold during first 2 months (after 2nd timer limitation lifted).

Big plot Treasure also performed very well despite all the issues like block to block proximity, single land road etc. I used to stay in Tampines, all my primary school friends bought resale there still, if you ask people in Tampines if they want to move Simei / Tanah Merah / Bedok / Eunos, they will likely say no. To them, such places are not an upgrade vs staying in Tampines. Tampines doesn't feel dense despite it being one of the largest residential estate.

Its different from people staying in SK/Punggol/HG, you tell them move to Serangoon/woodleigh/potong pasir/boon keng they will see it as an upgrade because of the proximity to town.

I don't think it is crazy, you have to look back to the past few launches in the east.

E.g, at the time when all the condos were selling at 1.3-1.5k PSF, Pasir Ris 8 hit 2k PSF on launch day for certain stacks.

The last 2 EC launches in Tampines, Parc Central and Tenet, on launch, were the most expensive EC compared to the competitors, they were almost completely sold during first 2 months (after 2nd timer limitation lifted).

Big plot Treasure also performed very well despite all the issues like block to block proximity, single land road etc. I used to stay in Tampines, all my primary school friends bought resale there still, if you ask people in Tampines if they want to move Simei / Tanah Merah / Bedok / Eunos, they will likely say no. To them, such places are not an upgrade vs staying in Tampines. Tampines doesn't feel dense despite it being one of the largest residential estate.

Its different from people staying in SK/Punggol/HG, you tell them move to Serangoon/woodleigh/potong pasir/boon keng they will see it as an upgrade because of the proximity to town.

Agree with most of what you said, esp the parts on Tampines being a choice estate for those who have lived here in their younger years (studied here), and I have the same sentiments that it is likely tampines people do not really find moving to another eastern area (bedok, simei, pasir ris) a significant upgrade of lifestyle/location, unless you are talking about maybe district 15 (katong, marine parade side).

And yes particularly those residing in the Sengkang/Punggol (further northeast) estates, it is very likely moving to almost any areas of singapore comes across as an upgrade to them. I cannot really explain why, but let me try based on my own observations:

1) Psychological feeling that when moving anywhere else, one would be nearer to central areas although technically could be the same distance/travel time.

2) The MOP effect for BTOs at the relatively younger NE estates are very real and frequently encountered. You hear of people moving almost all the time, including your own neighbours start saying goodbyes and conversations even go to comparing profit from selling after MOP and try outprice the record if they can . Don't be surprised if you are the one of the few remaining or only unit at your level left as many first time owners move between 5 to 10 years timeframe. However, i do not assume all move out entirely from NE areas, I'm sure many would still choose to move but still remain within the same estate.

3) Overcrowding and relatively higher prices (food for one) at NE estates are also increasingly in the mindset of people staying here, esp Sengkang/Punggol. They are pricier than other mature heartlands and people form this opinion very quickly. I have also lost count of people saying that childcare services is very competitive and many a time, I have heard of parents having to travel further to secure a childcare slot and even outside of the estate they reside in. This may have started young couples on the wrong note and they tend to think that overcrowding would only worsen and impact their child's future schooling needs too. They rather take the plunge to venture out into a more mature estate and they think they have nothing to lose, more to gain with better/more amenities, less competition for space/services, cash out from their bto, list goes on.

Agree with most of what you said, esp the parts on Tampines being a choice estate for those who have lived here in their younger years (studied here), and I have the same sentiments that it is likely tampines people do not really find moving to another eastern area (bedok, simei, pasir ris) a significant upgrade of lifestyle/location, unless you are talking about maybe district 15 (katong, marine parade side).

And yes particularly those residing in the Sengkang/Punggol (further northeast) estates, it is very likely moving to almost any areas of singapore comes across as an upgrade to them. I cannot really explain why, but let me try based on my own observations:

1) Psychological feeling that when moving anywhere else, one would be nearer to central areas although technically could be the same distance/travel time.

2) The MOP effect for BTOs at the relatively younger NE estates are very real and frequently encountered. You hear of people moving almost all the time, including your own neighbours start saying goodbyes and conversations even go to comparing profit from selling after MOP and try outprice the record if they can . Don't be surprised if you are the one of the few remaining or only unit at your level left as many first time owners move between 5 to 10 years timeframe. However, i do not assume all move out entirely from NE areas, I'm sure many would still choose to move but still remain within the same estate.

3) Overcrowding and relatively higher prices (food for one) at NE estates are also increasingly in the mindset of people staying here, esp Sengkang/Punggol. They are pricier than other mature heartlands and people form this opinion very quickly. I have also lost count of people saying that childcare services is very competitive and many a time, I have heard of parents having to travel further to secure a childcare slot and even outside of the estate they reside in. This may have started young couples on the wrong note and they tend to think that overcrowding would only worsen and impact their child's future schooling needs too. They rather take the plunge to venture out into a more mature estate and they think they have nothing to lose, more to gain with better/more amenities, less competition for space/services, cash out from their bto, list goes on.

I feel that Tampines is neither less crowded than Sengkang / Punggol, nor significantly more central haha.

DevilPlate

Arch-Supremacy Member

- Joined

- Nov 22, 2020

- Messages

- 12,216

- Reaction score

- 5,146

If let say Watertown is launched TODAY, it is gona be roughly the same pricing as PTR (23xxpsf)

jeffong

Senior Member

- Joined

- Jan 1, 2000

- Messages

- 2,199

- Reaction score

- 1,255

Having reviewed through the floor plans for PTR, overall seems okay leh and the key question is more on entry pricing. However I have always considered Tampines no different than all their ulu cousins such as Punggol, Jurong, Yishun. This project though have the TC vibe where facilities are split across two sides accessible via bridges.If let say Watertown is launched TODAY, it is gona be roughly the same pricing as PTR (23xxpsf)

DevilPlate

Arch-Supremacy Member

- Joined

- Nov 22, 2020

- Messages

- 12,216

- Reaction score

- 5,146

Floorplans passable but when we compare EC Aurelle then it looks bad liao.Having reviewed through the floor plans for PTR, overall seems okay leh and the key question is more on entry pricing. However I have always considered Tampines no different than all their ulu cousins such as Punggol, Jurong, Yishun. This project though have the TC vibe where facilities are split across two sides accessible via bridges.

If u can get mid floor 3+store 1066sqft at 22xxpsf then can consider lor.

See developer give chance anot

DevilPlate

Arch-Supremacy Member

- Joined

- Nov 22, 2020

- Messages

- 12,216

- Reaction score

- 5,146

Since PR8 mid 2021 todate, general market has risen ~20-30% and add 5% for post harmonyNot too long ago, we are still laughing at those who bought PR8 at 2kpsf.

Now PTR 22xxpsf became like a steal.

How time flies. Lol

Time flies....u buy any decent ocr 3br at end of 2022 todate at least make 200-300k paper gain.

Whereas ah hai bot PR8 at 2k psf hoping to breakeven nia lolol

Last edited:

2 subsale txn happened in PR8, gross profit for 1b is 110k and 3xxk for 3b.

Both subsale txn hovering around 18xxpsf to 19xxpsf.

I'm not sure if PTR 24xxpsf is still palatable given both have similar attributes though some might say Tampines is better than pasir ris in terms of location. But that's a whopping 500-600psf diff tho one is pre and the other post harmo.

Not forgetting, PR8 is still relatively new.

Both subsale txn hovering around 18xxpsf to 19xxpsf.

I'm not sure if PTR 24xxpsf is still palatable given both have similar attributes though some might say Tampines is better than pasir ris in terms of location. But that's a whopping 500-600psf diff tho one is pre and the other post harmo.

Not forgetting, PR8 is still relatively new.

oldchanggold

Master Member

- Joined

- Jun 17, 2023

- Messages

- 3,102

- Reaction score

- 1,503

wow 3xx … I feel one thing is PR mall is very well done.. the facade of PR8 is very nice also.. location wise honestly that part of Tampines is like no different from PR.. I feel cannot use the EW line as gauge2 subsale txn happened in PR8, gross profit for 1b is 110k and 3xxk for 3b.

Both subsale txn hovering around 18xxpsf to 19xxpsf.

I'm not sure if PTR 24xxpsf is still palatable given both have similar attributes though some might say Tampines is better than pasir ris in terms of location. But that's a whopping 500-600psf diff tho one is pre and the other post harmo.

Not forgetting, PR8 is still relatively new.

saikangwarrior

Senior Member

- Joined

- Jan 12, 2012

- Messages

- 2,447

- Reaction score

- 1,005

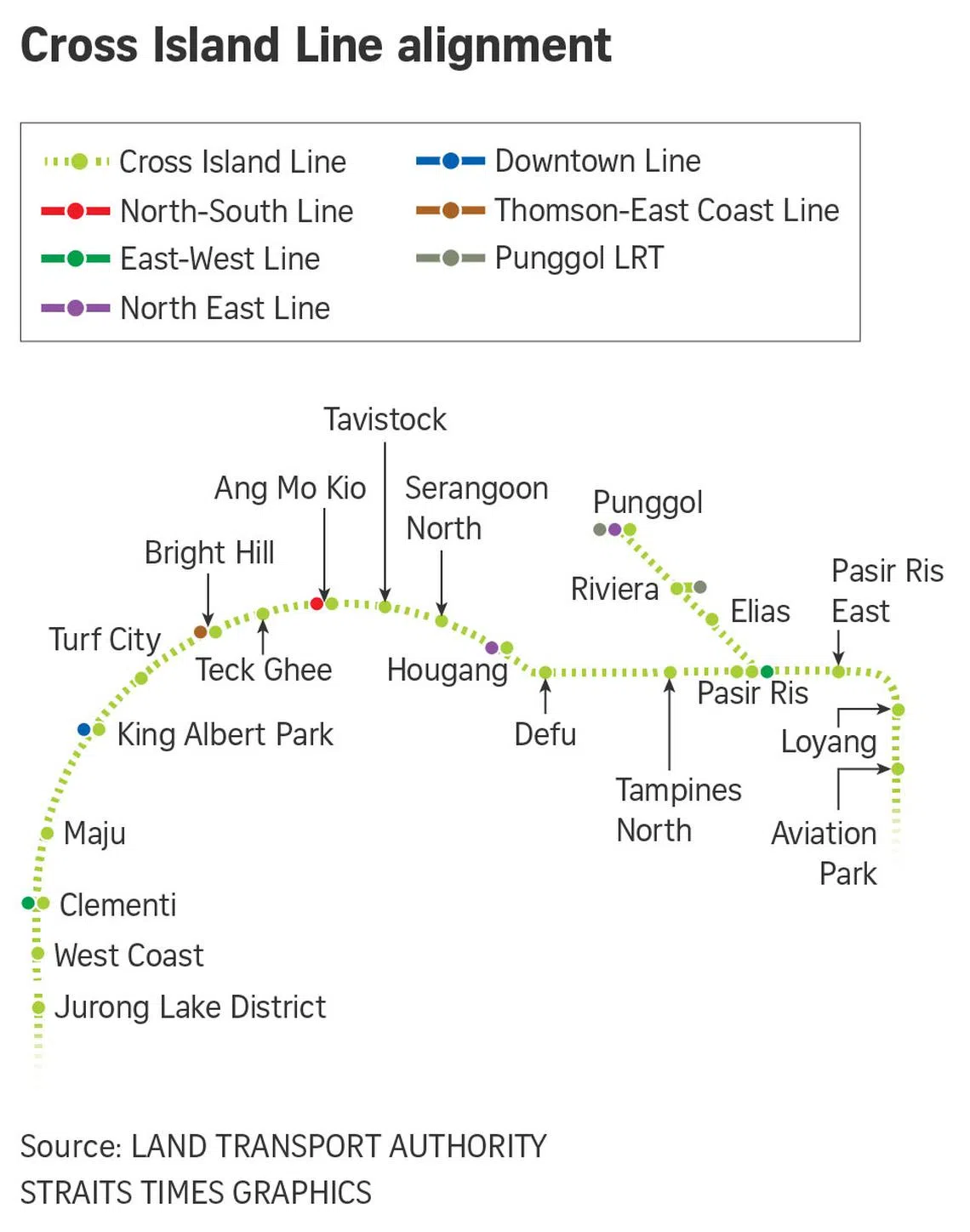

Parktown will be near Tampines north MRT station. While pasir ris is also future connected to tampines north linewow 3xx … I feel one thing is PR mall is very well done.. the facade of PR8 is very nice also.. location wise honestly that part of Tampines is like no different from PR.. I feel cannot use the EW line as gauge

DevilPlate

Arch-Supremacy Member

- Joined

- Nov 22, 2020

- Messages

- 12,216

- Reaction score

- 5,146

I said before that 2 sellers either no holding power or listen to too much doom and gloom porn2 subsale txn happened in PR8, gross profit for 1b is 110k and 3xxk for 3b.

Both subsale txn hovering around 18xxpsf to 19xxpsf.

I'm not sure if PTR 24xxpsf is still palatable given both have similar attributes though some might say Tampines is better than pasir ris in terms of location. But that's a whopping 500-600psf diff tho one is pre and the other post harmo.

Not forgetting, PR8 is still relatively new.

i predict 6-12mths after TOP surely hit 2-2.2k psf

Hi,

Can I ask, usually for new launch we need to pay 5% option fee of the property price. Then we need to get the bank to agree to give us a loan.

The question is, do we need to get the bank to agree to loan us 75% of the property price for exercising the OTP? Because I understand that for new launch the installment will start small in increase at every new milestone. How ah?

Can I ask, usually for new launch we need to pay 5% option fee of the property price. Then we need to get the bank to agree to give us a loan.

The question is, do we need to get the bank to agree to loan us 75% of the property price for exercising the OTP? Because I understand that for new launch the installment will start small in increase at every new milestone. How ah?

jeffong

Senior Member

- Joined

- Jan 1, 2000

- Messages

- 2,199

- Reaction score

- 1,255

Generally it will be better for you to secure your bank IPA first before you book that property in case you not able to even secure 75% loan due to bad credit record that you may not be aware of. The last thing you want to do is to return the unit and forfeit 1.25% of your downpayment.

DevilPlate

Arch-Supremacy Member

- Joined

- Nov 22, 2020

- Messages

- 12,216

- Reaction score

- 5,146

21xxpsf one say buy one say wait, 24xxpsf both say avoid.

Average 21xxpsf js whack liao (5% post harmony = 20xxpsf)

If 3+store mid floor at 2300psf then hard decision. Anything below 2250psf can consider.

DevilPlate

Arch-Supremacy Member

- Joined

- Nov 22, 2020

- Messages

- 12,216

- Reaction score

- 5,146

I think around 1-2years ago, i say remaining few units 3+study in PR8 at 17xxpsf pretty reasonable but then the quantum was huge….i think around 2.3MPasir Ris 8 has many points which are better than Parktown Residences. If PR8 sub-sale below $2kpsf, it is a very good buy. Being an integrated project, the retail component add on future appreciation. PR8 has more than 169 stores, 3 food courts. The existing White Sand has another over 136 stores with a regional library. Free shuttle bus to Downtown East with Cathay cinema and Wild Wild Wet . Pasir Ris hawker is within walking distance and ActiveSg Sport hub is just beside. If not enough, take MRT to Tampines station, another 3 malls, 2 cinemas and OTH nearby.

The new PR X-line station is the deepest underground station with more retail stores. Many people did not realise the new station has an extension to Punggol, home of Digital District.

PTR has a very small retail space. Similar to Sengkang Grand mall. X-island phase 1 will only be ready 2030. By the time it TOPs, residents still have to take shuttle bus to nearest MRT for a year or two. Even if it is ready, they have to go to either Pasir Ris or Hougang station and transfer to another line to get to CBD.

Another point is density. PR8 has the lowest density of all integrated transport hub projects. The land plot is huge with only 487 units. Very livable.

Side track a bit. The Pasir Ris temporary bus interchange will be demolished after the integrated transport hub is ready by this year. It is quite a big area with future potential. Wonder what can it be. Commercial expansion or residential?

If PTR sells well, PR8 with better location and amenities, will appreciate in tandem. I will got for PR8 sub sale or the upcoming Hougang integrated project. PTR will make money but not as much as the other 2 private condos or the new ECs nearby.

PTR 3+store estimated to be also around 2.3M

gonewiththesmart

Banned

- Joined

- Feb 15, 2019

- Messages

- 10,002

- Reaction score

- 2,659

9 to 11 units per floor,,,

Important Forum Advisory Note

This forum is moderated by volunteer moderators who will react only to members' feedback on posts. Moderators are not employees or representatives of HWZ. Forum members and moderators are responsible for their own posts.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.

Please refer to our Community Guidelines and Standards, Terms of Service and Member T&Cs for more information.