endlssorrow

Arch-Supremacy Member

- Joined

- Apr 11, 2007

- Messages

- 10,922

- Reaction score

- 818

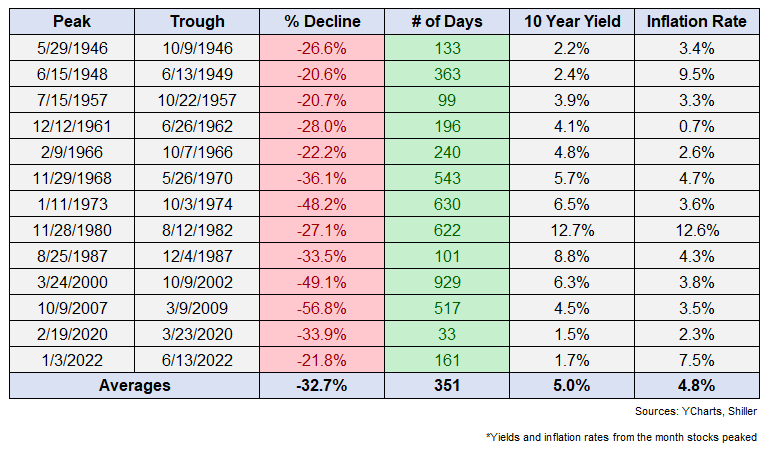

DCA monthly above for now doesn’t not work efficientlyIf you had a long time period and had DCA your way through these high and low inflation periods, you would have done well. From a retirement planning perspective, sequence of risk seems to be more a key risk.

These are some of the details I was able to elicit from reading research and articles across the various finance blogs mostly from U.S.

If weekly it will be great as for now